Editor’s Note: This is Part One of a four-part series on the challenges brought on by the shortage of diesel technicians in the U.S. You can read Part Two of the series by clicking here. Read Part Three, here. Read Part Four, here.

Today’s market heights have put an exclamation point on the construction equipment technician shortage, one that’s having a direct impact on contractors.

Contractors can’t find the people they used to hire to take care of the equipment to the level they did in the past. Their go-to dealerships have had to raise service rates to keep up with technician pay raises, an inevitable outcome of demand outstripping supply. Plus, dealerships may not be able to get to their down machine in a timely manner.

The Associated Equipment Distributors says the heavy equipment technician shortage is costing its members $2.4 billion in revenue each year. “You take that down to the dealer level, it’s costing each dealer $6 million on average,” says Steve Johnson with the AED Foundation. At the technician level, the cost is over $300,000 per technician. “It’s a very big problem,” he says.

AED research has placed the immediate technician shortfall among AED dealers at more than 4,000. “And in the next five years or so, we’re talking about adding around 20,000 technicians,” says Cory Hayes with the AED Foundation. “That’s just in the heavy construction equipment sector. Everyone wants the same person, so it’s important for us to start finding these students as early as possible for our members.”

“It’s just escalating as time goes on,” says Diane Benck, vice president of West Side Tractor Sales, a John Deere dealer in northern Illinois, Indiana and southern Michigan. The direct impact for dealerships such as hers is loss of revenue. “If you can’t meet their needs, they will go somewhere else,” she says. “It really boils down to our ability to respond quickly because contractors are looking for the fastest response. Downtime costs them a tremendous amount of money. If we tell them they’re going to have to wait a week before we can even take a look at their equipment, they are going to find another solution.”

“We’ve turned down business because of the lack of mechanics,” says Michael Vazquez, vice president of MECO Miami, which carries Atlas Copco, Dynapac and Sany lines in South Florida. “If I’ve got two machines that need to be fixed within the next couple of weeks, and I’m already booked with current clients, I can’t help you. I turned down work just recently because we didn’t have the mechanics.”

It’s everyone’s problem

Diesel technician students at Western Dakota Tech learn that today’s complex machine electronics require technicians to go beyond the wrench by using specialty tools, laptops and diagnostic software.

Diesel technician students at Western Dakota Tech learn that today’s complex machine electronics require technicians to go beyond the wrench by using specialty tools, laptops and diagnostic software.This is not just a dealer problem. “Our customers are struggling with the exact same problem,” Benck says. “They can’t go out and hire someone to even do their routine maintenance work. So they are relying more on the dealer channel to do their maintenance work.”

And stealing techs from another dealer or contractor does nothing to fix the problem, Benck asserts. “It just solves an immediate need.”

Raises in technician pay have resulted in increased shop rates, says Steve Meadows with Berry Companies, a Bobcat and Komatsu distributor with 33 locations in six Midwestern states. “We always want to be able to keep our great technicians. You’ve got to keep an eye on where your pay is, or your technicians will get picked off by a competitor. We need these people to be both good at their jobs and satisfied with what they’re doing.”

“We’re presently looking for five to 10 mechanics to hire in the next year,” Vazquez continues. “If we could hire five today, I’d be extremely content.”

Kim Rominger, CEO of the Equipment Dealers Association, says that most of the group’s members need at least three more technicians each.

“There’s just a huge shortage,” he says. “And the market is pretty thin. It’s not just equipment dealers. It’s auto dealers, over-the-road trucking firms. Everybody is looking for techs.”

Dirty, dark and dangerous…not

Diesel technician students at Western Dakota Tech learn that today’s complex machine electronics require technicians to go beyond the wrench by using specialty tools, laptops and diagnostic software.

Diesel technician students at Western Dakota Tech learn that today’s complex machine electronics require technicians to go beyond the wrench by using specialty tools, laptops and diagnostic software.“None of the three D’s – dirty, dark and dangerous – are really true these days,” Benck says. “Today the most important tool that our technicians have is their laptop. It really takes highly skilled people to fix the machines of today. It’s not anything like it was 25 years ago.”

“Today’s shops are often well-lit, well-tooled and good working environments,” says Wayne Brozek, aftermarket vice president for 21st Century Equipment, a John Deere dealer serving Nebraska, Colorado and Wyoming.

“You don’t just come in and replace greasy, dirty parts. You use your laptop, you train well, you get paid well.”

“It really boils down to our ability to respond quickly because contractors are looking for the fastest response. Downtime costs them a tremendous amount of money.”

– Diane Benck, vice president, West Side Tractor Sales

A good technician after three to five years in an efficient, well-run shop – where the tech’s job is spent working billable hours and not sweeping floors or other menial tasks – can make a six-figure salary, Rominger says. Dealers are also offering to pay for training, as well as offering tool reimbursement and other bonuses and incentives.

