Editor’s Note: This information on data provider RigDig is from Big Iron Dealer’s sister site, Successful Dealer, and is part of a series on the best practices for moving used trucks. RigDig, like Equipment World and Big Iron Dealer, is a brand of Randall-Reilly.

Fleets start up and go out of business all the time. Owner-operators from miles away travel through your area daily. These are prospects that might be interested in one of your used trucks—if only they knew you were there and what inventory you have to offer.

“Unless a dealer uses a solution that pulls in multiple data sources to give a clear picture of the trucking landscape, there’s no way they know every potential customer out there,” says James Vogel, vice president of analytics and professional services with RigDig Business Intelligence. RigDig, a sister brand to Successful Dealer, provides in-depth fleet profiles to help dealers target new prospects.

Savvy dealers use both a push and a pull strategy to market used trucks, Vogel says. They push their truck inventory out through traditional channels, such as used truck publications. They also use data from providers such as RigDig and competitors such as Polk, FleetSeek and TDS, to target potential customers and pull them in.

“If a dealer has several 3- to 5-year-old trucks on his lot that he’s having trouble moving, we’ll use our RigDig database to identify fleets in his area that are running older trucks, and thus might be ready to trade up to a newer used truck,” Vogel says.

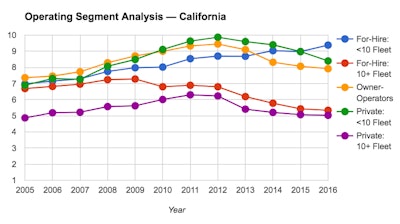

One sample of fleet data available through RigDig Business Intelligence is this trend report of fleet ages in California. Most trucking segments there saw the average ages of their fleets increase for at least a few years following the 2008-2009 recession before coming down as older trucks were phased out. One exception is for-hire fleets of less than 10 trucks. Their fleets have continued to age since 2005. RigDig can show more granular data, identifying the best potential used truck buyers in a dealer’s area.

One sample of fleet data available through RigDig Business Intelligence is this trend report of fleet ages in California. Most trucking segments there saw the average ages of their fleets increase for at least a few years following the 2008-2009 recession before coming down as older trucks were phased out. One exception is for-hire fleets of less than 10 trucks. Their fleets have continued to age since 2005. RigDig can show more granular data, identifying the best potential used truck buyers in a dealer’s area.RigDig can also identify fleets that are having maintenance issues due to their trucks’ age. “This type of information lets a dealer salesperson start a discussion with a potential customer about how a newer vehicle could help lower their maintenance costs and improve their inspection profile,” Vogel explains.

Brian Murphy, vice president of sales with Bruckner Truck Sales, says RigDig data gives his sales people a competitive advantage. “How else can you procure lists with user names and contact information, and have in hand what their fleet consists of and their pain points?” he asks.

Data targeting can also help identify prospects dealers typically wouldn’t have in their CRM, such as fleets that are domiciled outside of the dealer’s area, but whose routes take them through your market on a regular basis. “RigDig can show you what fleets and owner-operators travel near your dealership,” Vogel says.

Dealers might be surprised to learn how many prospects outside their area of responsibility are interested in their offerings.

For example, analysis of the website of a large dealer group that uses RigDig showed that 45 percent of its web traffic comes from states where they don’t even have a location. That was true for six of the 10 states that generated the most traffic.

New prospects can also come from business segments dealers typically wouldn’t target. “When oilfield dropped off, we had to switch to highway,” Murphy says. “Without this tool and without some of the sales training we took on, we would have had an unbelievably terrible year in 2016. We survived and found a lot of niches we wouldn’t have (otherwise) been in.”