The Cat 259D compact track loader had the highest number of financed sales in the West Region during 1Q 2019.

The Cat 259D compact track loader had the highest number of financed sales in the West Region during 1Q 2019.The West Region of the country showed an overall decline of 7 percent in the number of new machines financed in the first quarter of this year compared to 1Q 2018, according to an analysis of UCC-1 filings as reported by EDA.

Albeit with small numbers — just 13 more machines — Alaska saw a new financed machine increase of 52 percent during the first quarter compared to the same period last year (38 machines compared with 2018’s 25 machines). The number of machines financed in Arizona rose 8 percent comparing quarter to quarter and Nevada buyers financed 7 percent more machines.

The minus side of the ledger was much more crowded. The number of machines financed in Wyoming was down by 27 percent compared with the same time last year, although this represented a drop of just 24 machines, compared to 1Q 2018’s 89 machines.

Also seeing double-digit declines were Idaho (-23 percent, with 66 fewer machines financed compared to 1Q last year); Montana (-17 percent, down 33 machines); Washington (-16 percent, down 84 machines); and Oregon (-16 percent, down 56 machines).

The U.S. Census Bureau’s West Region includes Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, New Mexico, Nevada, Oregon, Utah, Washington and Wyoming.

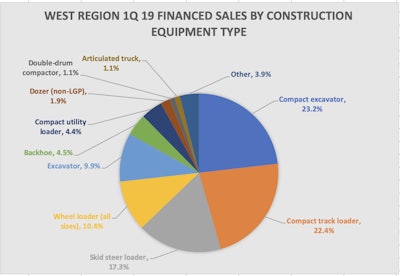

In terms of number of units, compact excavators were clearly favored in the region, with 1,077 machines financed, representing 23.2 percent of the total. CTLs were a close second (1,039 machines, 22.4 percent), followed by skid steers (902 machines, 17.3 percent). (We compiled the data on June 6th; while EDA updates this data on a continual basis, this represents the majority of machines financed during the quarter.)

Machines in this report include backhoes, dozers, articulated haulers, excavators (mid- and full-size), compact excavators, skid steers, compact track loaders, compact utility loaders, wheel loaders and toolcarriers, asphalt and concrete pavers, scrapers, graders and single and double-drum compactors.

Here’s a state-by-state breakout of equipment financed during 1Q 2019. (Percentages are rounded.)

Alaska

Total number of machines financed in the first quarter: 38 (52 percent increase from 1Q 2018)

Top models: Cat 279D (3 machines); Cat 259D (2 machines); Bobcat T650 (2 machines), all CTLs

Top machine types: CTL (13 machines); compact excavator (8 machines); wheel loader (5 machines)

Top financed brands: Cat (24 machines, 63 percent of total); Bobcat (5/13 percent); Kubota (3/8 percent)

Arizona

Total number of machines financed in the first quarter: 320 (8 percent increase from 1Q 2018)

Top models: Bobcat S70 skid steer (21 machines); Cat 259D CTL (9 machines); Bobcat S70 skid steer (8 machines)

Top machine types: Skid steer (89 machines); compact excavator (71 machines); CTL (41 machines)

Top financed brands: Cat (119 machines, 37 percent of total); Bobcat (54/17 percent); Deere (43/13 percent)

California

Total number of machines financed in the first quarter: 1,426 (5 percent decrease from 1Q 2018)

Top models: Cat 259D CTL (69 machines); Bobcat T595 CTL (29 machines); Bobcat S70 skid steer (28 machines)

Top machine types: Compact excavator (345 machines); CTL (22 percent); skid steer (17 percent)

Top financed brands: Cat (484 machines, 34 percent of total); Bobcat (270/19 percent); Deere (210/15 percent)

Colorado

Total number of machines financed in the first quarter: 525 (5 percent decrease from 1Q 2018)

Top models: Bobcat S650 skid steer (18 machines); Cat 259D CTL (15 machines); Kubota SVL75-2 (13 machines)

Top machine types: Skid steer (126 machines); CTL (106 machines); compact excavator (102 machines)

Top financed brands:Deere (135 machines, 26 percent of total); Cat (122/23 percent); Bobcat (118/23 percent)

Hawaii

Total number of machines financed in the first quarter: 84 (2 percent increase from 1Q 2018)

Top models: Kubota KX040-4 (6 machines); Cat 305E2 CR (5 machines); Cat 308E2 CR SB (4 machines), all compact excavators

