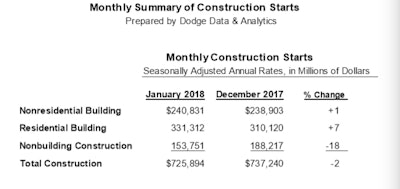

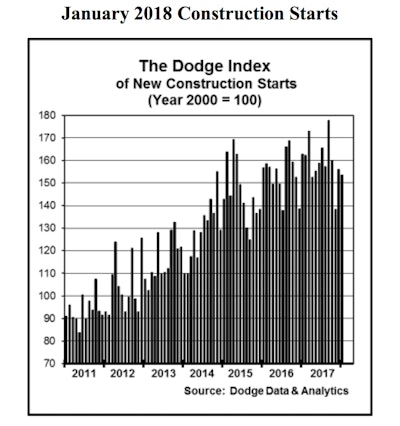

Following December’s 13-percent hike, the value of new construction starts in January slipped 2 percent to a seasonally adjusted annual rate of $725.9 billion, according to Dodge Data & Analytics. In addition, the Dodge Index for January was 154, compared to December’s revised 156 and November’s 138.

The nonresidential building sector, however, saw a slight 1 percent gain from December, which included the groundbreaking for the $1.3 billion domed stadium in Las Vegas, the new home for the former Oakland Raiders of the NFL.

And the residential building sector climbed 7 percent in January compared to December. One underlying reason: a rebound for multifamily housing after three straight months of declines.

Regarding the Dodge Index, the company reports an up-and-down pattern during 2917. “The 154 reading for the Dodge Index in January, along with December’s 156, shows construction starts climbing back close to last year’s mid-range of activity,” Dodge says. “For 2017 as a whole, the Dodge Index averaged 159.”

According to Robert A. Murray, Dodge chief economist, varied factors will affect construction going forward. “Some dampening may come from higher material prices and tight labor markets, yet while interest rates are rising the increases are expected to stay moderate this year. The tax reform legislation is anticipated to lift economic growth in the near term, which may benefit commercial building and manufacturing construction starts.” In addition, the Trump Administration’s infrastructure program still needs to pass Congress, which is also dealing with a growing federal budget deficit, perhaps limiting benefits for public works projects this year.

On the plus side, the institutional side of nonresidential building should stay close to last year’s elevated pace, Murray says.