Mixed patterns of spending within nonresidential and residential construction categories appear to be indicating a shift in the market.

Remaining strong overall, total construction spending increased by 0.6% in October.

Construction spending, not adjusted for inflation, totaled $2.027 trillion at a seasonally adjusted annual rate in October. Both residential and nonresidential spending rose overall but with mixed results by segment.

“It is apparent that the construction market overall remains healthy,” said Ken Simonson, AGC’s chief economist. “A rotation is occurring among nonresidential segments as manufacturing construction expands while commercial construction slumps and highway and street spending stagnates.”

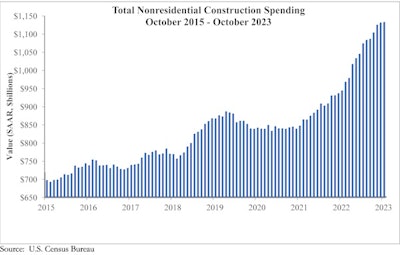

Analysis of federal spending data by the Associated General Contractors of America and Associated Builders and Contractors showed that nonresidential construction spending increased by only 0.1% for the month.

ABC Chief Economist Anirban Basu noted that it was the 17th consecutive month that nonresidential spending increased. Spending is up 20% over the past year.

“As has been the case, more than 45% of that year-over-year increase is due to surging construction activity in the manufacturing sector, though infrastructure-related categories like highway and street and sewage and waste disposal have also outperformed,” Basu said.

Associated Builders and Contractors

Associated Builders and Contractors

Spending on private residential construction rose by 1.2 %, as single-family construction climbed for the sixth straight month, by 1.1% while spending on multifamily projects dipped 0.2 percent.

According to analysis of the data, spending on private nonresidential construction edged up 0.1% in October, while public construction investment rose 0.2 %. Spending rose 0.9% on the largest nonresidential segment, manufacturing plants. Other increases were seen with investments in power, oil, and gas projects rising 1.0 % and education spending increasing 0.4 percent.

“Spending in the commercial category, which includes construction of distribution and warehouse space, fell sharply in October,” said Basu. “This is likely due to a severe slowdown in the freight industry and slowing warehouse-related construction rather than a sudden decline in retail-related construction. Despite weakness in the commercial category and other headwinds like high-interest rates and labor shortages, contractors remain optimistic.”

Meanwhile, highway and street spending declined 0.4% and spending on commercial construction, which includes warehouse, retail, and farm construction, slumped 1.5%. In addition, transportation facilities spending declined 0.3 percent.

Simonson suggested that the decline in highway and street construction came as the Biden administration continued to fall behind in implementing recently enacted reforms to the federal permitting process. He added that many state and local officials are having ongoing challenges in following the administration’s complex Buy America rules.

“The Biden administration seems to be suffering from a bit of policy schizophrenia; it talks a lot about wanting to build infrastructure while it keeps working to tie those projects up in red tape,” said Stephen E. Sandherr, AGC’s chief executive officer. “Simplifying the Buy America rules and making required progress on permitting reform will help boost a wide range of construction activities across the country.”

Associated Builders and Contractors

Associated Builders and Contractors