Deere & Company global and net sales and revenues increased 22%, to $14.102 billion for the third quarter of 2022 and rose 13%, to $37.041 billion for the first nine months of the company’s fiscal year.

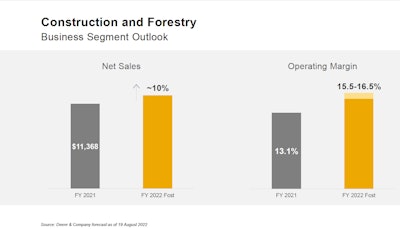

Net sales for Deere’s Construction and Forestry segment were up 8% for the quarter to $3.269 billion due to price realization. Favorable price realization offset higher production costs during the quarter.

John Deere

John Deere

With oil and gas activities remaining steady, U.S. infrastructure spending beginning to ramp up and capital expenditure programs from the independent rental companies driving re-fleeting efforts, end markets for earthmoving are expected to remain strong.

Global roadbuilding markets are expected to be flat to up 5%. Deere says roadbuilding demand remains strongest in the Americas, while markets in China and Russia are down significantly.

The company forecasts forestry to be flat to down 5%, primarily due to supply constraining the ability to meet demand.

In Deere’s Production and Precision Ag segment, net sales were at $6.096 billion, up 43% compared to the third quarter last year, largely due to higher production and shipment volumes.

The company saw a 16% increase in sales in the Small Agriculture and Turf segment, totaling $3.635 billion in the third quarter due to higher shipment volumes and price realization more than offsetting negative currency translation.

The production cost increases across the company’s segments were mainly a result of elevated material and freight as well as higher overhead spending. Overhead was also higher for the period as persistent supply challenges continued to cause production inefficiencies.

Despite these challenges, Deere officials said, factories were able to achieve higher rates of production and made progress on reducing the number of partially completed machines in inventory. Focus has turned to finishing the shipping of remaining machines in Q4 to help progress toward restoring productivity and efficiencies heading into 2023.

“We're proud of the extraordinary efforts by our employees to increase factory output and get products to customers under challenging circumstances,” said John C. May, chairman and chief executive officer. “At the same time, our results reflected higher costs and production inefficiencies driven by the difficult supply-chain situation.”

Deere is now forecasting a range of $7 billion to $7.2 billion for fiscal 2022.

“Looking ahead, we believe favorable conditions will continue into 2023 based on the strong response we have experienced to early-order programs,” May said. “We are working closely with our factories and suppliers to meet higher levels of customer demand next year. Additionally, we are confident the company’s smart industrial strategy and leap ambitions will continue unlocking new value for customers through Deere’s advanced technologies and solutions.”