With the first half of 2022 in the rearview mirror, Ritchie Bros. Mid-Year Market Trends Report sheds light on the current state of used equipment inventory and pricing, as well as what to expect in the coming months.

Prices hit record levels from January through June 2022, as lower interest rates, increased infrastructure investment and commodity prices fueled the demand for equipment.

But as inflation climbs and the pool of newer machines in the marketplace grows, pricing of used construction equipment will likely cool off, Ritchie Bros. says.

While used equipment values in general remain higher compared with the same period last year, across the board they’re down by single-digit percentages relative to earlier in the year.

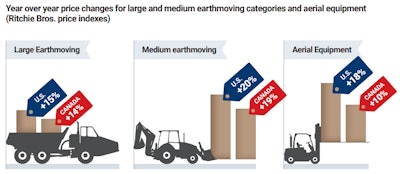

In the three months ending in July, Ritchie says, prices for used large and medium earthmoving equipment increased by 15% and 20% respectively, compared with the same period last year.

Prices in the aerial segment are up 18% compared with the same three-month period in 2021.

Truck tractors continue to take the brunt of the inflationary increases with a year-over-year price increase of 39%. Vocational trucks prices are also up 25% compared to the same time last year. The vocational segment includes dump, flatbed, boom, water, tank, van, reefer, field service and concrete mixer trucks.

“Used equipment sales volumes continue to run behind prior year levels across all sales channels. Retail values for most categories of equipment continued to rise in June, albeit at a slower pace than we’ve seen in recent months,” says Doug Rusch, managing director, Rouse Sales. “After rising 18 straight months, auction values have stabilized. In some cases – aerial, telehandlers and medium-sized earthmoving equipment – auction values decreased slightly last month in contrast to record highs experienced in recent months.”

“Demand for low-hour, late-model equipment is strong with competitive bidding coming from multiple sectors across multiple geographies. Equipment sellers continue to benefit from the demand we're driving,” adds Doug Olive, SVP, pricing, Ritchie Bros.

Ritchie Bros.

Ritchie Bros.

Selling older equipment at lower volumes

The Ritchie report also took a deep dive into the volume of equipment sold, and it shouldn’t come as a surprise that volumes declined across most product types.

Earthmoving equipment, excavators and compact track loaders saw the largest declines by volume sold. All aerial categories – boom lifts, scissor lifts, forklifts and telehandlers – also saw declines in volumes sold.

Furthermore, across all categories examined, the median age of the asset categories sold in 2022 were older or the same age as the units sold in the first half of 2021, Ritchie Bros. says.

Ritchie Bros.

Ritchie Bros.

The top U.S. selling models sold at Ritchie Bros. auctions by volume in the first half of 2022 were as follows:

- Excavators: Cat 336FL, Cat 336EL, Cat 349FL

- Mini Excavators: Deere 35G, Agrotk YM12, Deere 27D

- Dozers: Cat D6NLGP, Cat D6TLGP, Cat D8T

- Wheel Loaders: Cat 980G, Deere 544K, Cat 950K

- Articulated Dump Trucks: Cat D400E, Cat 740B, Cat 740

- Motor Graders: Cat D400E, Cat 740B, Cat 740

- Backhoes: Deere 310KEP, Deere 310SK, Deere 310K

- Compact Track Loaders: Bobcat T590, Cat 259D, Bobcat T550

- Skid Steers: Cat 246C, Bobcat S530, Cat 262D

- Telehandlers: JLG 10054, JLG 8042, Genie GTH1056

- Boom Lifts: Genie S65, JLG 600S, Genie S40

- Scissor Lifts: Skyjack SJII3219, Genie GS1930, JLG 1930ES