Credit: Washington Post Wonkblog

Credit: Washington Post WonkblogThough construction industry employment in the U.S. is steadily improving—adding 18,000 jobs in March amid a dreary overall jobs report—the numbers don’t match the boom the housing market is seeing.

This has a lot of people searching for an answer.

Recently, we shared with you one interesting theory from the Washington Post’s Neil Irwin. Irwin, writing at the paper’s Wonkblog, posited that we’re not seeing a boom because a large number of construction employers held on to as many workers as they could during the recession rather than laying them off. He called it “labor hoarding.”

Now, Irwin’s colleague Brad Plumer has followed up with a theory of his own based on some pretty simple numbers. In short, Plumer says despite the uptick in home building, construction isn’t seeing a hiring boom because, historically, the industry’s employment numbers are already pretty high.

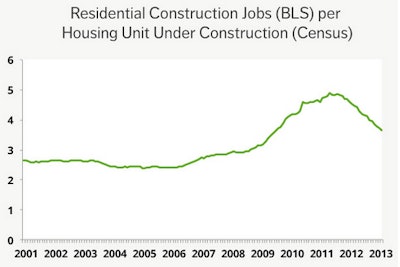

“Back in the early 2000s, before the housing bubble took off, the number of construction jobs per housing unit under construction tended to hover around 2.6. It’s at about 3.7 today,” Plumer writes.

The graph from the Post above illustrates his point very well.

But what about Washington D.C., Denver, Seattle, San Francisco and all the other markets where labor is tight or a skilled labor shortage is underway? Plumer turns to a quote from Jed Kolko, the Trulia economist who supplied these numbers:

“But these markets are the exceptions. In most of the country, employment relative to construction activity is high now compared with the bubble and pre-bubble years.”