Analysis of spending and job-opening data by the Associated Builders and Contractors suggests the months ahead could become easier for construction contractors or more challenging.

“Many economists believe that a recession in America over the next 12 to 18 months has become virtually inevitable,” said ABC Chief Economist Anirban Basu. “Thus, even as delivering construction services becomes more affordable, demand for construction services, particularly private construction, may begin to fade.”

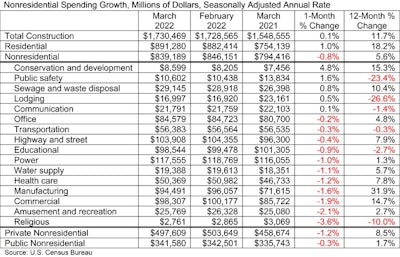

In March, national nonresidential construction spending was down 0.8% as contractors continued to struggle to find workers and get deliveries on materials. Basu said spending was down monthly in 11 of 16 nonresidential categories. Private nonresidential spending was down 1.2%, although the March total was 8.5% higher than in March 2021. On a year-over-year basis, nonresidential construction spending is up 5.6%, led by 31.9% growth in construction related to manufacturing.

“March’s construction spending numbers aren’t adjusted for inflation and are actually worse than they look,” Basu said. “While overall construction spending rose 0.1% in March, largely because of the strength in multifamily residential construction, construction spending was down in real terms.”

He noted that nonresidential construction performance declined because of weakness in segments like commercial (-1.9%) and amusement/recreation (-2.1%).

“Even though nonresidential construction spending levels are significantly short of what they were pre-pandemic, many contractors indicate that they are operating at capacity,” Basu said. “This speaks to how challenging the economic environment is becoming, with contractors wrestling with workforce skills shortages and sky-high materials prices.”

Associated Builders and Contractors

Associated Builders and Contractors

Job openings

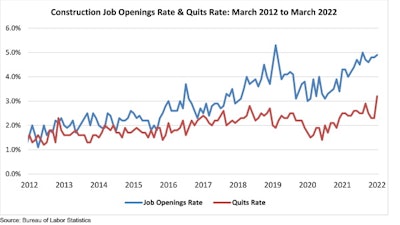

Construction workers quit their jobs at a faster rate than they were laid off or discharged in March, with the quit rate of 3.2% well above the layoffs and discharges rate of 1.6%. March represented the 13th consecutive month in which quits outpaced or equaled layoffs and discharges.

Overall, according to ABC’s analysis of U.S. Bureau of Labor Statistics data, the construction industry had 396,000 job openings in March, which was up 13,000 from February and 60,000 from March 2021.

“The March data reflects a labor market that continues to be strong and an economy that continues to have forward momentum,” Basu said.

In March, the number of available, unfilled job openings in construction approached 400,000, according to Basu. He said construction was not the only economic segment registering an increase in the number of positions awaiting candidates.

“The upshot is that many contractors are operating at capacity and expanding that capacity,” said Basu. “The construction industry faces a severe skilled-worker shortage of 650,000 in 2022, and it is likely that construction wages will continue to grow at above-average rates as contractors compete for talent.”

The increased wages will only further drive up the price of construction services, which he said is supported in the recent decline in contractor profit-margin expectations.

“The Federal Reserve’s stepped-up efforts to combat inflation will eventually translate into better pricing for key construction inputs. However, those same efforts will soften the economy,” Basu noted.

ABC

ABC