The Highway Trust Fund (HTF) is a major talking point in the highway construction industry right now, especially because the major funding source is likely to run out of money in less than three months. HTF insolvency would mean projects across the nation would not be able to begin and 700,000 workers would lose their jobs.

So, you know why the HTF is important, but do you understand how it works?

The Congressional Budget Office (CBO) on Wednesday released details about the fund and how it’s handled.

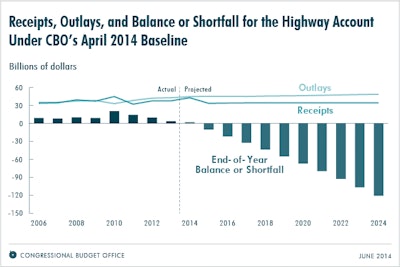

(Photo credit: CBO)

(Photo credit: CBO)CBO notes that HTF spending has exceeded revenues by more than $52 billion for the past 10 years and is expected to continue outpacing revenues. Spending is estimated to exceed revenue by $167 billion by 2024 if both obligations (adjusted for inflation) and revenues continue at their current rate.

To understand the problems surrounding the HTF, it’s important to understand how it’s treated differently than other items in the federal budget. CBO explains that the HTF has a split budgetary classification.

The programs funded by the HTF are considered discretionary and are not subject to the reductions required of mandatory programs. However, the budget authority for those programs is classified as mandatory, so the HTF doesn’t have the statutory cap on spending that most discretionary programs have.

According to CBO, those two factors “facilitate the spending of more money from the trust fund than there are dedicated revenues to support such spending.”

To see how cost estimates for funding are calculated click here.

It’s also worth noting that the HTF gets its revenue from the federal fuel tax, which has remained at the same rate — 18.4 cents per gallon for gasoline and 24.4 cents per gallon for diesel — since 1993 without any index for inflation.

CBO suggests alternatives for funding surface transportation programs such as reducing commitments from the HTF, increasing fuel taxes and supplementing user fees with transfers of general revenues.

The agency also looks at three options for enforcing rules to surface transportation programs.

According to CBO, these could “provide more effective budgetary control of surface transportation programs.”

1. Treat both budget authority and outlays as mandatory.

2. Treat both budget authority and outlays as discretionary.

3. Keep the split classification of mandatory budget authority and discretionary outlays, but count transfers from the general fund to the HTF as new budget authority and outlays.

Congress has the opportunity to fix the HTF this year. The current highway bill, MAP-21, expires at the end of September. The Obama administration has proposed a 4-year highway bill that aims to address the HTF shortfall, and the Senate is considering a 6-year bill that would provide greater transparency of HTF use.

The CBO released its reports during the Transportation Construction Coalition’s (TCC) 2014 Fly-In, during which transportation advocates met with lawmakers and discussed highway funding.

For more details about the HTF, including CBO suggestions for fixing the fund, click here.