Heading into the new year, 88 percent of contractors report in a recent survey to having projects canceled or postponed in 2020 and 2021, and only one-third plan to add workers this year.

The results of the Associated General Contractors of America’s 2021 Construction Hiring and Business Outlook are a stark contrast to its pre-pandemic outlook, in which 80 percent of contractors planned to add employees heading into 2020. Project cancellations and delays were not even an issue then. The new survey, which received 1,329 responses, was conducted November 10 to December 14.

“This is clearly going to be a difficult year for the construction industry,” said AGC CEO Stephen Sandherr during a webinar January 7 to release the survey.

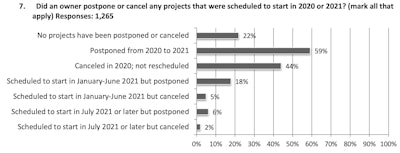

The percentage of contractors reporting project delays and postponements has also steadily risen during the pandemic, from 32 percent in June, 75 percent in November, to the most recent 88 percent.

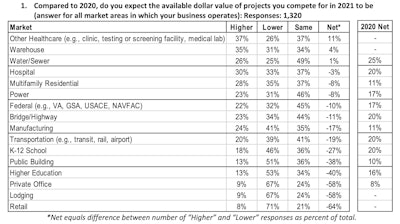

The economic conditions are wearing on contractors’ confidence. They expect the markets for most types of construction to contract in 2021, according to AGC Chief Economist Ken Simonson. In the 2020 survey, all sectors were expected to rise.

“One reason so many construction firms expect demand for construction to shrink is the high number of projects that have been delayed or canceled,” he said. “… As a result, few firms expect the industry will recover to pre-pandemic levels anytime soon.”

When asked on the survey when construction firms expected business volume to return to pre-pandemic levels:

- 35 percent selected “more than 6 months (or never)”

- 12 percent selected “1-6 months”

- 20 percent selected “don’t know”

- 33 percent selected “volume of business already matches or exceeds year-ago level.”

‘Work still available’

Though the survey paints a dark picture, contractors speaking during the webinar and those Equipment World has interviewed are still working, and some are thriving.

A lot of that success depends upon the region and the industry sector, as well as the company’s ability to switch gears to find new markets to enter.

“I think we’re going to have a challenging year, but … you can find work,” said Rosana Privitera Biondo, president of Mark One Electric Company, an electrical contractor in Kansas City, Missouri.

“There is work available, but you have to work harder at getting it.”

Some contractors have reported in Equipment World interviews that work picked up in the second half of 2020. The bulk of the cancellations and delays that surveyed contractors referenced are for 2020 projects.

So far for the new year, 23 percent of respondents reported that projects planned for the first half of 2021 have been postponed or canceled, and 8 percent reported delays or cancellations for projects scheduled in the second half.

Credit: AGC 2021 Construction Hiring and Business Outlook

Credit: AGC 2021 Construction Hiring and Business OutlookMore competition and higher costs

Bob Schafer, president of Ranger Construction in West Palm Beach, Florida, said the heavy-highway firm has benefited from the Florida Department of Transportation’s revving up road construction, taking advantage of fewer vehicles on the road during the early stages of the pandemic. His firm is also looking to hire workers and is finding a shortage of skilled labor.

At the same time, he’s seeing other contractors, particularly in the commercial sector, struggle. He’s also seeing more competition for roadwork from companies with no experience as they try to shift from stalled sectors to new markets.

“We’re seeing bidders we’ve never seen before,” he said. “Folks that have never even thought of building a road … are bidding on projects. And they are shockingly low at times.”

Material costs have also been rising. And contractors have had the unanticipated additional expenses of meeting social distancing, mask and other Covid protocols. He estimates his company has spent up to $200,000 on such measures and expects that to continue into 2021 as the virus spreads.

Those preventive measures also reduce productivity.

“It’s hot outside in Florida in the middle of summer. It’s 105 degrees, and they’re working around 300-degree asphalt with a mask and a face shield on,” he said. “You’re not going to be as productive. It’s impossible.”

Along with the pandemic, 2020 and 2021 are ushering in another change for the construction industry. Michael Kennedy, CEO of KAI Enterprises design-build firm, said construction firms and project owners are demanding more diversity in hiring of minorities and women. “And if you don’t have a diversity strategy, good luck,” he said. “They are serious.”

“If you’re not a diverse company,” he added, “then it’s time to align yourself or find out what your strategy is in that marketplace, or make your organization look more diverse.”

Seeking help from Washington

The AGC and contractors on the panel are hoping 2021 will be the year for a big infrastructure package to help boost the economy.

President-elect Joe Biden campaigned on a $1.3 trillion package. His pick for transportation secretary, Pete Buttigieg, campaigned on a $1 trillion package as a candidate in the Democratic presidential primaries. Both houses of the new Congress will be majority Democrat, possibly giving Biden traction for his infrastructure plans.

“With traffic still below pre-pandemic levels and a large pool of workers available, now is an ideal time to improve highways, repair transit systems, upgrade airports, modernize waterways and otherwise improve other types of public works,” said Sandherr, AGC CEO.

He said such funding must also include more money to state and local governments to help recoup revenue losses during the pandemic. “As we learned during the recession of the late-2000s, boosting federal infrastructure investments without backfilling state and local construction budgets is counterproductive.”

Congress recently passed Covid relief that included $10 billion for state departments of transportation to help recoup lost revenues and $284 billion more for the Paycheck Protection Program. Contractors have been one of the largest recipients of the loans, which are forgivable if used to pay worker salaries and benefits to prevent layoffs.

Contractors on the webinar panel also said those loans helped their companies weather the economic downturn of 2020. Schafer, of Ranger Construction, said federal Covid relief is vital to the industry’s recovery and for helping local governments that have incurred not only a drop in revenues but also unanticipated expenses due to the pandemic.

Overall, though, he was confident the construction industry would survive 2021:

“So it’s interesting times, but we’re contractors. That’s what we do, is figure out how to get through it.”

Survey highlights

For more highlights from the AGC survey, continue reading below:

What most concerns contractors

A majority of respondents reported that because of the pandemic projects were taking longer than anticipated (64%), and costs have been higher than expected (54%).

The pandemic’s continuing impact on projects, workers or the supply chain is also the biggest concern weighing on contractors, at 84%.

Other top concerns:

- Material costs – 58%

- Increased competition for projects – 55%

- Not enough private-sector work – 44%

- Worker shortage – 43%

- Worker quality – 40%

- Rising labor costs – 40%

- Federal regulations – 36%

- Inadequate funding for infrastructure – 35%

- Inadequate legal protection against unwarranted coronavirus-related claims from worksites – 33%

- State and local regulations – 33%

- Inadequate funding for public building projects – 32%

- Subcontractor availability or quality – 28%

Sector breakdown

Contractors were asked their expectations for the dollar value of projects they compete for in 2021 in specific industry sectors when compared to 2020.

This chart from AGC provides those results: