Having experienced some growth over the past two years, construction contractors remain cautiously optimistic going into 2023.

Results from an annual survey conducted by the Associated General Contractors of America and Sage suggest contractors are less optimistic about private-sector segments than in 2022 but have relatively high expectations for the public sector market.

“Contractors are optimistic about the construction outlook for 2023, yet they are expecting very different market conditions for the coming year than what they experienced last year,” said Stephen E. Sandherr, the association's chief executive officer. “Even as market demand evolves, contractors will continue to be confronted by many of the challenges they faced in 2022, including the impacts of supply chain problems and labor shortages.”

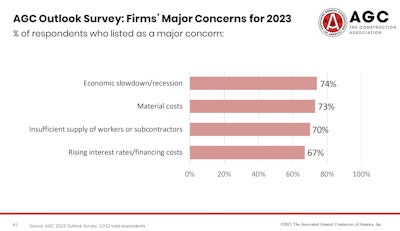

Two of the four most frequently mentioned major concerns in the survey were recession or economic slowdown, noted by 74% of respondents, and rising interest rates/financing costs, cited by 67%. Sandherr noted that not surprisingly materials costs and labor shortages were highly ranked.

Two of the frequently mentioned concerns in the American General Contractors of America survey were recession or economic slowdown, and rising interest rates/financing costs.Associated General Contractors of America

Two of the frequently mentioned concerns in the American General Contractors of America survey were recession or economic slowdown, and rising interest rates/financing costs.Associated General Contractors of America

“We are very optimistic as contractors in general. We think 2023 will be a good year,” said Chris Long, president and COO of Kaufman Lynn Construction in Delray Beach, Florida. “My personal view is we will see a slight correction in the market, a slowdown or recession if you will, but it'll be minor, and 2023 will end up being a very strong year as well.”

The prospect of a potential recession has dimmed the short-term outlook for some projects, such as warehouses, data centers and manufacturing plants.

At the same time, Sandherr said, many contractors hope to finally see the benefits of a flurry of new federal investments in infrastructure and construction from the Bipartisan Infrastructure Law, the CHIPS Act and the so-called Inflation Reduction Act.

"As an overall statement, Caddell Construction as well as the industry as a whole, I believe, in the past year or two has certainly grown and is thriving despite the economic woes we've experienced,” said Mac Caddell, president and CEO of Montgomery, Alabama-based Caddell Construction. "Our industry is vibrant, and it's a central part of our nation's wellbeing. It is a bright spot where a lot of times it doesn't seem to be a lot of bright spots at the moment.”

The contractors’ comments ring true, according to AGC’s survey results.

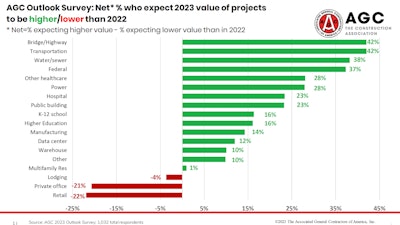

AGC Chief Economist Ken Simonson said the net reading – the percentage of respondents who expect the available dollar value of projects to expand compared to the percentage who expect it to shrink – is positive for 14 of the 17 categories of construction included in the survey. He said respondents were most optimistic about infrastructure categories, with net positive readings of 42% for highways, bridge construction and transportation projects.

According to the report, contractors are almost as upbeat about sewer and water construction, with a net reading of 38%. The net reading for federal projects is 37%.

“Despite this optimism, only 5% of respondents say they have worked on new projects funded by the law, while 6% have won bids but have not started work,” Simonson said. In addition, another 5% say they have bid on projects but have not won any awards yet; whereas, 21% plan to bid on projects but say nothing suitable has been offered yet.

For private sector categories, the highest expectations are for power projects and healthcare facilities, with readings of 28%. Simonson said contractors were optimistic about education-sector work, as well.

While still positive, the net reading for manufacturing construction is 14%, compared to 27% in the 2022 survey. Similarly, the net is 12% for data centers, down from 31% a year ago, and 10% for warehouses, down from 41%.

He said there were negative readings reported for office, retail, and lodging construction.

“Despite the largely positive net readings, respondents are less confident about growth prospects than they were a year ago,” he said. “For all but three project types, the net reading is less positive than in the 2022 survey.”

War for talent

Going into 2023, the war for talent is expected to continue having a huge effect on the entire industry.

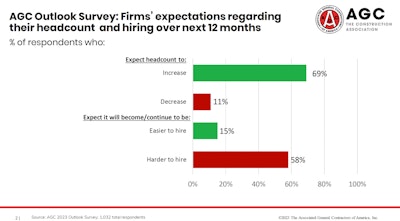

According to the survey, 66% of respondents expect to add to their workforce, and only 11% expect a decline.

