July saw an uptick in planned nonresidential building projects, despite concerns about rising interest rates and a sluggish economy.

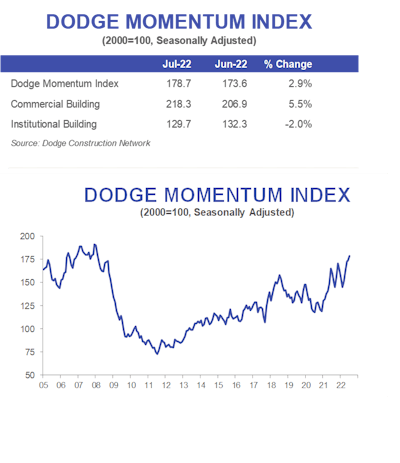

The Dodge Momentum Index reported a 2.9% increase over June to 178.7. The index is shown to lead construction spending for nonresidential buildings by a full year.

A rise in commercial planning offset a dip in institutional activity for July, Dodge reports.Dodge Construction Network

A rise in commercial planning offset a dip in institutional activity for July, Dodge reports.Dodge Construction Network

Data center, office and warehouse projects drove a 5.5% increase in the index’s commercial planning component, while fewer education and healthcare projects drove the institutional component lower, Dodge says.

When compared to July 2021, last month’s overall index increased 8%, with commercial up 15% and institutional down 3%.

A total of 14 projects with a value of $100 million or more entered planning in July.

Top commercial projects included:

- $300 million Schnitzer Industrial Park in Sacramento, CA

- $275 million Parteere 42 mixed-use complex in Miami,

- $180 million Edgecore Data Center in Sterling, VA.

Top institutional projects included:

- $500 million Vanderbilt University Medical Center in Nashville, TN,

- $157 million life sciences building in San Francisco

- $150 million Cal Poly Humboldt Craftman’s student housing project in Arcata, CA