Types of equipment

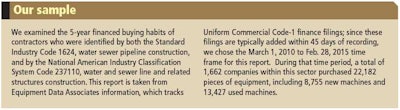

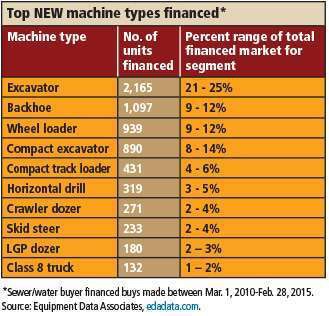

As they were with excavation and road building contractors (reported in February and March), excavators are the top financed machine of choice in the sewer/water segment in both new and used equipment, ranging between 21 to 25 percent of the total financed new machines for this sample in the past 5 years.

In the top new machine type chart below, the 2,165 excavators financed were more than double the backhoes, in the No. 2 position at 1,097 units. The gap between excavators and backhoes becomes even larger when looking at financed used units: 3,035 excavators to 1,248 backhoes.

The top used financed machines for this segment mirror the top new buys, with the exception of Class 8 trucks, which at 822 units and 5 to 8 percent of the total number of used machines purchased has a much stronger showing on the used equipment list than on the new equipment list.

In addition, two machines appear on the used equipment list that do not appear on the new list: single-drum vibratory compactors and motor graders. Also, horizontal drills, a key production machine, do not appear on the top used list.

Models purchased

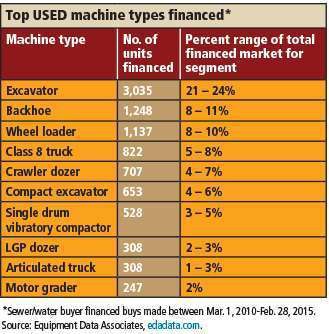

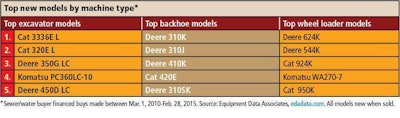

When looking at just the sewer/water segment of contractors, not only is the backhoe the second most popular machine purchased in terms of number of units, the John Deere 310 K backhoe was the most popular new model sold in the past five years. Its predecessor, the Deere 310J, also had the No. 3 position in top models financed (the chart tracks machines purchased new throughout the 5-year period, so there is a mix of current and previous models). To round out the Deere K Series mention on this chart, the 410K came in at No. 5 and the 310SK was No. 10.

Caterpillar’s stellar historical resale value is reflected in the top used models financed for the sewer/water segment. Five out of the top 10 used models financed were Caterpillar machines.

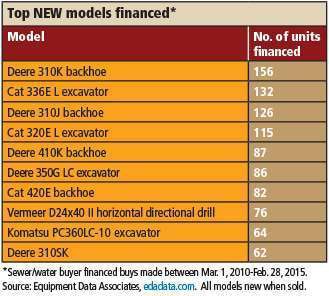

The following chart delves further into both top machine types and top models financed by this segment, showing the top five models for each machine type:

Brands

Contractors in this segment favor three primary brands – Caterpillar, Deere and Komatsu – after which there is a substantial drop off in the number of machines financed with other brands.

Most active states