Against a backdrop of supply chain shortages, inflationary pressure, energy challenges, and war in Ukraine, capital project owners and construction contractors appear to remain positive about the direction for the industry, according to the second annual Global Projects Outlook from InEight Inc.

Based on research conducted with 300 of the world’s largest capital projects owners and construction professionals across North America, Europe and the Asia Pacific region, the study focused on optimism levels and digitization.

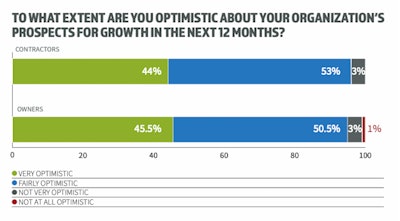

Findings of the outlook show 99% of North American respondents are either "very optimistic" or "optimistic" about their organization’s growth prospects for the next year, up from 97% in 2021. With research conducted in March 2022, the sense of optimism displayed is not surprising closer to the start of the year, compared to today as many economists believe the industry and the overall economy might be heading into a recession.

“Last year was a uniquely challenging time, and the global construction sector’s buoyancy and resilience in the face of it was exceptional,” said Jake Macholtz, CEO InEight.

InEight

InEight

He notes that any breathing room that was gained from the pandemic subsiding has been taken up by global supply chain shortages, inflationary pressure, an energy crisis, and the war in Ukraine.

“Tough times no longer look like the exception,” he said. “While the challenges have remained, so too have the confidence, optimism and resilience of the global construction sector. Those with higher levels of technological maturity are best placed to do so and threaten to outpace their slower rivals.”

Macholtz said that everyone they’ve spoken to is talking about growth opportunities for both owners and contractors.

“The optimism, resilience and confidence of the industry is almost tangible it’s so strong,” he added.

Notably, North American respondents reported a significant increase in construction and capital projects spending (up from 61% last year to 75% in 2022).

Differing from last year’s report, the completion of projects on time and on budget, as reported by contractors, has fallen dramatically (-23% and -26% respectively) with the region performing worse than other regions. An inability to see current project status and data at a detailed level (54% versus a 47% global average) was reported as a key influence on North American respondents’ project performance.

“Project certainty is still an aspiration for many,” Macholtz said. “We still have a long way to go until we achieve productivity that is on par with other sectors, and the dented project certainty we see this year shows us that hard-won gains are easily lost. Nonetheless, project owners are demanding more data and insights, which will lay the foundation for improved project certainty.”

He noted that many projects become late and over-budget because of poor planning, not poor execution. “Many organizations lack rich, real-time data on project performance and progress, so they are repeatedly blindsided by unmanaged or unexpected risks and miss opportunities to make smarter decisions.”

InEight

InEight

A digital transformation

The remainder of the report focuses on the significance of technology within the industry.

“Digital transformation doesn’t happen in a vacuum,” Macholtz said. “Its success or failure depends on people. By keeping that top of mind, organizations can get the best out of their tech stacks and their workforces.”

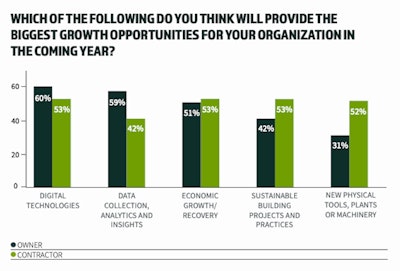

According to the report, digital technologies (54%) offer the top opportunity for growth, however 95% of North American respondents said that their experience of change management left room for improvement, signaling a need for a more sophisticated, human-centric approach to technology implementation.

“Technology maturity and investment is highly valued,” Macholtz said, noting that a highly strategic approach to digitalization and technology correlates well with metrics such as confidence and resilience. “Respondents see this and are excited by the potential of technologies such as data analytics, artificial intelligence and machine learning. However, change management practices leave significant room for improvement.”

Tracking the global sentiment, the InEight report shows that North American respondents identified uneven or sporadic implementation (55%), process and data integration issues (54%) and technical and system limitations (49%) as the top frustrations caused by technology upgrades.

Also, North American respondents were also most likely to say that legacy ways of working prevent them from adopting new tools and processes in comparison to other regions (52% vs. a 46% average).

The outlook found that respondents see digital technology as broadly helpful in their day-to-day roles, particularly having reassurance of environment, health and safety (EHS) policy adherence (56%) and gaining detailed and holistic information on projects and events (53%).

Highlighting the need for a human-centric approach, 92% of North American respondents said they had concerns about the future of digital transformation. Reduced in-person communication (45%), increased difficulty in understanding site/project reality (43%), and professional experience and human intuition being replaced by technology (35%) were all cited, reflecting similar concerns to their global peers.

When asked what benefits they hoped digital transformation could deliver in the future, North American respondents said greater strategic insights (49%), more automation (46%), better communication (46%) and more control (44%).

“Respondents are clear on the benefits of digital technologies and eager to realize this new vision of the future, but right now we are falling short when it comes to managing organizational change, making digital transformation unnecessarily arduous.” Macholtz said. “The bottom line is that the construction sector — capital project owners and contractors alike — is investing in technology, seeing the benefits, and planning for bright, tech-led futures. The sophistication of an organization’s digital transformation strategy is emerging as a reliable predictor for performance across a range of metrics from optimism to project certainty, and we expect that to continue into the future.”