Signs of an economic slowdown are becoming increasingly more evident and are reflected in labor market data, according to economists with the Associated Builders and Contractors and the Associated General Contractors of America.

“Economic slowing is part of the process necessary to curb inflationary pressures and restore the rate of price increases to pre-pandemic norms,” ABC Chief Economist Anirban Basu said. “Contractors have seen significant pressure on their profit margins, according to the most recent data from ABC’s Construction Confidence Index, and any easing of labor shortages will provide much-needed relief.”

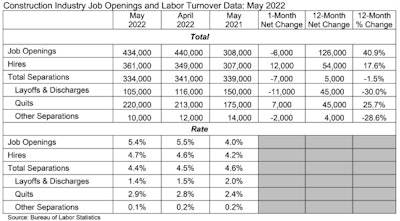

The U.S. Bureau of Labor Statistics Job Openings and Labor Turnover survey showed that there were 434,000 registered job openings in construction in May. The survey defines a job opening as any unfilled position for which an employer is actively recruiting. Analysis of the data indicates that industry job openings decreased by 6,000 in May but are up 126,000 from the same month last year. Associated Builders and Contractors

Associated Builders and Contractors

May represented the 15th consecutive month during which construction workers quitting their jobs outpaced or equaled layoffs and discharges. The quits rate of 2.9% was meaningfully above the layoff/discharge rate of 1.4%.

“In response to rising interest rates and declining asset values, corporate layoff activity has been on the rise,” Basu said.

He said the federal jobs survey report indicates that the number of available, unfilled job openings is now in decline, with the economywide number of unfilled positions at its lowest level since November 2021.

“That decline is likely to continue during the months ahead as many employers shift from racing to meet elevated and unmet demand to preserving cash in the context of expanding recession risks and the pernicious effects of inflation,” he said.

However, the data also shows that construction employment increased in two out of three U.S. metro areas between May 2021 and May 2022.

Construction employment rose in 248 or 69 percent of 358 metro areas over the 12-month period. Declines were evident in 62 metro areas from May 2021 and was unchanged in 48 areas.

According to AGC’s analysis, Houston-The Woodlands-Sugar Land, Texas added the most construction jobs (23,800 jobs or 11 percent), followed by Dallas-Plano-Irving, Texas (11,800 jobs, 8 percent); St. Louis, Mo.-Ill. (5,500 jobs, 8 percent); and Chicago-Naperville-Arlington Heights, Ill. (4,900 jobs, 4 percent). Cheyenne, Wyo. had the highest percentage gain (35 percent, 1,200 jobs), followed by Decatur, Ill. (21 percent, 700 jobs) and Lawton, Okla. (20 percent, 300 jobs).

The largest losses were in Orlando-Kissimmee-Sanford, Fla. (-5,600 jobs, -7 percent), followed by Richmond, Va. (-2,000 or -5 percent), and Middlesex-Monmouth-Ocean, N.J. (-1,600 jobs, -4 percent). The largest percentage declines were in Niles-Benton Harbor, Mich. (-13 percent, -300 jobs); Lewiston, Idaho-Wash. (-12 percent, -200 jobs); and Greenville, N.C. (-8 percent, -300 jobs).

“Construction employment has rebounded from post-pandemic lows in most metro areas,” said Ken Simonson, AGC chief economist. “But near-record low unemployment and historically high job openings show that employment would be even higher if enough qualified workers were available.”

The number of jobseekers with construction experience tumbled by nearly 40 percent over the past year, from 642,000 in May 2021 to 392,000 last month, the AGC economist noted. He said this indicated a scarcity of qualified workers available to hire in many metro areas.

Openings exceeded the 455,000 employees hired in April, which suggests that construction firms would have added twice as many employees if they had been available, Simonson asserted.

Since the early stages of the pandemic, contractors have been able to pass along their cost increases to project owners.

“There are growing concerns among industry leaders that the ability to pass along cost increases will dissipate during the months ahead as financial conditions tighten and confidence in economic performance wanes,” Basu said. “A primary implication is that contractor margins may be squeezed going forward, and there is growing anecdotal evidence that this is already occurring.”

In addition, he said there also is a growing risk of a significant number of project postponements in both private and public construction segments due to high materials prices and labor costs.

Basu suggested that the key to sustaining nonresidential construction’s recovery will be slower inflation.

“As long as inflation remains elevated, monetary policy will continue to tighten and project owners will be less willing to move forward with projects in an effort to preserve cash,” he said. “Unfortunately, ongoing efforts to limit inflation are likely to result in recession or at least further economic slowing, which will create additional issues for many contractors. However, less inflation and more favorable construction materials prices would create a foundation for renewed construction spending vigor.”

Associated Builders and Contractors

Associated Builders and Contractors

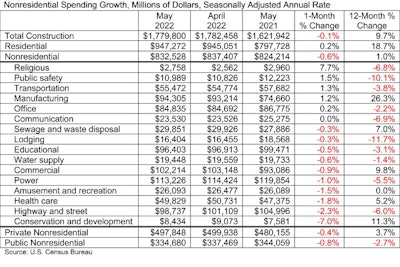

Construction spending dips in May

AGC and ABC reported that total construction spending declined slightly in May, making it the third month in a row to drop. Overall, each said spending on new houses and apartments has stalled and public and private nonresidential construction is slumping.

The capacity to build projects was limited by workforce shortages and supply chain issues.

“Contractors say demand remains strong for nonresidential projects, but they are having trouble both getting materials on time and hiring enough workers,” Simonson said. “The industry’s unemployment rate was down to 3.8 percent in May, a sign of how scarce experienced workers are.”

The downturn in nonresidential construction spending was widespread. The largest segment, power — comprising electric, oil, and gas projects — slipped 1 percent in May. Spending on commercial construction — warehouse, retail, and farm projects — declined 0.9 percent. Educational construction spending decreased 0.5 percent. Among the five largest segments, only manufacturing construction increased, by 1.2 percent, as work began or continued on numerous large factory projects.

Association officials said that contractors are having to slow schedules and even turn down work because of challenges they are having finding workers and procuring materials needed for projects

Associated Builders and Contractors

Associated Builders and Contractors