The partial collapse of a bridge over the Skagit River on Interstate 5 in Washington earlier this year turned attention to the need for infrastructure funding.

The partial collapse of a bridge over the Skagit River on Interstate 5 in Washington earlier this year turned attention to the need for infrastructure funding.Ever since the statistical end of the Great Recession an argument has raged about deficit spending by the federal government.

Belt-tightening types (usually Republicans) want to rein in spending because they think government deficits hurt the economy. Their opponents (usually Democrats) say the government needs to spend more to stimulate the economy.

Who is right? The spenders seem to be winning the argument right now. Mother Jones magazine has a good summary of the debate here.

But buried on the second page of the Mother Jones article is this key paragraph:

“Unless the borrowed money is spent in ways that foster economic growth in a big way, paying it back or paying interest on it forever will mean future pain in the form of higher taxes or lower spending.” In other words, if borrowed money is spent wisely—for example, on roads or electric grids—then it will promote future growth, which makes paying down the debt manageable. If it’s not, high debt might indeed cause future pain.

To spend or not to spend should not be the issue. The real issue is what to spend our tax dollars on. Politicians hide behind a false narrative of a battle between tax-and-spend or fiscal restraint. But our government has been taxing, borrowing and spending about the same percentage of the GDP for decades.

So why, despite the Federal Reserve’s four massive stimulus spends—aka Quantitative Easing 1, 2, 3 and 4—is the economy not recovering as it has in every past recession and recovery?

I would wager that it’s exactly as the Mother Jones quote says. We’re spending our tax dollars on the wrong things. Instead of roads and electric grids, which benefit everybody and boost our economic health, we’re throwing money down thousands of special interest rat holes—everything from ACORN on the left to overpriced and unnecessary military hardware on the right.

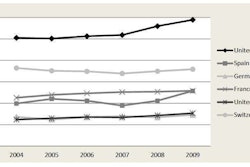

When you look at the economies of Germany, Sweden and much of Protestant Western Europe, their government spending is, to American eyes, shockingly high—50 percent of GDP in many cases. But these countries have stronger and more competitive economies, better infrastructure, abundant public transportation, lower crime rates, better education, less income inequality and more pension and job security than the United States.

They’re doing great and we’re not. And the reason is simple. These governments spend their money on things that benefit the maximum number of its citizens. Our government spends its money on things that bring the maximum benefits to politicians.

Infrastructure spending, while great for everybody, doesn’t bring sufficient opportunities for graft and campaign contributions. There’s no one giant construction company comparable in size to Google or Microsoft, that can sway elections and accordingly reap federal megadollars.

As a result, until we change the system and the players, infrastructure will never be a priority. And we’re all the poorer for it.