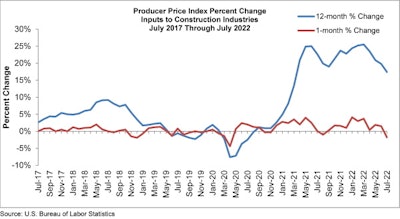

A drop in construction input or material prices in July may suggest that any pending recession could be milder than originally predicted by construction industry economists.

Construction input prices decreased 1.8% in July compared to the previous month, according to an analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data. Similarly, the price of materials and services fell 1.3% in nonresidential construction.

“Contractors welcome any relief they can get in the cost of most construction materials,” said Stephen E. Sandherr, Associated General Contractors of America's chief executive officer. “It is still too hard to acquire most materials and prices remain quite elevated for many key products.”

Meanwhile, Anirban Basu, chief economist for the Associated Builders and Contractors, suggests the data from the producer price index provides additional evidence that inflation has indeed peaked.

“A weakening global economy and ongoing supply chain adjustments have resulted in significant declines in the prices of a number of key commodities, ranging from oil to steel,” he said. “While the risk of recession remains elevated, recent government reports on consumer and producer prices make it more likely that the Federal Reserve will be able to engineer a soft landing or that any recession to come could be quite mild.”

Basu said prices were down in eight of 11 subcategories on a monthly basis. Prices in all three energy subcategories fell in July, with natural gas prices falling 27.6%, the largest decrease. Unprocessed energy materials prices were down 21.2%, while crude petroleum prices fell 19.1%.

Although there were declines, in some cases the year-over-year comparison still showed dramatic increases. Construction input prices remain 17.4% above July 2021. Showing a 1.3% drop in July in nonresidential construction, the level was still 14.6% above the July 2021 level.

Also, contractor bid prices were up 5.4% from June to July and has increased 23.9% over the past 12 months.

Several commodities did see decreases but remain above the 2021 levels. For example, the price index for diesel fell 16.3% in July but remains 71.3% above its July 2021 level.

There were one-month increases in July in the index for paving mixtures and blocks, 2.7%; concrete products, 2.2%; plastic construction products, 1.0%; and gypsum building materials, 0.3%. The price index for diesel fuel fell 16.3 % in July but remained 71.3% above its July 2021 level. The index for asphalt and tar roofing and siding products fell 0.4% in July but increased 18.8% over 12 months. Steel mill products fell 3.7 % in price last month and increased 6.4% year-over-year. The index for lumber and plywood decreased 0.5% in July and fell 7.7% over 12 months. Copper and brass mill shapes fell 9.7% for the month and 7.9 % over the past year.

“We are not out of the woods yet when it comes to high materials prices and supply chain problems,” Sandherr said. “Unless public officials can put in place measures to arrest materials price inflation and unjam supply chains, contractors will continue to be squeezed by high prices.”

Associated Builders and Contractors

Associated Builders and Contractors

Associated Builders and Contractors

Associated Builders and Contractors

Associated Builders and Contractors

Associated Builders and Contractors