Heavy equipment values on the resale and auction markets are showing a downward trend, according to recent reports.

Both the quarterly Rouse Market Trends report for Ritchie Bros. and the monthly EquipmentWatch February report indicated declining values for used construction equipment.

“Throughout the year we saw consistent volume increases in many categories leading to pressure on median pricing,” said Doug Olive, senior vice president of pricing and appraisals at Ritchie Bros. “The transportation sector felt the pressure of high volumes, with median prices down significantly compared to the year prior. We will be monitoring to see if this trend continues going into 2024.”

According to the Rouse report, retail sales volume increased 16% in 2023 versus the prior year, with total volume returning to the levels last seen in 2019-2020.

EquipmentWatch

EquipmentWatch

Despite the decline, the overall equipment values remain high, at 10 to 15% higher than long-term historical trends, according to Ritchie Bros.

Specifically, the Ritchie Bros. report states that prices and volume for wheel loaders and articulated trucks increased in the U.S. in 2023. Also, pricing for motor graders remained flat with there was a slight reduction in volume.

Additional categories with larger volume increases in the U.S. included multi-terrain loaders, skid steers, and telehandlers. Those same segments of equipment also saw lower median prices throughout the year.

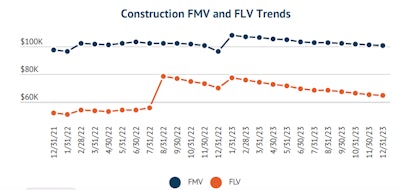

EquipmentWatch noted that construction equipment fair market values (FMV) experienced a minimal month-to-month drop, with values declining from $100,461 to $100,245 or a .54% change from November to December 2023 while overall values were still up 3.84% from December 2022.

Comparatively, values on the auction channel also continued a slow decline, dipping 1.22% month-over-month and remaining even more evident on the year-to-year analysis with an 8.02% decline.

Similar numbers were reported via Ritchie Bros. as the Rouse report stated that prices for used large and medium earthmoving categories were down approximately 6% and 17% respectively for the three months ending December 31, 2023. Similarly, Ritchie Bros. reported truck tractor prices of 21% and aerial equipment of 7%.

Rouse

Rouse

Equipment on the auction market saw an increase of 15.75% month-over-month in usage rates but remained down 10.24% compared to December 2022. Meanwhile, the usage rates on the resale side dipped 1.47% on a month-to-month basis and were down 9.07% on a 12-month review.

The age of the equipment on the resale market was down 1.47% on a month-to-month basis and down 8.31% from December 2022, continuing a consistent downward trend according to the EquipmentWatch report.

On the auction channel, the average age of equipment was 3.38% lower than in November 2023. The monthly decrease compared with a 7.80% decline year-over-year and a nearly 15% decrease since December 2021.

Rouse

Rouse

"Last year marked a year of transition in the used equipment markets," said Doug Rusch, senior vice president of seller and platform solutions, at Ritchie Bros. "The pandemic years were characterized by a tight supply environment, lower transaction volumes, and record-high valuations; as new machine availability has eased, the trends have essentially reversed."

EquipmentWatch

EquipmentWatch