“The tech is kind of like an accountant or a lawyer, the only thing he has to bill is his time,” Rominger says. “So the more time he spends working, doing what he’s supposed to be doing and billing that time out, the better for the dealership and better for the tech.”

Brozek says that when he goes into local high schools to recruit young talent, he often finds deep misconceptions about the career opportunities for a technician. But when he brings in technicians who can tell how they started out making $35,000 and now make $100,000-plus, the mindset changes.

“It blows people’s minds,” he says. “When we go out and educate our high school counselors and teachers, they’re like, ‘What?’”

Brozek tells them: “Do you realize I will pay your student $20 an hour and pay for all his school, all his tools and guarantee him a job for four years?”

Make ’em rock stars

Derek Dassel, who’s been with Berry Companies’ White Star Machinery division for 4.5 years, tackles a machine fix with an open laptop.

Derek Dassel, who’s been with Berry Companies’ White Star Machinery division for 4.5 years, tackles a machine fix with an open laptop.Many believe the industry hasn’t done a good enough job of getting that message out.

Keaton Turner is the president of Turner Mining Services, a company that specializes in recruiting and retaining millennial and Gen Z workers using social media. When it comes to attracting techs, the industry is failing not due to lack of effort, but from poor branding, he says.

“They need to make their technicians rock stars and part of their branding and marketing,” Turner says. “I don’t think there is anybody out there who is making the career of a diesel technician appear to be sexy.”

Janet Goble faced a similar image problem when she took over as the director of Career and Technical Education at the Canyons School District in Sandy, Utah. The district’s diesel technician training program had suffered from benign neglect, and students and their parents had an indifferent view of the profession.

“They need to make their technicians rock stars… I don’t think there is anybody out there who is making the career of a diesel technician appear to be sexy.”

– Keaton Turner, president of Turner Mining Services

The program had just two diesel engines for 25 to 30 students to work on, and those were Tier 0 engines. And despite the area’s booming mining and energy resources, the students were not connected with the industry as potential employees.

So the district formed a Diesel Industry Partnership program with trucking and construction vendors such as Cat, Komatsu and Cummins. Cummins donated 12 newer engines to the program. The partners took students to their workplaces and let them job shadow technicians. The high schools coordinated their curriculum with the community college so students could get college credit for advanced technician training in high school. As a result, the industry is getting more technicians trained at a higher level, and the district’s diesel training program has a waiting list of students to get in.

And when these partners visited parents and students they wore button-down shirts and talked about the pay and job prospects, especially as it compares to the four-year college route. “Once they understand what the environment for a diesel mechanic is like today, they’re usually 100 percent on board,” she says.

Despite the improvements, the demand for diesel technicians in the Salt Lake City area will not be fully met in the foreseeable future, Goble adds. “We’re doing the best we can to offset it. But we just don’t have the facilities or the teachers to accommodate the demand. A majority of the teachers here come from industry. There is a severe national shortage of teachers, and everybody is looking for ways to address that.”

Complicated machinery, low experience

The Think BIG program, sponsored by three Caterpillar dealers at the Florence-Darlington Technical College in Florence, South Carolina, includes a paid dealer internship every semester.

The Think BIG program, sponsored by three Caterpillar dealers at the Florence-Darlington Technical College in Florence, South Carolina, includes a paid dealer internship every semester.As a diesel technician, Dan Ammon has seen all facets of the industry, from washing parts and changing oil as an apprentice to working at Cat and Deere dealerships. He’s also worked jobs with oilfield services company Schlumberger and engineering-construction firm AECOM. At AECOM, he got involved with the Association of Equipment Management Professionals and became the chairman of the AEMP Workforce Development Committee. When the opportunity arose about a year ago to teach diesel mechanics at Western Dakota Tech, he jumped at it.

One of the reasons the country is facing a shortage of techs is the complexity of the equipment, says Ammon. This has made the job harder to fill and potential recruits less skilled, he says.

“For years you could take a hose off, run down to the local shop and have a new one made, put it back on and away you’d go,” Ammon says.

Now with today’s complex machine electronics, you need specialty tools, laptops and diagnostic software and that often means a dealer service call and fewer opportunities for independent mechanics.

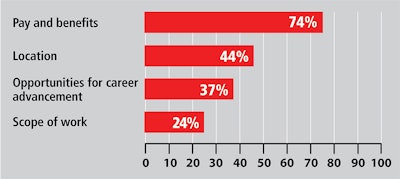

Source: Dakota County Technical College

Source: Dakota County Technical CollegeLikewise, today’s cars and trucks are more complex than they were 20 years ago, and that has an impact on young people coming into the trade, says Ammon. In the past, it was typical for a young person who wanted to be a mechanic to have some experience tearing down engines or rebuilding cars. On their first day of vocational school, they already knew their way around the engines and tools. Now that’s not necessarily the case.

