Editor’s Note: This is the final part in our four-part series on the challenges brought on by the shortage of diesel technicians in the U.S. You can read Part One of the series by clicking here. Read Part Two, here. Read Part Three, here.

Talk about the future of construction equipment technicians and several terms rise to the surface: electrification, autonomous vehicles, virtual reality and augmented reality.

But many argue that even as construction machines evolve, technicians will still need basic hydraulic, electronic and mechanical knowledge.

“You’re still going to have hydraulics and electronics,” says Al Cevero, vice president of construction, mining and utility for the Association of Equipment Manufacturers. “Most of it stays the same.”

“Right now, there’s nothing to replace the power and speed of a hydraulic cylinder,” says Dave Wilson, Indiana product support manager for West Side Tractor Sales, a Deere dealer headquartered in Naperville, Illinois. “For the foreseeable future, there will be hydraulic pumps, hydrostatic pumps and hydraulic oil. People still need to understand how to read schematics. There are still the fundamentals of understanding voltage, electricity, hydraulic flow, pressure and temperature, and how a diesel engine runs.”

Evolving machines

In many ways the future is already here. “There are already a ton of electronics and telematics on these machines,” says Preston Wery, vice president of Aring Equipment, a Volvo Construction Equipment dealer headquartered near Milwaukee. “Not only do technicians need to know how to repair the machine, they will have to know what the end result should be, what the contractor is trying to accomplish.”

“No one’s going to throw a switch and we’ll suddenly transform, but in 10 years, most heavy equipment will be at least partially – and some of it fully – automated,” says Barrie Kirk, executive director of CAVCOE (formerly the Canadian Automated Vehicles Centre of Excellence), which produced an autonomous-technology study for the Associated Equipment Distributors earlier this year. “And by the 2030s, 80 percent of the equipment sold will use electric powertrains.”

Technicians will need more expertise in electronics, electric drivetrains and software, Kirk says. And while this transition is taking place, the older machine population still needs servicing.

“Dealers have to make sure they have the people who can fix both current and future machines,” Kirk says.

Future techs will need to know how to use digital tools and correctly analyze the data coming off machines, says Bill Chimley, Komatsu America director of training and publications. Eventually, artificial intelligence may have a role in supplanting some of these analytic skills.

Komatsu estimates that by 2023 half of its dozer and excavator fleet will have intelligent machine control as standard, Chimley says. Technician training will be needed to support these advanced machines and solutions.

“The rise of simulators and digital training is a cornerstone in our ability to train on electrification and autonomous technology,” Chimley says. To support this, Komatsu recently purchased Immersive Technologies and Oryx Systems, which specialize in mining and equipment simulation technologies.

Providing technician resources could involve an Alexa-type service in the shop or field, says Hannah Ross, marketing manager for 4Rivers Equipment, a Deere dealer based in Greeley, Colorado. “They could state the problem, and Alexa could answer,” she says. “The key is having a database that we could use to quickly train new hires on the product.”

In the future, the mix of humans and autonomous machines on jobsites will make technician safety a concern, Chimley says. “We’ll be able to do that training much more effectively through VR, AR and mixed-reality type training, but you’re going to have to take into consideration the human element when you’re around autonomous machines.”

And it’s not just autonomous machines. “There are some safety precautions with the future of electrification, especially when you de-energize a machine,” Chimley adds. “For instance, there’s an ultracapacitor on our hybrid machines. Before you work on it, you always want to make sure that ultracapacitor is de-energized and not part of any circuitry and has no charge.”

Senior/junior tech teams

Many experts see a two-tier system developing in construction shops: the veteran technicians providing the brains and the younger techs doing the heavy lifting. “It’s not just using AR or another technology,” Cevero says. “You need a 30-year experienced guy sitting in the shop that can tell the tech in the field what the problem is and how to fix it.”

“As we deal with the tech shortage, this gives an option to extend the work life of these senior technicians,” says Greg Currier, director, region fleet, United Rentals.

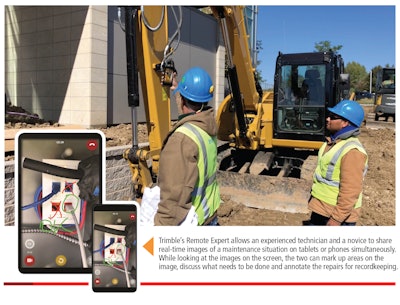

Trimble has just introduced its Pulse Remote Expert app as a first-step approach to such peer-to-peer communication. The app was developed after the company noted that today’s technicians either focused on electrical or mechanical work and its customers didn’t want to send out two technicians for one job.

“It connects two technicians in a peer-to-peer way and allows for a remote collaboration session to be established using the built-in AR capabilities of their phone,” says Brent Carter, strategic marketing director at Trimble’s Field Service Management. “We went with the phone approach, because everybody has a phone, and they’re already using them for work.”

“You can point the phone at a bulldozer or a diesel engine or whatever the part is and then the expert can start marking up the screen with his finger to show the other technician where to look for the problem,” Carter says. The techs can also text questions and answers back and forth and save job, project and repair data for review later.

Scalpel and sledgehammer

Other nuances are at play, Wilson says.

“You’re always going to need the sledgehammer as well as the scalpel,” he says, further explaining: “You’re always going to need the guy who can replace engines and transmissions and you’re going to need the person who can pinpoint and chase down that phantom intermittent electrical issue. We’re always going to need both.”

