Tier 4 Interim

Big changes in store for new equipment next year … and 2012 … and 2014.

By Tom Jackson

It’s just three months and counting before the Environmental Protection Agency’s Tier 4 Interim regulations for non-road engines takes effect for most medium to large horsepower bands. And when it does, the new machines rolling out the factory doors on January 1, 2011, will be like nothing you’ve seen yet.

But everything that can be tweaked has been tweaked. The new 2011-2012 engines will put out far fewer exhaust emissions: 90 percent less particulate matter (PM) and 50 percent less oxides of nitrogen (NOx) than their Tier 3 brethren. To do so, they will in most cases require the use of diesel particulate filters (DPFs), higher levels of exhaust gas ratio (EGR), ultra low sulfur diesel fuel (ULSD) and a new low-ash engine oil formulation – the American Petroleum Institute’s CJ-4 category.

It’s a smorgasbord of new acronyms to learn, but more importantly these changes will affect the cost, maintenance and to a small extent the performance of the new equipment going forward.

The DPF

The biggest visible difference between the Tier 3 and 2011 Tier 4 Interim engines is the DPF. Its size will vary depending on engine displacement, but for heavy equipment in general they’re about 3 feet long and 12 to 18 inches in diameter. These trap particulate matter in the exhaust stream.

The DPF and exhaust units on many Tier 4 interim machines are packaged as one unit to save space.

The DPF and exhaust units on many Tier 4 interim machines are packaged as one unit to save space.DPFs are not new technology. Almost a million of them have been installed in passenger cars in Europe since 2000. And they’ve been standard equipment on all heavy diesel truck engines since 2007. The term DPF is a bit of a misnomer, in that most DPFs also contain a diesel oxidation catalyst (DOC) in line with the DPF that is often part of the same canister. But many in the industry are using the term DPF to describe an integrated DPF/DOC.

Hot exhaust gases will help burn off the soot that builds up inside a DPF. This is called “passive” regeneration. The hotter the machine runs, the cleaner the DPF will stay. The more you idle, the sooner it will start to clog up, creating backpressure. When that happens the engine will shoot a burst of fuel into the DPF, which quickly burns out the residue and restores normal exhaust pressure. This is called “active” regeneration.

A PRE-BUY PROBLEM?

In a survey of dealers by Construction Equipment Distribution magazine, 67 percent of respondents said they anticipated pre-buying of 2010 equipment to avoid price increases on Tier 4 equipment.

The DPF is an essential component for reducing emissions in Tier 4 interim engines going forward. In larger horsepower engines it may need periodic removal for ash cleanout.

The DPF is an essential component for reducing emissions in Tier 4 interim engines going forward. In larger horsepower engines it may need periodic removal for ash cleanout.“In both of these modes it should be transparent to the operator,” says Joe Mastanduno, product marketing manager, engine/drivetrain, John Deere. “The operator never needs to intervene.”

OEMs may put an indicator light on the dash to let you know when active generation is taking place. But except in areas where high heat levels may pose a safety risk – waste transfer stations or forestry applications – you will be able to continue to work uninterrupted during the process.

Ash buildup and maintenance

Despite the active and passive regeneration, at some point ash will build up inside the DPF sufficient to warrant its removal and cleaning or replacement. Ash is an incombustible material derived from the oil’s additive package, says Clint Schroer, off-highway communications manager at Cummins. When oil is burned in the combustion chamber along with the fuel, a small amount of residual ash from the oil is trapped in the filter section of the after-treatment system. During filter regeneration the particulate matter in the filter is oxidized and removed from the filter, however ash from the lube oil cannot be oxidized and remains in the filter.

NEW FUEL COSTS

The EPA estimates that ULSD fuel will cost 5 to 7 cents per gallon more than low sulfur diesel fuel. But note also that ULSD has about 1 percent less energy density, which will lead to a reduction in fuel economy.

The EPA has mandated that DPFs go at least 3,500 hours on engines from 75 to 173 horsepower and 4,500 hours on engines from 174 horsepower and up before they need ash cleanout. Most manufacturers say they’re exceeding those minimums. But eventually they’ll all need cleaning or swapped out, and that requires their removal. Mastan-duno says a crane or overhead hoist will be needed to handle most DPFs. “You don’t want to drop these filters,” he says. “They’re ceramic inside and expensive. On the big machines these are 250-pound devices. They’re not easy to grab and hold onto. There are safety issues and costs involved if you break one.”

