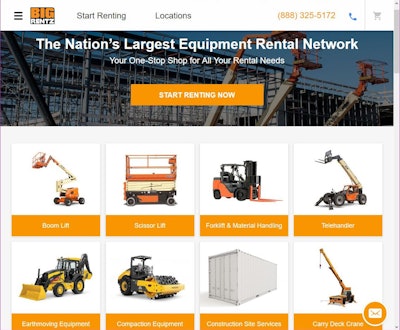

Though the company offers the Google-like ease of finding just about any piece of construction equipment for rent, anywhere in the country, you won’t find a search bar on the BigRentz homepage. Just easy-to-navigate images gradually guiding you to the right machine.

Though the company offers the Google-like ease of finding just about any piece of construction equipment for rent, anywhere in the country, you won’t find a search bar on the BigRentz homepage. Just easy-to-navigate images gradually guiding you to the right machine.In the short time since the company’s founding in 2012, BigRentz has grown up fast. It lists locations in all 50 states, offers a wide selection of heavy equipment in eight categories, is open 24 hours a day, seven days a week, and boasts what it calls the “largest equipment rental network for construction equipment” in the United States.

But here’s the twist: BigRentz is all of these things and doesn’t own a single piece of equipment.

So how did the Irvine, California-based company manage all of this in just six years? The internet, of course.

At it’s core, BigRentz is akin to being the Google of heavy equipment rental in that it’s a one-stop shop where anybody, anywhere in the U.S. can find the machine they need and rent it. Actually, it’s a bit more convenient than Google. There’s no phone numbers to deal with, no locations to track down. BigRentz does all of the calling and procuring for you.

The BigRentz offices in Irvine, California. Photo: Courtesy of BigRentz

The BigRentz offices in Irvine, California. Photo: Courtesy of BigRentzYou won’t even find a search bar on the BigRentz website. Just large, easy to understand images representing exactly what equipment they have available. And when you find your machine and rent it, there’s nothing else to be done in most cases. Soon after, the machine shows up to the office or jobsite, ready for work. And when you’re done, it’s whisked away.

If this all sounds too good to be true, believe me, I understand your skepticism. However, after a visit to the company’s offices, I can assure you, that the promise of BigRentz is very real. During my time at the office, company leadership took me through each step of the finely-tuned process that allows the company to facilitate rentals at more than 8,000 locations across the U.S. through a network of more than 1,650 suppliers.

Here’s how it all comes together.

The Tech

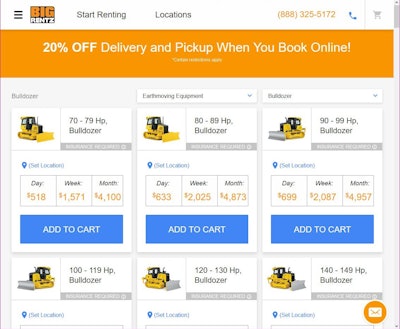

BigRentz displays most of its machine rates within a few clicks of your rental search.

BigRentz displays most of its machine rates within a few clicks of your rental search.Whether you’re a contractor who rents equipment or a dealer/rental house that rents equipment to those contractors, BigRentz has a message for you: “We feel your pain.”

“All of the challenges inherent to the rental industry, we feel dramatically,” Chief Technology Officer Liam Stannard says. In the early days of BigRentz, it wasn’t uncommon to see the following chaotic scene:

“Before we had built out any real technology, we were operating on pad and paper. The phones would be ringing off the hook for rentals and folks here were shouting out ‘Who’s got a telehandler in Kansas?’ while everyone flipped through a huge sheaf of paper to find people and, oh yeah, ‘What should we pay for a telehandler in Kansas?’” Stannard explains.

In other words, BigRentz knows well the challenges of both making and filling orders. And Stannard says the company’s website, customer dashboard and fulfillment back-end (dubbed QuickRentz) are all designed with one purpose in mind.

“We want to provide the tools and visibility to make your job simple,” he says. “For contractors, your job is not to become a procurement and logistics expert and go find 14 different rental companies scattered hither and yon and call them up, get credit applications with them and get the equipment delivered and make sure it’s terminated and off the site when the time comes, and so on.”

Customer portal tracks each step of the rental

BigRentz chief technology officer Liam Stannard says the company’s employees strive to offer capable tech to allow for speedy online rentals, but also one-on-one phone support for more complicated rental requests. Photo: Courtesy of BigRentz

BigRentz chief technology officer Liam Stannard says the company’s employees strive to offer capable tech to allow for speedy online rentals, but also one-on-one phone support for more complicated rental requests. Photo: Courtesy of BigRentzBeyond how easy it is to price and order a machine on BigRentz, where the company really takes care of contractors and other renters is through its customer portal. As soon as you place an order, you receive a text message and an email containing a link to this portal, which makes it easy to track the progress of your order, extend a rental once it’s in progress, and terminate a rental.

But Stannard and the rest of the BigRentz leadership know that not every rental scenario is appropriate for the website.

