Editor’s Note: Make your voice heard in our next survey. How is coronavirus impacting your business? Click here to participate in the survey.

* Survey conducted Mar. 27-Apr. 1, 2020.

* Survey conducted Mar. 27-Apr. 1, 2020.Contractors are seeing deepening impacts as the COVID-19 coronavirus impact spreads throughout the nation, according to an Equipment World survey conducted Mar. 27-Apr. 1.

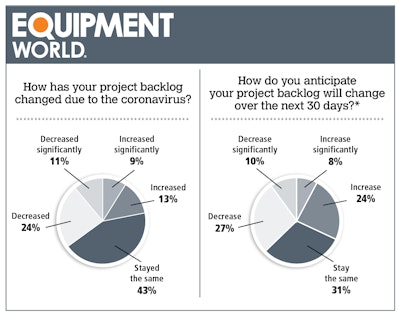

When asked how their current project backlog has changed due to the coronavirus, 35 percent of contractor respondents told Equipment World that their project backlog had either “decreased” (24 percent) or “decreased significantly” (11 percent). (See chart above.)

On the other hand, another 18 percent of respondents say backlogs had either “increased” (13 percent) or “increased significantly” (9 percent).

“Some jobs have cancelled, other have postponed,” wrote one small excavating contractor respondent. “We have also picked up some new jobs.” Says a roadbuilding contractor: “Prior to the stay-in-place order, the phone was ringing. It has stopped.” And this from another excavating contractor: “Wet conditions are keeping us from working, not the virus.”

(This survey, which had 179 respondents, is the first in a series of surveys that Equipment World and other Randall-Reilly brands are using each week to gauge market sentiment. To participate in the next survey, go here.)

30-day outlook

The sentiment gets more split as respondents look 30 days out, with 32 percent saying they expect their project backlogs will either “increase significantly” or “increase” while 36 percent still see either backlogs decreasing or significantly decreasing. (See chart above.)

Sectors expecting more pronounced backlog decreases in the next 30 days include demolition (50 percent of sector respondents answering “decrease” or “decrease significantly”); utility contractors (48 percent); and commercial building contractors (48 percent).

Two sectors – excavation/site prep (28 percent) and roadbuilding (29 percent) – had the fewest respondents expecting a decline. In fact, roadbuilding respondents were the most optimistic, with 39 percent saying they expected backlogs to either “increase” or “significantly increase.”

Many noted that demand will be enormous when restrictions are lifted. “Once we can resume work, we will have the largest backlog of projects to complete in our 32 years of doing business,” said one large Pennsylvania specialty contractor. Pennsylvania contractors, except those working on certain projects, were ordered by Gov. Tom Wolf in mid-March to stop construction.

“We were behind schedule before this hit,” says a larger excavating contractor. “When we go back, all hell’s going to break loose.”

Workforce, equipment changes

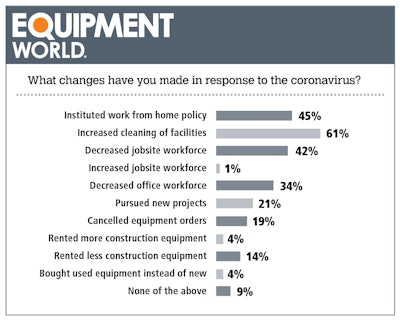

Our survey asked a multiple-choice question about changing business practices as the result of the outbreak. The results are seen in the chart above.

Following national trends of massive layoffs, 42 percent of respondents said they had decreased their jobsite workforce, with 34 percent decreasing their office workforce.

Nineteen percent of respondents said they had already cancelled equipment orders; another 4 percent said they had bought used equipment instead of new. On the rental side, 14 percent said they had rented less equipment, and 4 percent said they had rented more.

“I returned my rental equipment,” said one smaller excavating contractor, “and I talked to the bank about my equipment payments.” Another excavating contractor said he was selling off some extra equipment; and a roadbuilding contractor said he had put a couple of equipment orders on hold.

One respondent summed up the situation thus: “This is serious but temporary. Once the virus passes, things will improve rapidly. The sky is not falling.. it’s just sagging a bit.”