More EGR

A key component of the new emissions strategy for Tier 4 engines is the use of recirculated exhaust gas (EGR) to slow down the combustion process in cylinder and encourage a more complete burning of the fuel. EGR is likewise not new and has been used successfully in heavy on-highway diesel engines for years. But it does bring more heat back into the engines.

The increased heat was less of a problem for highway trucks that blast down the road at 60+ mph. For an excavator that sits and digs, or a dozer moving at 3 or 4 mph, heat rejection is a challenge. “The cooling packages and the platforms for the engines are definitely getting bigger,” says Mike Buckantz, president/CEO of consultant Associates Environmental. “They’re taking up more space. The engine platform for Tier 4 Interim is going to be substantially larger than Tier 2 and Tier 3.”

A small side benefit to increased EGR rates is that the increased volume through the turbochargers tends to boost machine performance, particularly throttle response. Cummins found in a side-by-side comparison with two machines, one Tier 4 product with EGR, the other non-EGR, the Tier 4 machine moved a pile of material considerably quicker, Schroer says.

Changes in sheet metal

The size of the DPFs has also proven to be a challenge. “In order to get these filters under hood, the appearance of the equipment is going to change a little bit,” Buckantz says.

“Manufacturers have done a good job on the safety side of getting everything under hood, keeping visibility and keeping the systems well insulated,” he says. “But it’s going to change the basic appearance of this equipment to get the filters inside.”

Finding room for the DPF and cooling systems may be the biggest challenge OEMs face. Customers want to maintain their equipment’s sightlines and a great deal of work is going into squeezing all this into packages that maintain the equipment’s profiles. Many manufacturers are working to enhance the efficiency of their cooling systems with viscous fan clutches and different shroud configurations to avoid increasing radiator sizes.

New fuel

It wasn’t too long ago that off-road diesel fuel contained up to 500 parts per million sulfur. By the end of this year, all that “low sulfur diesel” will be gone and flushed from the pipelines, replaced by ultra low sulfur diesel with just 15-ppm sulfur. ULSD is absolutely essential for the DPFs to function properly in a Tier 4 engine, Buckantz says.

Come January in the United States you won’t be able to buy anything other than ULSD. Just be aware if you have diesel storage tanks with 500-ppm diesel in them you need to avoid putting this fuel or the mixture of the two fuels in any new equipment with a Tier 4 Interim engine.

There have been some concerns about the lack of lubricity with ULSD. Buckantz thinks this concern stems from the first reduction in diesel sulfur levels more than a decade ago. Manufacturers weren’t prepared for it and problems erupted. But California has had nothing but ULSD for several years now and nationwide the diesel for on-highway trucks has been ULSD since the beginning of this year.

Petroleum manufacturers are supposed to be putting lubricity additives in their ULSD formulations. But some engine and equipment OEMs are offering their own lubricity additives nonetheless. If you have concerns or questions check with your fuel supplier and your equipment OEM.

New oil

Likewise with engine lube oils, Tier 4 Interim engines need to use new lube oil formulations that are low in ash to reduce ash buildup inside the DPF. The low-ash oils are designated by the American Petroleum Institute as the CJ-4 category.

CJ-4 has been used in all on-highway diesel engines since the beginning of this year and is readily available. It’s also backward compatible with Tier 3 and Tier 2 engines, so if you want to avoid mistakes or having to inventory two lube oils you can just stock CJ-4 and use it in all your equipment.

Costs

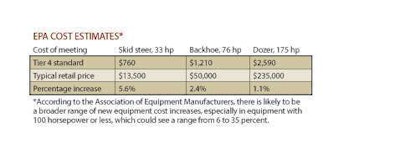

All this new technology doesn’t come cheap. The EPA estimated during its rule making that Tier 4 technology would add between about 1 to 5 percent to the cost of an off-road machine, but most industry experts say this is unrealistically low. (See EPA cost estimates, page 54.)

Caterpillar has announced a 12 percent price increase on its Tier 4 equipment that will be phased in at roughly 4 percent a year over the next three years.

Do you need it?

It may be tempting to fill your new equipment needs before the end of the year when the prices go up and the new technology arrives. But depending on where you live and work and what kind of customers you have, you may need Tier 4 machines in the near future.

