Prices for auction sales of used equipment and trucks in the U.S. have continued to drop since hitting an apparent peak earlier this year, according to Ritchie Bros. August Market Trends Report.

Prices hit record levels from January through June 2022, as lower interest rates, increased infrastructure investment and commodity prices fueled the demand for equipment, the auction company says.

The highest inflation remains in transportation at 28% year-over-year and in truck tractors at 27%.

However, the price inflation rate appears to be slowing down in most categories. On a month-to-month comparison, the biggest decrease was in transportation with 28% this month and 40% last month and truck tractors dropping to 27% from 39%.

"We continue to experience year-over-year price inflation for equipment and trucks in the U.S. and Canada," said Doug Olive, senior vice president of pricing. "However, as the transportation and logistics markets normalize, we have seen truck prices decline. We are seeing similar pricing trends across our other industry indexes as well, with year-over-year increases, but declining on a month-to-month basis." For the three months ending July, prices for used medium earthmoving equipment increased 15% (± 1.5%) compared to the same time frame last year.Ritchie Bros.

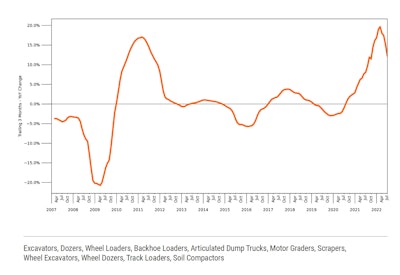

For the three months ending July, prices for used medium earthmoving equipment increased 15% (± 1.5%) compared to the same time frame last year.Ritchie Bros.

Ritchie says medium-sized earthmoving equipment continues to show higher inflation compared to large earthmoving equipment with a gap of approximately 3 percentage points.

For the three months ending July 31, 2022, Ritchie says, prices for used large and medium earthmoving categories are up by 12% and 15%, respectively, compared to the same period last year.  For the 3 months ending July, prices for used large earthmoving equipment increased 12% (± 1.5%) compared to the same time frame last year.Ritchie Bros.

For the 3 months ending July, prices for used large earthmoving equipment increased 12% (± 1.5%) compared to the same time frame last year.Ritchie Bros.

Prices for aerial equipment (telehandlers, scissor lifts, boom lifts) are up 13%.

Truck tractors continue to take the brunt of the increases with a year-over-year price increase of 27%. Vocational truck prices are also up 18% compared to the same time last year. The vocational segment includes dump, flatbed, boom, water, tank, van, reefer, field service and concrete mixer trucks.

On the retail channel, July 2022 saw 27% fewer transactions than July 2021, consistent with the overall pace of 2022.

“Tight supply continues to be the story in the retail market, with lower-than-typical sales volumes driving strong pricing and retail values increasing 2% in July,” says Doug Rusch, managing director Rouse Sales. “Excavators have shown strong pricing, with retail values rising 4% to 5% in the past 90 days across all sizes classes. Auction values for excavators have moderated a bit since June 2022. Since then, we have seen smaller class mini excavator prices decline 6% to 7% at auction, while larger excavators have declined 2%."

Large and compact excavators

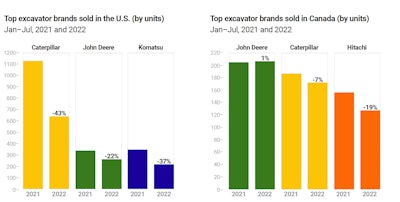

According to Ritchie Bros., excavator auction volumes are down year-over-year due to a slowdown in production. The company sold 33% fewer large excavators in the U.S. in the first half of 2022 than in the same period in 2021. The top three brands sold were Caterpillar, John Deere and Komatsu.

Caterpillar and John Deere excavator sales sold over the past 90 days show median prices down 7% and 6% year-over-year. While Komatsu excavators, the third most-common brand sold recently, declined in pricing by approximately 23%, with units that were approximately six years older than units sold in 2021.

Ritchie Bros.

Ritchie Bros.

Overall, Ritchie says, median prices for large excavators are down 9% year-over-year, and the machines are nearly two years older than those sold in 2021.

Compact excavators are a different story, with volumes up approximately 4% in the U.S. For those smaller machines, the top brands sold at Ritchie Bros. were Bobcat, John Deere and Caterpillar.

Over the past 90 days, Bobcat prices declined approximately 13%, with units sold having approximately 39% more hours than units sold in 2021. By contrast, John Deere compact excavator units sold over the past 90 days had 43% less usage and achieved 18% higher prices year-over-year. Caterpillar compact excavator prices also increased recently, up 6% from 2021.

Ritchie Bros.

Ritchie Bros.