“Historically this has been a really person-to-person, supplier-to-customer relationship business. Like all business, that’s changing because of digital technology,” he says. “But there are still plenty of folks and plenty of applications where you really need to have a phone call. If you go to our site, you can rent a 19-foot scissor, with no problem. Put in your cart, check out, put in your credit card, it will show up whenever you ask for it. But if you need a 180-foot boom, we need to have a conversation about that.”

That’s why the company prominently displays its phone number at the top of the site.

For dealers, Stannard says, BigRentz has been able to have a major positive impact by exposing many of those businesses to a much larger customer base than they had seen before. “Beyond that, we’re aggregating that customer demand in a way that is consumable and doesn’t drown a supplier,” he says.

As a middle man between supply and demand, BigRentz depends heavily on both sides being successful to find success for itself. Stannard says the core service the company offers is doing the heavy lifting when it comes to the logistics in bringing both sides together.

“All of this is just sort of an ugly necessity of doing your job and it isn’t your core competency,” he says. “But it is in fact our core competency.”

QuickRentz fulfills orders quickly

BigRentz team members at work. Photo: Courtesy of BigRentz

BigRentz team members at work. Photo: Courtesy of BigRentzSo how does the company bring both sides together so quickly? That’s done by an aptly-named fulfillment platform the company built called QuickRentz.

When an order comes into BigRentz, be it from the website or a phone call, it’s sent to a queue of tasks within the QuickRentz system. Among those tasks are orders to source and calls that need to be made to customers or rental suppliers. When a member of the BigRentz team finishes one task, they’re immediately sent another that has been deemed the most pressing task in the system. When that task is an order, a sourcing team member pushes that out to suppliers near the customer.

The suppliers then get a text message and an email with a link to the order. The link provides the supplier with all the details: what machine is needed, where and when it’s needed, and the rate BigRentz is offering to pay the rental house for it. From there, a supplier can accept the order or decline it. And if no supplier claims an order? That’s when the BigRentz sourcing team starts making phone calls to suppliers.

Sharing data with suppliers

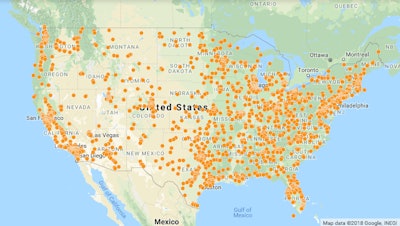

BigRentz has nearly 1,700 rental partners in all 50 states and the District of Columbia, amounting to more than 8,000 U.S. rental locations.

BigRentz has nearly 1,700 rental partners in all 50 states and the District of Columbia, amounting to more than 8,000 U.S. rental locations.And beyond keeping in nice order what used to be a spreadsheet-based, highly chaotic process for BigRentz, the system mines a lot of valuable data on the equipment rental business all across the U.S. And BigRentz shares just about everything it learns about the industry with its suppliers.

“The data that we provide to our suppliers is crucial. They are already able to see their market locally. Traditionally, that would be all they know about other than word of mouth,” Stannard says. In addition to identifying what machines are renting well in various parts of the country, BigRentz is also able to see what machines are most needed by aggregating the reasons why suppliers can’t accept a rental, whether it be rate or supply.

“From that data we can see areas where there is lack of supply and we can go back to our suppliers and say, ‘You know, we had a really hard time finding warehouse forklifts in this area, maybe you should consider that data point when you’re doing your fleet planning.”

The company also gathers data on rental experience from its customers and shares that information with rental suppliers as well. “At the end of a rental we ask how it went and if any issues are raised, those are reported and all of that data goes back into our system against the rental and for our use internally for supplier rankings and for supplier relationship management, but we also provide that data to the supplier.

“We really want to support the industry, support the suppliers. A big part of that on our side, in addition to giving them more business, is to help them do business better by giving them insight.”

Supply side relationships

Just as BigRentz customers can speak to a person when they need to, BigRentz has a team dedicated solely to cultivating and supporting supplier relationships.

That team is run by Director of Supply Keith Holmes who has seen the company’s number of supply partners grow from 50 in 2014 to nearly 1,700 today.

“The relationship piece is the biggest part. With a business like BigRentz, a digital business coming in to a very old school industry, many of the suppliers are right to ask, ‘Who are you guys?’ There’s even I think a fear aspect. I mean, think about it. Online company. They don’t own assets. How will this company play with us and this space that we’ve already defined?”

Holmes says his team’s primary purpose is to give a face to what could be perceived as a digital monolith casting a shadow over the mom and pop rental industry. A big part of the supply team’s first encounter with suppliers is shaking hands and demystifying what the company’s real end goal is.

“We want to partner with you. We’re not competitors and here’s why we’re not competitors. Here’s why we can add value to you,” he explains. “It’s not a sales pitch. It’s us wanting to build a long-term relationship … We want to keep getting more and more data and supply that to suppliers to keep sending them revenue.”

In many instances, Holmes says, that data holds surprising revelations for many rental houses. “There was a guy the other day who covers New Jersey, New York and part of Connecticut. For him we looked up our opportunities for rentals in those areas and there were over 20,000 opportunities,” Holmes says.

This type of data can also be useful for those rental fleets that are already operating at 90 percent utilization, he explains. BigRentz can identify machine types in high enough demand to influence future fleet purchases for its suppliers. “And that’s what I mean about the long term picture. If we can get really good at those types of recommendations we can then add the value of forecasting future demand to where a supplier feels comfortable purchasing more of a machine because they can feel confident in the demand they’ll see from BigRentz orders.”

Apart from the data and revenue BigRentz can pass along to suppliers, another major benefit suppliers have reported to the company is exposure. Holmes says he met a supplier recently who told him about an order his rental house fulfilled for an Amazon fulfillment center. “He told me, ‘Honestly? We’ve been down (to the fulfillment center) multiple times but none of the people in charge of ordering equipment are actually at that facility. But with one click of a ‘Yes’ with BigRentz, we were able to get into that fulfillment center.’ And these are his words, not mine, he told me, ‘I would never had a shot with Amazon before you guys.’”

“A sales and marketing arm for our suppliers”

CEO Scott Cannon forecasts strong growth not only for his company, but the equipment rental industry as a whole. Photo: Courtesy of BigRentz

CEO Scott Cannon forecasts strong growth not only for his company, but the equipment rental industry as a whole. Photo: Courtesy of BigRentzBigRentz CEO Scott Cannon joined the company in January 2017, first as its chief operating officer. He accepted an offer to run the company because of the promise he saw in the service the company provides and its culture.

“I saw an opportunity to scale a business in an industry that is disruptable and the benefits of that disruption go right to the consumer,” Cannon says. “And I thought we could scale this business pretty quickly.”

Cannon says he has been pleased with the company’s performance and that it has done well enough to up its spending on marketing and sales initiatives. The ability to up its presence in the market comes at a good time, too, Cannon says.

“My forecast for the next two to three years is rapid growth within the industry,” he says. “I think the new tax law is going to be very beneficial to our industry. You can see it in the earnings of the publicly traded companies just in terms of the ability to write off the purchase of equipment. Demand at the current point actually exceeds supply, which is good, it’s healthy for the industry as well. I also think in the industry you’re going to continue to see consolidation and I think it’s an opportunity for late stage investors in rental companies to get out in the next couple of years and make a healthy return.

“Construction itself is cyclical, but the current cycle should continue for the next couple of years unabated.”

Cannon also pointed to more contractors opting to own less equipment and rent lesser utilized machine types more often as a result of the 2008 financial crisis. “From a contractor’s standpoint, it just makes financial sense to only own vital equipment and to outsource what you can,” he said. “We’ve had contractors on advisory boards in the past and this next generation coming through has changed the business model. They are getting rid of everything they can and only keeping equipment they absolutely have to have, and they see that as a competitive advantage.

“And if you look at a lot of the items we rent, they’re high turnover. You don’t need a scissor lift on your yard doing nothing. And you can rent them relatively inexpensively.”

Based on what he’s seen, Cannon says that he doesn’t expect this “own only what you need trend” ever reversing, especially with how easy renting a machine is becoming. That is due in large part to the rise of companies like BigRentz, which not only make the process faster, but also offer a selection of machines that differs in a very important way than the selection offered by a traditional rental house.

“If you look at the traditional model, a contractor would have a relationship with a local rental yard. And most rental yards once you get down past the majors, typically concentrate on certain types of equipment,” Cannon says. “So you’ll see an independent dealer who might have aerial equipment or telehandlers, but maybe doesn’t offer earthmoving equipment. Or vice versa. So because of that, you kind of had to own some of this stuff.”

Cannon at work in his office. Photo: Courtesy of BigRentz

Cannon at work in his office. Photo: Courtesy of BigRentzBigRentz, on the other hand, offers both the small stuff and the big stuff. So the decision of what to own and what not to own is getting a lot easier, Cannon says. He adds that the company is aware that this new advantage the company holds could be seen as a threat by some of the smaller, traditional rental houses. But Cannon says the company sees all of its suppliers as partners, not competition.

“We act as a sales and marketing arm for the small, independent rental companies, who don’t feel like they have the budget, the knowhow or the wherewithal to compete with the larger companies online,” he says. “We pull together thousands of small- and medium-sized contractors and make it easier for them to work with one customer instead of all of them at once.”

Cannon says that in the next year or two BigRentz has plans to make its wealth of data even more accessible to suppliers.

“We’ll have a robust portal where suppliers can go in and look at their own lost rental data, themselves. That’s incredibly valuable information,” he says. Cannon added that the company also plans to offer, for a fee, more advanced market insights gained from what the company knows about who’s searching for and renting what equipment and where.

Cannon says as the company grows, he expects the data it provides to become even more powerful and reliable.

“We have a very robust growth plan which is going to require a significant spend in sales and marketing,” he says. “As we do that, we’re going to continue to gather a significant amount of data. We have a big enough sample size today to provide really good information in most markets. But obviously, the bigger sample size you have, the more concrete that data becomes and the more valid it is.”