“All the time, I see more requirements for either new equipment or particulate filters,” Buckantz says. “With publically funded projects, whether its stimulus money, or airport projects in Chicago, port projects in New York and New Jersey – a lot of it has a requirement in the bid spec to use the newest emissions technology or best available technology. Pretty soon that’s going to mean Tier 4. So I’ve been telling contractors all over the country to keep an eye on their bid requirements, especially on publicly funded jobs. Make sure you have an equipment spread that allows you to do the work as required in the contract.”

If purchasing new Tier 4 equipment is not something you can afford right now, Buckantz says a lot of the rental companies keep fairly new machines in their inventory and some are already starting to put the smaller horsepower Tier 4 interim equipment on their lots. Rental companies have tended to avoid DPF retrofits, he says, but he anticipates a lot of them will market the merits of their emissions-compliant machines to contractors who need those machines to qualify for emission bid specs.

Project requirements for “best available” emissions technology like this may soon spread beyond the major urban areas. The EPA was expected to rule in August on a new set of air quality criteria, that if passed, would vastly increase what it calls “non-attainment zones.” And if your city or county is deemed a non-attainment zone, it will be required to submit a plan to the EPA for reducing air pollution. Diesel emissions will certainly be on the table.

The next big thing

Tier 4 Final kicks in from 2012 to 2014 (2015 for engines over 751 horsepower), and while few manufacturers have made a firm commitment, many suggest that the only way to meet those regulations is with selective catalytic reduction technology or SCR. With SCR you dose the exhaust stream with a mixture of water and urea, what the manufacturers are calling diesel exhaust fluid or DEF. When the DEF-laden exhaust is run through a SCR catalyst it chemically changes the NOx in the exhaust to harmless water and nitrogen.

SCR seems to be the only way to control NOx, enough to meet Tier 4 final regulations, but it does have the advantage of letting engine manufacturers reduce the level of EGR in the engine. SCR requires a separate fluid tank for the DEF and the hardware for dosing and catalyzing the exhaust. So it’s yet again more complicated. But it is being used on all but one brand of 2010 and newer heavy highway diesel engines.

Regulating carbon

There is also still the possibility that the EPA will want to regulate engine emissions further. But since NOx and PM will have been reduced to near zero by then, what’s left?

Manufacturers are watching Washington, D.C., to see if the federal government will make good on its threat to regulate carbon dioxide, or CO2. Mastanduno jokingly calls this “Tier 5,” but acknowledges that it may soon be no laughing matter.

“In the energy bill delayed this year, it talked about capping carbon and having carbon credits and that’s all related to CO2,” he says. “When you look at diesel engines, the only way you can control CO2 is to burn less fuel. If you have to burn less fuel a lot of times you have to give up something and that’s sometimes power or performance. Going from Tier 1 to Tier 2, 3 and 4 we’ve been able to maintain the same power and performance. But if you control CO2, something will have go. So we’re watching this whole thing with cap and trade very closely. It has the potential to be the biggest thing we’ve had to face.”

Buckantz agrees. “On a BTU-to-BTU basis diesel is a more favorable fuel than gaseous fuels or even gasoline. If you want the most bang for the buck, look at diesel first. I’m keeping my fingers crossed, but I think we should be able to say that we are carbon neutral as we go to Tier 4. But we’re just getting to the tip of the iceberg when it comes to how we’re going to deal with diesel engines and CO2. California is already working on a rule to reduce the allowable carbon content in fuel by 10 percent. We’ll see how that goes. It’s going to be a pretty big deal.” EW

TIER 4 INTERIM: FAST FACTS

Horsepower Bands:

174 to 751 hp: Rule takes effect January 2011

75 to 173 hp: Rule takes effect January 2012

25 to 74 hp: Rule took effect in 2008

Tier 4 Final: Fast Facts

Horsepower Bands:

174 to 751 hp: Rule takes effect January 2014

75 to 173 hp: Rule takes effect January 2014

25 to 74 hp: Rule takes effect January 2012

TECHNOLOGY SOLUTIONS

Manufacturers using primarily cooled EGR for all or most Tier 4 Interim engines:

• Caterpillar

• Case/New Holland/ Kobelco

• Cummins

• Deere

• Hitachi

• JCB

• Komatsu

• Perkins

• Terex

• Volvo

Manufacturers who will use SCR on some equipment:

• Case/New Holland/ Kobelco

• Terex