“There’s still no way around some of the heavy lifting mechanical parts of these machines, such as replacing a 2,000-pound final drive on a dozer,” says Chimley. “I don’t see a way around that, other than human labor.”

But robotics may offer an assist later on, adds Chimley. A robotic assistant in an equipment shop, for example, could ensure that humans stay safe and procedures are accurate during heavy removal and installation jobs.

Skill sets, positions

“Future technicians are going to have to have a deeper understanding of electrical diagnostics,” Wilson says. In fact, he says, “electrical is the biggest challenge for our machines today. There isn’t anything that’s just mechanical anymore.”

The rise of telematics data has prompted dealers to create positions that play in both the technician space and information technology.

Some Volvo CE dealers have “service IT support representatives.” This position helps dealers direct resources to where they’re most needed, says Ryan Flood, vice president with Highway Equipment & Supply, a Volvo CE dealer in Harrisburg, Pennsylvania.

“We’re not dispatching a $175,000 truck and a technician we need elsewhere to just do a computer update,“ Flood says.

Not quite yet

Augmented reality and virtual reality offer intriguing possibilities of how machines will be serviced in the future.

For example, Caterpillar’s Service Information System online portal, which debuted last year, has 3D and augmented-reality elements that drive visual learning, says Jason McIntire, senior IT analyst with Caterpillar. “The system offers guided troubleshooting and diagnostics from connected [telematics equipped] assets and allows you to overlay that 3D model and identify the part location using augmented reality,” McIntire says. For instance, users can quickly locate one sensor from the banks of sensors used on a large machine.

But using headsets such as Oculus Rift to pinpoint step-by-step repairs won’t happen tomorrow, says Trimble’s Carter.

“Headsets are not quite ready for widespread adoption now, especially in outdoor environments,” Carter explains. “For one, they’re very expensive. They can run $3,000 to $7,000 apiece. And when you’re deploying this type of technology, you need a critical mass. You can’t just give it to five or 10 technicians. If you look at a dealership that has a lot of technicians and you ask them to invest in these, the initial investment becomes a barrier.”

The headsets also face a common technology fear: obsolescence. “People are worried next year that a better headset is going to come out, and they’re going to become obsolete. And they’re probably right,” says Carter.

Perhaps the biggest barrier to getting digitized engine and machine schematics into an artificial or mixed-reality format is just the sheer volume of information that needs to be uploaded to make these systems work.

“To digitize the schematics and get all that content into a delivery mechanism requires a ton of participation from the OEMs,” says Carter. While digitizing this information is easier with newer machines, providing that information for older machines seems to be less of an OEM priority, he says. And there are plenty of older machines in contractors’ fleets, all of which need servicing.

And then there is the question of how much of the diagnostic information OEMs want to share with their customers, says Carter. “They are still deciding what entry points they want to allow and for what purpose. They’re still figuring out the business models around that,” he says.

Remote fixes

Machine telematics have prompted OEMs to offer a wave of fleet management services aimed at predicting failure and optimizing downtime. Now machines can be diagnosed and receive software updates remotely, much like your smartphone updates.

Cat’s Remote Troubleshooting and Remote Flash are examples of how OEMs are using remote functions. With Remote Flash, customers receive a notice from Cat or their dealer that a software upgrade is available, much like a smartphone software upgrade.

Once an authorized user receives the flash-file push notification, he confirms the machine or engine is ready and initiates the process. Using the machine’s onboard telematics, Remote Troubleshoot allows the dealer to run diagnostics testing and pinpoint potential issues. Some issues can even be resolved remotely, saving a technician repair call.

“We’re certainly on a development journey with these remote features, one that is driven by the value that we can create in making technicians more efficient at our dealerships,” Cat’s McIntire says.

These capabilities have been a significant factor in getting machines fixed more quickly, Wilson adds. “The more OEMs put that as standard will have a big effect on our technicians. It gives us the ability to pre-diagnose before we leave for the job and fix it more quickly when we get there.”

Remote solutions have already saved tens of thousands of hours of technicians’ time, Chimley adds.

Uber tech?

A short-term impact of today’s technician shortage might be the rise of the “uber tech,” an all-brands person who focuses on PM items, such as filter and oil changes while OEM dealer techs do more complex repairs.

“I don’t see the technological improvements happening quick enough in the next three years to overcome the pace of the current technician shortage,” Chimley says. “However, our dealers have realized this and are focusing different skilled technical employees into both of these product support segments – one group for preventive maintenance and another group for technical repair.”

In one way the uber tech is already here, says United Rental’s Currier. “We’re actively engaged in using third-party vendors,” he says, speaking of his area of concern: power HVAC equipment, such as portable and diesel generators, chillers, air conditioners and cooling towers. “We particularly use them if we are short-staffed in a certain area, or we’ve got a large project coming on.”

What’s really needed

Don’t forget about the human element, Wilson says.

“When I look at what skills technicians will need in the future,” Wilson says. “I really don’t need any different skills than we have today. But I need people who are trustworthy and honest. Maybe instead of a huge diesel engine, in the future, you will have a smaller engine and drive motors. But what I still need to fix that complex tractor is the same thing I needed 10 years ago: a good human being.”