Editor’s Note: This is Part Eight of an eight-part series on the evolution of construction equipment and the diesel fuel alternatives manufacturers are introducing, including hybrid machines, electric and battery-powered equipment, and hydrogen combustion and hydrogen fuel cell technology. You can read Part One in the series by clicking here. Part Two. Part Three. Part Four. Part Five. Part 6. Part 7.

The increasing demand to minimize exhaust emissions, ventilation costs in underground mining, and preference for the low noise construction machines in residential areas is expected to continue to create growth opportunities within the battery and hybrid-electric construction equipment market.

The demand for construction equipment is high across the world. However, the trend of full electrification is limited to compact construction equipment, including compact and mini excavators and loaders. The currently available battery technologies do not provide the required power output, resulting in major mining dump trucks operating on hybrid-electric propulsion while also offering automation.

Emissions regulations and preference for more compact equipment place a higher demand for electric equipment in Europe, and North and South America.

There are some advantages to electric in terms of performance, reduction of noise, and lack of emissions. Despite disadvantages such as overall cost for both the manufacturer and the end-user, off-highway vehicles in agriculture, mining and construction equipment, are being electrified in greater numbers. The question remains, will those alleged limitations of charging infrastructure and runtime stunt growth in the market over the next five years?

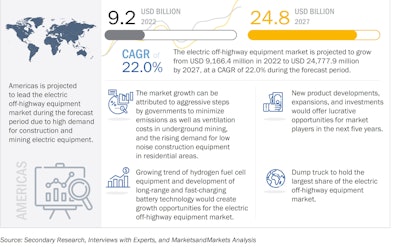

Several market research studies in 2022 suggest the answer is a definitive “no.” A recent forecast from MarketsandMarkets projects strong growth within the battery-electric and hybrid-electric off-highway equipment market in the next five to 10 years.

In 2021, the market was valued at approximately $4.3 billion. That number more than doubled to approximately $9.2 billion in 2022 and is anticipated to continue growing. The electric construction equipment market is forecast to grow to $24.8 billion by 2027 at a compound annual growth rate (CAGR) of 22%. Additional studies have pushed the number as high as $42.4 billion by 2030.

Major construction equipment manufacturers, including Volvo CE, John Deere, Caterpillar, Komatsu, Hitachi, Doosan Bobcat and more are working on several prototypes and have adopted strategies such as product launches, expansions, collaborations, partnerships, and mergers and acquisitions to gain traction in catering to the new demand.

They are focused on providing advanced and technologically driven equipment for construction, mining and agriculture applications, while also reducing the carbon footprint and adhering to emission regulations around the globe. Several OEMs have made commitments to reduce their fleet emissions level by 2050 through the development of electric or hybrid-electric machines.

For many of the OEMs, as the development of electric machines continues, the diesel versions of at least their compact equipment will likely be phased out. However, the compact lineup of electric equipment is only the first in the rollout as engineers from various manufacturers develop systems for larger construction equipment.

Various studies show that hybrid-electric vehicles accounted for the largest market share, 58.8%, in 2021. Such machines are designed to augment the use of an internal combustion engine in collaboration with an electric powertrain. The technology enables users to run a smaller engine at lower rpm, providing fewer moving parts and higher fuel efficiency. All these factors are expected to contribute to the growth of the hybrid-electric vehicle segment going forward.

Additional challenges facing the OEMs in further expansion of fully electric vehicles is the standardization of charging and overall battery capacities. Such issues pose severe challenges to the global electric construction equipment market even as it continues to grow going forward.

MarketsandMarkets

MarketsandMarkets

Global market

The North American market accounted for the largest revenue share, 42%, of the electric off-highway equipment market in 2021 and is anticipated to continue dominating the market over the next five years due to the large projects and increasing demand for advanced technology with improved efficiency.

According to the U.S. Environment Protection Agency, in 2018, off-highway equipment constituted nearly 30% of the total greenhouse gas emission. The increasing emissions have prompted companies to launch electric models of their off-highway vehicles in the market. Like other countries, the U.S. has issued stricter carbon emission regulations, prompting further demand for electrified equipment among construction contractors.

With the high electrification trend in developed countries and high demand for construction and mining equipment, Europe is also predicted to continue to have a large market share for electric equipment in the next five years. The stringent emission regulations along with many sustainability initiatives by the government are some of the key reasons for this region to have a larger market for electric construction equipment.

According to the World Health Organization (WHO), approximately 44% of the European population is affected by road and vehicle noise, leading to severe health issues among people. To counter this, countries are working toward regulations to control the noise generated by construction equipment. The noise from diesel-powered construction machines is driving the development of initiatives and policies associated with minimizing noise in residential areas. For example, in Oslo, Norway, city officials are anticipating operating all public construction sites with such machinery by 2025. The plan involves setting minimum standards for bidders on contracts it puts out to tender to create the market for electrified construction equipment. Similar programs are in development in London and Paris.

With all these emerging regulations and initiatives, construction companies in Europe are showing increasing interest in electric construction vehicles and equipment. These machines are designed with decibel levels making them apt for working within city limitations without any restrictions. Most of the leading manufacturers are introducing compact electric equipment that is designed especially for such urban applications and meeting the noise decibel restrictions.

The rapid development of such technology also has occurred in countries such as China, India, South Korea, and others. China is a major contributor to the manufacturing of construction equipment owing to the presence of numerous OEMs, low labor cost, low production cost, and availability of better manufacturing facilities in the country.

How do you use it

Grand View Research’s analysis of the electric off-highway equipment market suggests that the construction equipment segment accounted for the largest revenue share, 38.2% in 2021.

In the construction segment, electrification of smaller or compact types of equipment such as wheel loaders, mini and small excavators, and more recently compact track loaders or skid steers appears to be the focus. Electrification is well-suited to the smaller machines which have lower power demands.

Their use in smaller projects means their daily duty cycle is lighter than larger machines, meaning the power demand can be met with a practical-sized battery and electric motor.

While construction equipment is being electrified at a fast pace, many would argue that it is the mining industry that currently has a substantial market share of electric off-highway equipment. Mining applications are currently leading the market in terms of value generation globally. This is primarily due to the initiatives by the mining corporations and governments about the safety, environmental and financial benefits of electric and hybrid-electric mining equipment.

To overcome various regulations on ventilation systems, reduction in noise, and reduced overall capital and maintenance costs, manufacturers and mine owners are turning to electrification and automation of mining vehicles. Electrification can leverage automation to help overcome labor and safety challenges in multiple markets.

Like the manufacturers, many leading mining companies have committed to net zero emissions by the year 2050, preferring electric fleets to reach those sustainability goals.

Within the agricultural market as John Deere, CNH Industrial and other manufacturers are advancing technology in tractors, harvesters, and other farm implements, interest continues to rise. Consumers in North America and Europe are adopting modern farm equipment and advanced agriculture processes to gain higher yields.

Demand for electric and hybrid-electric excavators, dump trucks, tractors, and more is expected to rapidly increase in the five-year forecast period.