Financial institutions recently were issued a notice by the Financial Crimes Enforcement Network (FinCEN) in coordination with an IRS Criminal Investigation to call attention to an increase in state and federal payroll tax evasion and workers’ compensation insurance fraud in the construction industry.

The two agencies said state and federal tax authorities lose hundreds of millions of dollars to such schemes annually. The fraud is generally carried out by illicit actors primarily through banks and check cashers.

“FinCEN is committed to combating fraud by shedding light on how illicit actors within the construction industry are using shell companies and other tactics to commit workers’ compensation fraud and avoid payroll taxes,” said Himamauli Das, acting FinCEN director.

“We are proud of our collaboration with CI in issuing this notice and exposing tax and insurance fraud that has plagued the construction industry and undermines law-abiding construction firms.”

A description of how payroll tax evasion and workers' compensation fraud schemes may involve networks of individuals and the use of shell companies and fraudulent documents are provided within the notice.

FinCEN

FinCEN

According to FinCEN, the basic structure of the scheme includes:

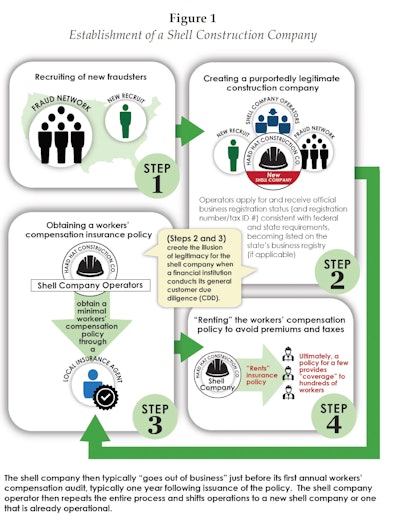

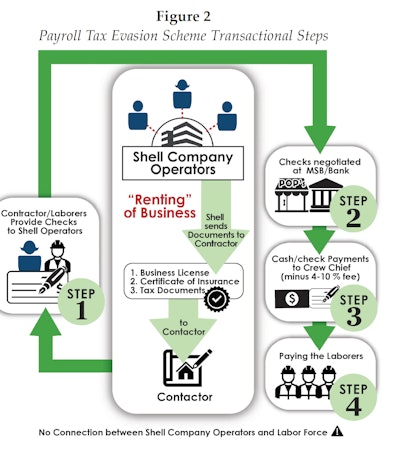

- Individuals involved in the scheme will set up a shell company whose sole purpose is to allow certain construction contractors to avoid paying workers’ compensation premiums as well as state and federal payroll taxes.

- The shell company achieves this by engaging in two kinds of fraud:

- First, once established, the shell company operators take out minimal workers’ compensation policies and rent or sell the policies to construction contractors that employ a much larger number of workers than the policy is designed to cover, thereby committing insurance fraud.

- Second, the shell company operators facilitate tax fraud because the contractors use the shell company to pay their workers “off the books,” and without paying the required state and federal government payroll taxes.

For more information download the notice here.

Das said the notice provides information that financial institutions can use to remain vigilant in monitoring, detecting, and reporting suspicious activity that may be indicative of payroll tax evasion and workers’ compensation fraud in the construction industry.

Earlier in 2023, the IRS Criminal Investigation division touted how the Bank Secrecy Act data plays a significant role in the agency’s criminal investigations.

The anticipation is that data provided in response to the latest notice will expose several payroll tax evasion and workman’s compensation schemes.

“By enlisting the help of financial institutions, we hope to crack down on fraudsters and level the playing field for legitimate business owners,” said Jim Lee, CI chief.

The notice aligns with the Anti-Money Laundering/Countering the Financing of Terrorism National Priorities and provides financial institutions with an overview of the underlying schemes, red flag indicators, and specific Suspicious Activity Report (SAR) filing instructions.

It also builds on the ongoing efforts to combat the use of shell companies.

Last year, FinCEN took a historic step to support the U.S. government’s efforts to crack down on shell companies and illicit financing by issuing a rule establishing a beneficial ownership information reporting requirement.

The rule, which falls under the Corporate Transparency Act, requires most corporations, limited liability companies, and other entities created in our registered to do business in the United States to report information about their beneficial owners, the persons who ultimately own or control the company, to FinCEN.

It is intended to protect U.S. national security and strengthen the integrity and transparency of the U.S. financial system.

According to FinCEN, the rule will help to stop criminal actors, including oligarchs, kleptocrats, drug traffickers, human traffickers, and illicit actors within the construction industry referenced in this Notice and others who would use anonymous shell companies to hide their illicit proceeds.

FinCEN

FinCEN