For some, this means the skill level is lower and that makes bringing young techs up to speed more challenging. This isn’t a huge detriment, say Ammon, but it does slow things down.

And students may find they just don’t like the work, Ammon says.

“With the high school vocational classes closing, students are losing the opportunity to explore different careers. Shop classes are a way to figure out what you want to do before you graduate high school.”

Another headwind for the industry in training new techs is the cost of setting up and running a program.

“They’re expensive to run,” says Ammon. “You have to have trucks and equipment, something to work on.” Tools are another expense.

Keeping techs

Techs at Berry Companies’ White Star Machinery division in Wichita, Kansas. “This group has a great culture and they help each other learn and grow,” says Steve Meadows.

Techs at Berry Companies’ White Star Machinery division in Wichita, Kansas. “This group has a great culture and they help each other learn and grow,” says Steve Meadows.Another underlying factor is that as machine technology expands older technicians are scrambling to keep up, says MECO Miami’s Vazquez.

“Tier 4 engines are completely different, and a lot of the older mechanics are not trained in that,” Vazquez says.

“There may be four or five technology systems on one machine, which presents a challenge to older technicians,” Berry Companies’ Meadows says. “You kind of have to reinvent yourself as a technician to keep up. You don’t want to be the technician who just works on all the older equipment.”

Ross Morgan with H&R AgriPower, an equipment dealership serving parts of Kentucky, Tennessee, Illinois, Alabama and Mississippi, says that each new product from manufacturers often requires new training for the dealership’s techs. He also notes that as techs get older and retire, they’re getting harder to replace. So few people have the diagnostic skills necessary to repair the new equipment.

“The problem is not finding people who can replace and calibrate,” he says. “It’s where the (repair) problem is intangible with multiple possibilities.”

That all puts more pressure on dealerships to hang on as best they can to their experienced techs to keep them from jumping ship.

“In order to win it’s all about the talent you keep within your organization,” West Side Tractor Sales’ Benck says. “We know that they’re always going to get job offers, so we want to make sure that they’re happy where they are and say they’re not interested when those offers come up.”

“If I’ve got two machines that need to be fixed within the next couple of weeks, and I’m already booked with current clients, I can’t help you. I turned down work just recently because we didn’t have the mechanics.”

– Michael Vazquez, vice president of MECO Miami

Brad Hershey, store manager and part owner of Hoober Incorporated, a dealership serving parts of Pennsylvania, Maryland, Virginia and Delaware, says the company has had to raise pay to keep its techs, and it provides generous benefits.

“You quickly find that talent has options,” he says. “And you’ve got to be willing to pay for talent.”

Ammon is part of a Facebook group for diesel mechanics, and while not a scientific survey, he asked the members to list the top reasons they left an employer and the top reasons they stayed longer than five years.

The number one reason they stay, he says, is “great pay, great company. Good work-life balance is also important.”

On the other hand, the top reason they leave is that the shop is disorganized and chaotic, followed by low pay and managerial problems.

Some may also fear the cyclical nature of the construction industry and the ensuing layoffs during economic downturns. Meadows suggests, however, that a technician’s job may be immune to this.

“During the last recession, I was president of Bobcat of Kansas City, and we determined that in order to survive we needed to lay off about 30 percent of our employees, which was very hard to do. Through that process we worked really hard to save our good technicians. We were very creative in what they could do so they could stay, with the hopes that things would turn around at some point. And boy did they.”

The center of the dealership

A student in the heavy construction equipment technology course at Dakota County Technical College in Rosemont, Minnesota, which is accredited by AED.

A student in the heavy construction equipment technology course at Dakota County Technical College in Rosemont, Minnesota, which is accredited by AED.Losing technicians and being unable to attract new ones also hits a dealership’s bottom line, affecting all aspects of the business.

“All areas rely on our technicians,” Meadows says. That includes sales, service, parts and rental.

“The service department is the heart of the branch because they have to prep machines and get them ready to sell,” he says. “Once a customer owns them, they have to keep the customer satisfied. The rental department is relying on them to keep their rental machines going. The parts department needs them to install parts. Then it goes back to sales because we need the service department to take care of the customer so that we can sell the next machine.”

Brozek expects the tech shortage to last at least another four to six years, but he’s optimistic that the industry will ramp up its educational efforts to dispel outdated perceptions.

“There needs to be progress on all fronts in fighting that stereotype,” Johnson says. “These are professional jobs. Technicians are on the front line with the customer.”

But to change that perception will require everybody in the industry working on the problem, asserts Benck.

“It’s really all hands on deck,” she says. “It’s a huge problem, not only for us but for our customers as well.”