Simonson noted that an overwhelming 80% reported that they are having a hard time filling some or all salaried or hourly positions. More than half also indicated that hiring would continue to be difficult or become harder in 2023.

“The workforce shortage makes everything take longer and cost more, and we see all that continuing into 2023,” Caddell said, noting that he expects the same with the supply chain and material cost issues. “It will continue to have a profound effect on schedules and affordability of new projects.”

John W. Casella II, president of Pittsford, Vermont-based Casella Construction, agrees that the labor challenge is the biggest threat. However, he said, it can also be the industry's biggest opportunity.

"I think as an industry, it's a problem that everybody has, and I think it's a great opportunity, as an industry, to retell our story," he said. "I think we've all been working on them and focused more on how to offer better careers and opportunities for people in the trades."

Casella said that in the last year, many efforts have been made to increase wages and benefits. Now, it is important to look at all the other aspects, including demographics and culture, what the jobs look like, and continue to invest in bringing people into the trades.

An overwhelming 80% of respondents to AGC's survey reported that they are having a hard time filling some or all salaried or hourly positions.Associated General Contractors of America

An overwhelming 80% of respondents to AGC's survey reported that they are having a hard time filling some or all salaried or hourly positions.Associated General Contractors of America

In some regions, there is a strong workforce.

Michael Cwienkala, vice President of K.R. Miller Contractors in Chicago, said he finds a talented and well-trained workforce in his region, but it is an aging one nearing retirement.

Acknowledging the labor force challenges, Cwienkala said there is no shortage of personnel looking to get into the trades.

“There is still a strong demand to get into these apprenticeship programs, which is great for the unions,” he said.

Supply, cost and time

Simonson said only 9% of firms reported supply chain problems in 2022. Many reacted to such issues by accelerating purchases after winning contracts, and most turned to alternative suppliers. Approximately 25% stockpiled items before winning contracts.

Between labor issues, supply and finances, most contractors have experienced project delays or cancellations.

According to the AGC survey, only a third reported no projects had been canceled or postponed. About 13% of firms have already experienced a canceled or postponed project that was set to begin in early 2023.

"The main reason for cancellations and postponements was rising costs – for construction, financing, insurance, etc. – which was cited by nearly half of the contractors," Simonson said.

That trifecta of cost, time and lack of talent are common indicators for many contractors.

"In the public sector side what we've seen, although those projects are coming to fruition, it's been a challenge for them to acquire dollars to keep pace with what inflation has done to the cost of those projects,” Long said. “When they're awarded, they're generally based on a budget that's a year ahead of when it's awarded. Funding is short by the time you get to pricing the job because of escalation.”

Working in a broad brush of public projects, he is optimistic about the overall public sector market in 2023.

Similarly, in the private sector, the bulk of Kaufman Lynn Construction’s work is in multi-family developments, where inflation and delays can have even more of an impact. He expects postponements and market stress to continue despite the continued demand.

“We're fortunate because of our market down here, but it is being strained. And we're optimistic as always but concerned about when that reaches a tipping point that developers tap the brakes and stop putting that money out and developing those sites and waiting for the tide to turn and the course correction to happen,” Long said. “Uncertainty in any market is tough for developers but us as contractors as well.”

Caddell pointed out that the impact can extend to the subcontractors. When projects are extended to 24 months in duration and subcontractors must predict material prices 18 to 20 months out from the time of being awarded the contract, the option to protect themselves is to pad the prices, only further driving up the overall cost.

“The awarding contracts are much larger than they would have typically been due to inflation,” he said. “As a result, many general contractors and subcontractors that we do business with have record backlogs, and it's straining their bonding capacity."

He is hopeful that will improve, at least on the subcontractor side because the subs typically can work off their backlog faster.

"I expect midway in 2023, subs will have worked off some of that large backlog and have more flexibility later in the year and make things more competitive on certain projects," Caddell said.

Specifically, he said, the cost increases may limit the volume of work with private entities in 2023. However, he does see more opportunity for public projects as Congress sorts out the funding requests.

Echoing others, Casella said he sees inflation and supply chain issues as challenges but ones that can be overcome with the right team.

Casella said the pipeline is strong for public projects, but there are a lot of budget and timing issues, because by the time projects make it to the bid process, they're over-budget. Similarly, he said, there are a lot of slow starts in the private sector.

"We're seeing a lot of skepticism and softness in the market," he said. "It's mostly around interest rates and fear of where things are going but still feel positive overall. I think those that can figure out the labor challenges and can put the teams together are going to be able to do well. Those that aren't, are going to struggle for the work."

Associated General Contractors of America

Associated General Contractors of America