Earlier this month, the U.S. House of Representatives passed H.R. 5771, which would reinstate both the bonus depreciation and increase Section 179 small business expensing.

“We expect the Senate to approve the tax bill in the next few days and the administration has indicated President Obama will sign it,” says Christian A. Klein, vice president of government affairs with the Associated Equipment Distributors.

If the bill becomes law, it will simply reinstate the prior 2013 law for 2014, says Klein. “This means that all the usual rules related to bonus depreciation will apply,” he says, including that the equipment must be new and purchased and placed in service by the buyer by the end of 2014.

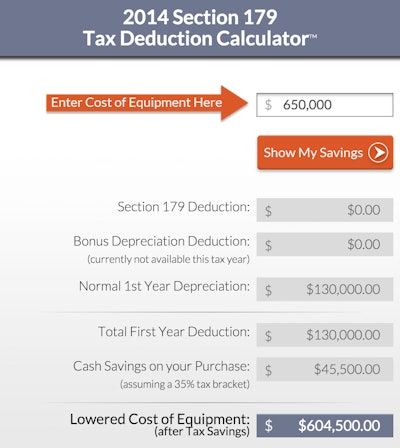

You can see an example of what this might mean for new equipment purchases on the Section 179 website using the calculator pictured above.