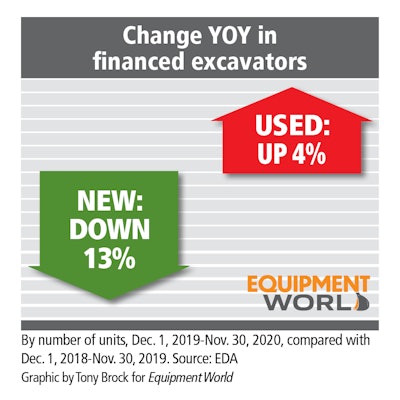

The number of new financed medium/large excavators decreased 13% during the December 2019-November 2020 period compared with the same period in the previous year.

Used financed excavators, however, fared much better, with the number of units increasing 4% year-over-year. (Compact excavators were not included in this report.)

Top financed models

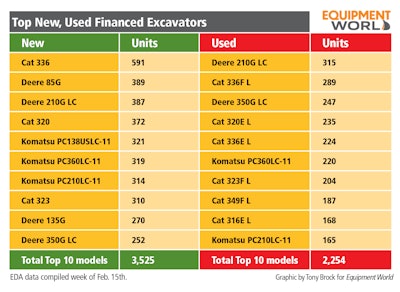

Cat, Deere and Komatsu dominated the top 10 model offerings in terms of number of units sold. (See chart below.) The Cat 336 was the undisputed leader of the pack, with 591 units sold; Deere's 85G came in a distant second at 389 units sold. (Note: EDA data is continually updated.)

Just looking at this top 10 model slice, Deere and Cat were in a close race in terms of number of financed new models sold during this time period, with Deere grabbing 37% of the pie, Cat 36% and Komatsu 27%.

On the used financed side, the Deere 210G LC topped the charts, with 315 units sold, followed by the Cat 336F L at 289 units sold.

Texas dominates

As with most types of equipment, excavator buyers in Texas lead the way, with 615 new equipment buyers and 951 used equipment buyers in the state during December-to-November time period. New financed excavator buyers were also prevalent in Florida (456 buyers) and North Carolina (367 buyers).

After Texas, the top states for those financing used excavators was Georgia (579 buyers) and North Carolina (442 buyers).

A look back at financed excavator sales

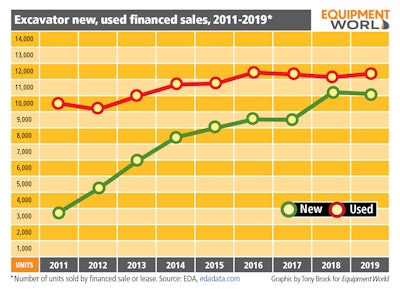

Looking at the extended 2011 -2019 trend line for number of units financed, new excavator unit sales peaked in 2018 with 10,823 units sold. Not surprisingly, the low point in this extended look was 2011, when 3,238 new financed units were sold.

On the used side, the number of units financed ranged from a high of 11,893 units in 2017 to a low of 9,863 units in 2012. (Note: Total 2020 financed sales data are still being processed.)

EDA data is compiled from state UCC-1 filings on financed construction equipment. Because there is a usual 40- to 50-day reporting lag from the states – exacerbated in 2020 because of the impacts of Covid-19 – we are using a Nov. 30th cut off in this report. Also note that EDA continually updates this data as information comes in. This report was compiled the week of Feb. 15th.

At auction

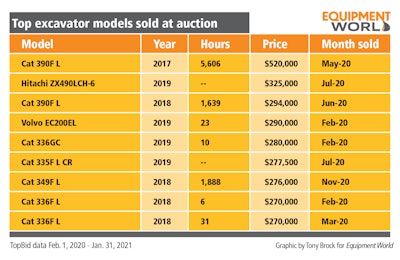

As reported by the TopBid auction price guide, 821 full-size excavators were sold at auction from Feb. 1, 2020 to Jan. 31, 2021.

The top full-size excavator sold during this time was a 2017 Cat 390F with 5,606 hours, which went for $520,000 in a May 15th Ritchie Bros. auction in Phoenix. Also topping the chart was a 2019 Hitachi ZX490LCH-6, which sold for $325,000 at an Alex Lyon & Sons July 23rd sale in Canastota, New York.

Rounding off the low-hour list was another 2018 Cat 336F L with 31 hours, which sold for $270,000 on Mar. 12 at a Ritchie sale in Las Vegas.

EDA and TopBid are owned by Randall-Reilly, parent of Equipment World.