Construction and lift/access equipment values are remaining relatively stable, according to the latest market report from EquipmentWatch.

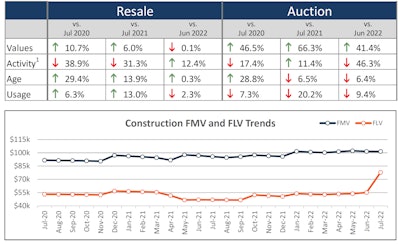

Overall, both construction and lift equipment prices maintained the trend of flat inflation In July.

EquipmentWatch’s latest Market Report states that the average full market value (FMV) for construction equipment was 0.1% lower than June 2022, nearly in line with the 0.3% inflation rate of the consumer price Index (CPI) in July, which was flat for the first time in 2022.

EquipmentWatch

EquipmentWatch

Through 2022, construction equipment inflation has trailed inflation in the broader economy. The report states that CPI inflation reached 8.5% in July, compared to the average construction equipment FMV being 6% above July 2021 and 10.7% above July 2020.

Overall, the resale market activity for construction equipment rebounded from June with a 12.4% increase. According to the report, it remains significantly down, 31.3% and 38.9%, from numbers reported in July 2021 and July 2020, respectively. EquipmentWatch

EquipmentWatch

The average age of the machines on the resale market had dipped in June, while remaining flat in July. In comparison to the past two years the average equipment age is on the rise.

From an auction market view, the report states that activity dropped nearly in half compared to June, with a 46.3% decline. The year-over-year comparison still shows an 11.4% increase from July 2021

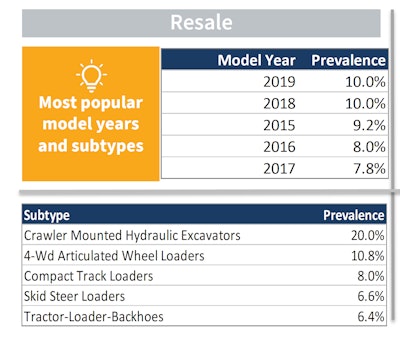

Among resale and auction channels, some of the top-selling types of equipment include crawler excavators, articulated wheel loaders, compact track loaders, skid steers and backhoes.

The EquipmentWatch report states that articulated wheel loaders are among the most popular types of machines from both a resale and auction viewpoint. In July the average value for the loaders increased faster than the overall construction equipment market. Fair market value prices were 1% higher than in June 2022, which put prices 13.9% above July 2021 and 13.4% above July 2020.

Due to the overall popularity, the usage rates were up almost across the board and outpaced rates of the broader construction market.  EquipmentWatch

EquipmentWatch

Surprisingly, model years for the wheel loaders on the auction market were much older than other pieces of construction equipment. Buyers were looking at 2006, 2013 and 2012 wheel loaders versus the 2015, 2016 and 2014 machines in the overall construction market.

Gimme a lift

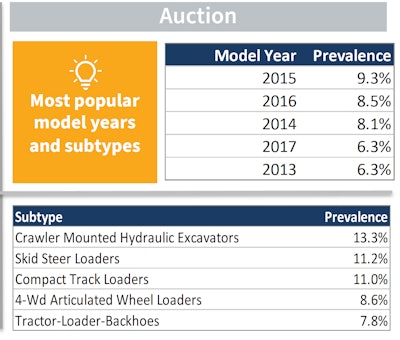

While not as flat as construction equipment values, lift equipment values also have been relatively stable. The average FMV was flat compared to June, rising by a mere 0.4% month-over-month. Compared to July 2021 and July 2020, the values have increased by 16.9% and 21.9%, respectively.

According to the EquipmentWatch report, lift equipment resale market activity was down 41.4% compared to July 2021 and 56.3% compared to July 2020. On a month-to-month basis, it remained flat with a 0.2% increase compared to June 2022.

In addition, the lift equipment usage rates dropped slightly, 0.5% compared to June, and continued rising sharply on a year-over-year comparison. Average usage increased by 48.3% over July 2021 and 51.8% over July 2020.

Within the auction market, activity has improved since July 2021, about 24.4% higher, but remains dramatically below (56.8%) July 2020.

The average age of lift equipment purchased had dropped by 2.6% in June 2022. In July, it increased 1.2% compared to June, meaning it’s still down 8.6% compared to July 2021.

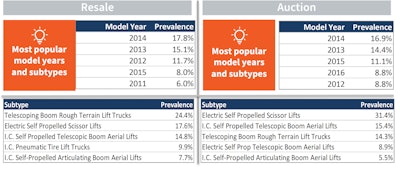

Lift equipment models on the auction market are slightly newer than those on the resale channel. The most prevalent models sold on resale were 2014, 2013 and 2012. On the auction market, 2014, 2013 and 2015 machines were most popular. EquipmentWatch

EquipmentWatch

The top lift equipment for sale or auction included telescoping boom rough-terrain lifts, electric self-propelled scissor lifts, and I.C. self-propelled telescopic boom aerial lifts.

The report states that usage rates within the auction market were down 30.9% below July 2021 and 11% below July 2020.

The monthly report from EquipmentWatch tracks resale and auction prices for over 15,000 models across 389 manufacturers throughout North America.

EquipmentWatch is owned by Randall Reilly, parent of Equipment World.