The next three months will be painful for the U.S. economy and the construction industry, with a more than 18 percent drop in the total amount of goods and services produced due to the economic impact of the COVID-19 coronavirus pandemic. After that, the economy will begin to rebound, quicker in some areas of construction than others.

That’s the prediction of Richard Branch, chief economist for Dodge Data & Analytics, who outlined his forecast April 9.

“We are in recession,” he said, “no question about it.”

For the construction industry, that will mean a 13 percent drop in both residential and nonresidential construction starts in 2020. The drops in starts will be due to the spread of the virus to workers, bans and halts to construction, broad economic declines and supply shortages, he said. Construction starts will then increase in 2021, with residential seeing a 3 percent rise and nonresidential going up 5 percent.

Branch released a series of charts to give a glimpse of the troubles awaiting the economy and contractors – and in many cases, already being felt.

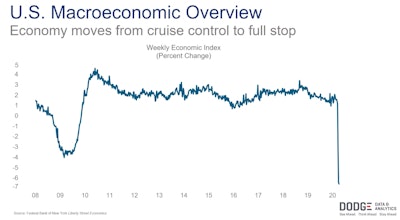

The first chart, of the New York Federal Reserve’s Weekly Economic Index for the week ending March 28, showed just how fast and sharp the economy has dropped in a week, reaching depths lower than the Great Recession reached in a year:

This chart shows the drop in the Weekly Economic Index for the week ending March 28 at -6.56 percent. The descent began March 14. The latest WEI released April 14 but not shown here shows an even further decline for the week ending April 4, at -8.89 percent. For more details, go to https://www.jimstock.org.

This chart shows the drop in the Weekly Economic Index for the week ending March 28 at -6.56 percent. The descent began March 14. The latest WEI released April 14 but not shown here shows an even further decline for the week ending April 4, at -8.89 percent. For more details, go to https://www.jimstock.org.

The recovery will not be as quick as the drop, as restarting an economy beset with massive layoffs, will take more time. “It will be a slog,” Branch said. How much of a slog will depend upon such factors as the extent of the virus’ spread, federal stimulus and infrastructure spending.

The chart below gives his quarterly predictions for gross domestic product, the sum of all goods and services an economy produces:

Branch predicts GDP will end the year down 2.2 percent. But momentum that he believes will begin this summer will continue into the following year, with 2.7 percent growth in GDP in 2021.

“ ’21 will be better than ’20, and ’22 will be better than ’21,” he said.

The decline in economic activity will affect the various sectors of the construction industry in different ways, but few will be able to fend off the short-term decline.

Here’s a rundown of how Branch predicts the recession will affect construction starts in 2020:

Residential

Single-family homes – 10 percent decline in 2020, followed by a 5 percent rise in 2021 with strong sales late in the year. Housing construction is coming off a banner first quarter, its best since 2007. Coronavirus has quickly halted that run, with Branch saying the typically busy spring and summer buying season is likely gone. He sees the market crashing in the second quarter, dropping as much as 50 percent or more from the first quarter. “The upside though here is I think that as the virus recedes, we’ll start to see construction pick up again,” Branch said. “It’ll start very slowly. The economic damage to households here will take time to repair and to heal. And it’s really not until we get into 2021 when we start to see construction get back to stronger growth.” But he also predicts after this, millennials will enter the market in larger numbers, leading to strong growth into 2023.

Multifamily construction – 19 percent drop in 2020, a 2 percent drop in 2021. Owners and developers are facing increasing financial difficulties. He also predicts it will take renters time to pay off back rent owed, and many are being saved by moratoriums on evictions in some areas.

Nonresidential

Commercial – a 16 percent drop in 2020, followed by a 6 percent increase in 2021. Bright spots could be grocery stores, offices and warehouses. The growth in online sales could also lead to building larger warehouses and distribution hubs for Amazon and others. The chart below, however, shows the decline will hit retail, hotel and parking garage segments particularly hard:

Institutional – 7 percent drop in 2020, 3 percent increase in 2021. Hospital construction could be a bright spot, as many areas’ number of hospital beds has not kept up with their population rises. This chart gives a breakdown of Branch’s predictions for the entire sector:

Manufacturing – 22 percent drop in 2020, 2 percent drop in 2021. The sector lost 18,000 jobs in March with more expected in the second quarter. Manufacturing has been hit by tariffs and had a weak first quarter, with not a lot of large projects in the works, Branch said. One bright spot could be if some manufacturing returns to the United States after witnessing the downside of relying on China for critical supplies.

Public works

The bright spot in public works construction will be highways and bridges. Many of these projects have been able to continue during the pandemic, deemed essential in most states.

Branch also predicts Congress in a few months will pass a replacement to the FAST Act, which expires in September. The current proposal from a Senate committee will add on average $10 billion a year in additional funding to states for highway projects, he said. There’s also the possibility of additional infrastructure funding as a way to stimulate the economy.

Overall, the public works sector will experience a 16 percent drop in starts this year and see a 13 percent rise in 2021.

The chart below gives Branch’s breakdown forecast for the sector: