Construction starts will fall 4 percent in 2020 in the United States in an “orderly pullback,” but there will be no recession, forecasts Dodge Data & Analytics.

The firm’s 2020 Construction Outlook, released today, cites trade fights and a labor shortage as the main causes for the construction decline. The decline, however, will be nothing like the Great Recession, and there will not be a recession in the overall economy. Instead, growth will slow.

“The recovery in construction starts that began during 2010 in the aftermath of the Great Recession is coming to an end,” says Richard Branch, Dodge chief economist. “Easing economic growth driven by mounting trade tensions and lack of skilled labor will lead to a broad-based, but orderly pullback in construction starts in 2020.”

“Economic growth is slowing but is not anticipated to contract next year,” Branch adds. “Construction starts, therefore, will decline but the level of activity will remain close to recent highs.”

According to Branch, construction starts rose 3 percent in 2018, dropped 1 percent in 2019 and will drop 4 percent next year.

‘Average recession’

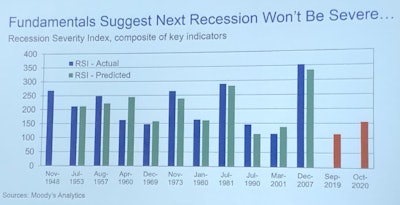

Cris deRitis of Moody’s Analytics presented this chart of his prediction for the severity of the next recession, if one had occurred in September and if one occurs next October using current data, as denoted by the red bars. The green bars represent his predictive model when compared to actual recessions’ severity. The blue bars represent the recessions’ actual severity.

Cris deRitis of Moody’s Analytics presented this chart of his prediction for the severity of the next recession, if one had occurred in September and if one occurs next October using current data, as denoted by the red bars. The green bars represent his predictive model when compared to actual recessions’ severity. The blue bars represent the recessions’ actual severity.Cris deRitis, Moody’s deputy chief economist, said during Dodge’s Construction Outlook Conference today in Chicago that if a recession should occur – and eventually one will – it would be one of the shortest and least severe, an “average recession.” But he added that he does not expect one to occur in 2020.

A wild card on the next recession’s severity, however, would be the uncertainty surrounding future national monetary and fiscal policy, which is now in uncharted territory – with low interest rates and a high federal deficit. That leaves less room for the Federal Reserve and the federal government to stimulate the economy in a downturn.

His top concern is an escalating trade war with China. The next round of tariffs would fall on consumer products. And consumer spending, he said, is driving the current economy.

He noted that the end of all of the previous recessions, except the Great Recession, have been led by the construction industry. And he said construction companies should be ready for the next recession’s opportunities, as recessions lead to lower labor and capital costs.

His prediction for 2020: The construction industry will weaken but not collapse.

Sector breakdown

Here’s Dodge’s forecast breakdown for construction industry segments:

Residential – The dollar value will drop 3 percent and number of units will be down 5 percent for new single-family housing. The eight-year growth in multifamily housing starts will end, with drops of 13 percent in value and 15 percent in units.

Commercial – Construction starts will drop 6 percent, particularly for warehouses and hotels. Office and retail construction will also drop. High-value data center construction will be a bright spot.

Institutional – No overall change expected. Education- and health-related construction will grow modestly but be offset by declines in recreation and transportation construction.

Manufacturing plants – A 2 percent decline because of trade tensions that have weighed down the sector.

Public works – A steady flow of federal government funding will lead to a 4 percent increase in construction starts across the board, including transportation and environmental projects.

Electric utility and gas plants – A 27 percent drop, which follows an 83 percent increase in 2019 when several large liquefied natural gas export facilities and new wind projects got underway.