Top machine types: Compact excavator (52 machines); CTL (17 machines); skid steer (5 machines)

Top financed brands: Cat and Kubota tied, each with 29 machines, representing 35 percent of total; Komatsu (9/11 percent)

Idaho

Total number of machines financed in the first quarter: 218 (23 percent decrease from 1Q 2018)

Top models: Case 621G XR wheel loader (17 machines); Deere 35G compact excavator (8 machines); Cat 259D CTL (7 machines); Ditch Witch SK800 compact utility loader (5 machines)

Top machine types: Wheel loader (68 machines); compact excavator (43 machines); CTL (36 machines)

Top financed brands: Cat (50 machines, 23 percent of total); Deere (37/17 percent); Case (31/14 percent); Bobcat (29/13 percent)

Montana

Total number of machines financed in the first quarter: 157 (17 percent decrease from 1Q 2018)

Top models: Cat 299D2 (6 machines); Cat 299D (6 machines); Deere 325G (5 machines), all CTLs

Top machine types: CTL (55 machines); skid steer (37 machines); excavator (17 machines)

Top financed brands: Cat (42 machines, 27 percent of total); Deere (31/20 percent); Bobcat (27/17 percent)

New Mexico

Total number of machines financed in the first quarter: 121 (No change from 1Q 2018)

Top models: Komatsu PC240LC-11 excavator (8 machines); Deere 333G CTL (4 machines); Deere 250G LC excavator (3 machines)

Top machine types: CTL (25 machines); excavator (23 machines); wheel loader (20 machines)

Top financed brands: Deere (32 machines, 26 percent of total); Komatsu (21/17 percent); Bobcat (21/17 percent)

Nevada

Total number of machines financed in the first quarter: 176 (7 percent increase from 1Q 2018)

Top models: Case 580N EP backhoe (26 machines); Bobcat S70 skid steer (12 machines); Cat 246D CTL (3 percent)

Top machine types: Backhoe (42 machines); compact excavator (35 machines); skid steer (33 machines)

Top financed brands: Cat (63 machines, 36 percent of total); Case (31/18 percent); Bobcat (28/16 percent)

Oregon

Total number of machines financed in the first quarter: 302 (16 percent decrease from 1Q 2018)

Top models: Kubota KX040-4 compact excavator (16 machines); Kubota SVL75-2 CTL (13 machines); Kubota R430 wheel loader (12 machines)

Top machine types: Compact excavator (100 machines) CTL (65 machines); excavator (46 machines)

Top financed brands: Kubota (71 machines, 24 percent of total); Cat (50/17 percent); Deere (41/14 percent)

Utah

Total number of machines financed in the first quarter: 305 (1 percent decrease from 1Q 2018)

Top models: Cat 259D CTL (19 machines); Kubota KX040-4 compact excavator (18 machines); Kubota SVL75-2 CTL (14 machines)

Top machine types: Compact excavator (90 machines); CTL (78 machines); excavator (46 machines)

Top financed brands: Cat (93 machines, 31 percent of the total); Kubota (69/23 percent); Bobcat (43/14 percent)

Washington

Total number of machines financed in the first quarter: 434 (16 percent decrease from 1Q 2018)

Top models: Kubota KX040-4 compact excavator (35 machines); Kubota SVL75-2 CTL (16 machines); Cat 259D (13 machines)

Top machine types: Compact excavator (185 machines); CTL (91 machines); excavator (42 machines)

Top financed brands: Cat (107 machines, 25 percent of the total); Kubota (94/22 percent); Deere (54/12 percent)

Wyoming

Total number of machines financed in the first quarter: 65 (27 percent decrease from 1Q 2018)

Top models: Cat 259D CTL (5 machines); Komatsu WA270-8 wheel loader (4 machines); Cat 420F2 IT backhoe (4 machines)

Top machine types: CTL (25 machines); skid steer (10 machines); wheel loader (10 machines)

Top financed brands: Cat (20 machines, 31 percent of total); Komatsu (12/19 percent); Deere (12/19 percent)

About the source

EDA, a division of Equipment World’s parent firm Randall-Reilly, tracks UCC-1 filings used by lenders when a machine is financed.

Depending on the type of machine, financed machines can represent 40 to 75 percent of the total number of machines of that type sold in the United States. While machines can also be bought by cash or letter of credit, which are not tracked by EDA, buyers of higher priced equipment (for example, a large excavator) tend to use financing. EDA continually updates its data.