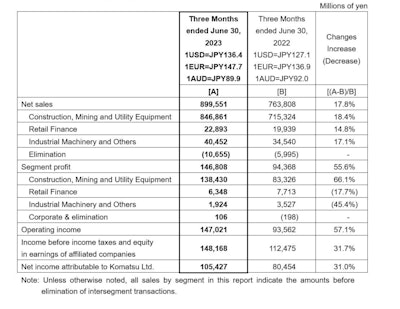

Komatsu saw a net sales increase of 17.8% to 899.6 billion yen in the first three months of its current fiscal year, which ends March 31, 2024.

The Japan-based construction equipment manufacturer cited increased volume, improved selling prices, and the positive impact of foreign exchange rates and interest payments as reasons for the increase.

As for profits in the first three months period, operating income was up 57.1% to 147 billion yen. In addition, net income attributable to Komatsu Ltd. was up 31% to 105.4 yen.

Combined, the quarter totals marked record quarterly highs for the company.

However, Komatsu continues to expect a decrease in consolidated net sales for the 2023 fiscal year. Also, operating income is still expected to be flat, while net income attributable would decrease mainly due to an increase in interest expenses caused by higher interest rates.

For construction, mining, and utility equipment, Komatsu sales increased by 18.4% year-on-year to 846.9 billion yen.

Sales were up in all regions, except for the Commonwealth of Independent States (CIS), which includes Russia, Ukraine and former USSR-member countries, and China. The company said there were particularly sharp sales increases in North America, Asia, and Latin America.

By cross-sourcing and strengthening the use of multi-sourcing, Komatsu worked at keeping its supply chain resilient to any changes in the external environment.

A portion of the sales increase included expanded parts sales and service revenues, which reflect high machine utilization centered on the mining equipment. In addition, the company said sales increased in the industrial machinery and other business categories such as sales of presses, sheet-metal machines, and machine tools for the automobile manufacturing industry.

While demand for construction equipment decreased, mainly in Latin America and Europe, it remained firm in North America. According to the Q1 fiscal review, total global demand was down 9% year-on-year for Komatsu’s fiscal 2023 Q1. Excluding China, demand decreased by 5% year-on-year. Comparatively, demand for mining equipment was steady.

“China dropped significantly year on year due to the economic slowdown triggered by the sluggish real estate market conditions," Takeshi Horikoshi, chief financial officer. He noted that overall, demand was more robust in North America and Japan and down in Europe, China, Latin America, and CIS.

Horikoshi pointed out that economic uncertainty and import restrictions in Latin America contributed to the weaker environment. Similarly, the Russian invasion of Ukraine has impacted demand and sales in the CIS region.

Due to the circumstances, the company has revised its 2023 forecast with demand projected to be between a negative 5% to 10% decline rather than a flat year-on-year projection offered in April.

“With construction equipment, some negative factors have been observed including the impact of China's economic slowdown and interest rate hike and inflation in many regions,” Horikoshi said, noting that they will be monitoring the trend closely.

According to Komatsu, the demand trends in North America increased by 3% in fiscal 2023 Q1 on a year-over-year basis.

Horikoshi said demand for infrastructure and rental increased, and business with energy customers was firm. However, demand for residential and nonresidential construction declined, primarily due to the impact of the higher interest rates.

Current projections for the region suggest a flat or negative 5% change for the year.

Komatsu

Komatsu

In Japan, demand increased by 2%, boosted by steady public works and private sector construction which is anticipated to remain solid.

However, the remainder of the Asian market saw a steep 5% decline. While mining equipment was up in Indonesia due to demand for coal and nickel mining, construction equipment dipped in Indonesia, Thailand, Vietnam, and other markets.

Horikoshi indicated that the anticipation is for the decline to continue due to the high-interest rates, presidential elections, and Ramadan.

According to Komatsu, the 5% decrease in the European market centered around the major markets of Germany, the United Kingdom, and France and the impact of high-interest rates and sustained high inflation.

“Due to the decrease, the FY 2023 projection was revised from a negative 5% decline to a negative 10%,” Horikoshi said. “Economic downside pressure by the tightening monetary policies might be sustained in the second quarter onward and as such, demand decline is expected to continue.”