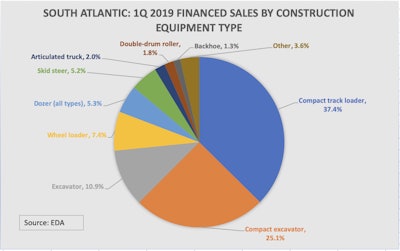

Number of units financed, Jan. 1-Mar. 31, 2019

Number of units financed, Jan. 1-Mar. 31, 2019The number of new construction machines financed in the first quarter of 2019 saw a near-flat 1 percent increase in the South Atlantic division compared with the same period last year, according to an analysis of UCC-1 filings as reported by EDA.

Gainers in the division included North Carolina (11 percent increase compared with the same quarter last year) and Georgia (7 percent increase). Both Virginia and West Virginia saw significant percentage decreases compared with 1Q last year at minus 27 percent and minus 25 percent, respectively.

The U.S. Census Bureau’s South Atlantic division includes the states of Delaware, Florida, Georgia, Maryland, North and South Carolina, Virginia, West Virginia and the District of Columbia.

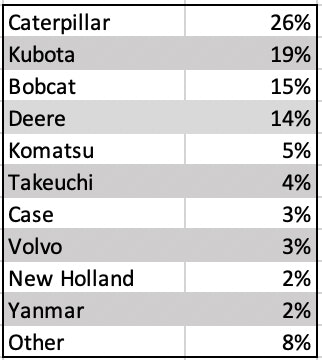

Top brands in the South Atlantic division in 1Q 2019. Source: EDA

Top brands in the South Atlantic division in 1Q 2019. Source: EDAAs in the Northeast Region, compact machines dominate in terms of number of financed units in the South Atlantic division, in part because their lower initial cost. Compact track loaders (CTLs) at 2,002 machines sold were 34.4 percent of the 5,350-machine total. Compact excavators at 1,345 machines sold were 25.1 percent of the total. Coming up a distant third were excavators: 584 machines at 10.9 percent. (We compiled this data on May 23rd; it is continually updated by EDA.)

Cat (26 percent of the total) was the top financed brand in the division, followed by Kubota (19 percent) and Bobcat (15 percent). At 239 units, the Kubota SVL75-2 CTL was the top model financed in the eight-state region, followed closely by its next-size-up brother, the Kubota SVL95-2s (231 units).

Machines in this report include backhoes, dozers, articulated haulers, excavators (mid- and full-size), compact excavators, skid steers, compact track loaders, wheel loaders and tool carriers, asphalt and concrete pavers, scrapers, graders and single and double-drum rollers.

State breakdown

Here’s a state-by-state breakdown of the construction equipment financed during the 1Q. (Percentages are rounded.)

Delaware

Total number of machines financed in the first quarter: 92 (down 3 percent from 1Q 2018)

Top models: Kubota SVL75-2 CTL (11 machines); Takeuchi TL10V2 CTL (4 machines); Cat 259D CTL (4 machines)

Top machine types: CTL (38 machines); compact excavator (15 machines); wheel loader (12 machines)

Top financed brands: Cat (28 machines, 30 percent of total); Kubota (24/26 percent); Takeuchi (9/10 percent)

Florida

Total number of machines financed in the first quarter: 1,621 (up 4 percent from 1Q 2018)

Top models: Kubota SVL95-2s CTL (80 machines); Kubota SVL75-2 CTL (47 machines); Bobcat T595 CTL (44 machines)

Top machine types: CTL (537 machines); compact excavator (385 machines); wheel loader (196 machines)

Top financed brands: Cat (496 machines, 31 percent of the total); Kubota (299/18 percent); Deere (211/13 percent)

Georgia

Total number of machines financed in the first quarter: 987 (up 7 percent from 1Q 2018)

Top models: Kubota SVL95-2s CTL (54 machines); Kubota SVL75-2 CTL (45 machines); Bobcat T770 CTL (28 machines)

Top machine types: CTL (402 machines); compact excavator (245 machines); excavator (97 machines)

Top financed brands: Kubota (207 machines, 21 percent of total); Cat (207/21 percent); Deere (161/16 percent)

Maryland

Total number of machines financed in the first quarter: 394 (flat compared to 1Q 2018)

Top models: Kubota SVL75-2 CTL (35 machines); Bobcat T595 CTL (14 machines); Bobcat T650 CTL (13 machines)

Top machine types: CTL (157 machines); compact excavator (88 machines); skid steer (61 machines)

Top financed brands: Bobcat (91 machines, 23 percent of the total); Kubota (84/21 percent); Cat (68/17 percent)

North Carolina

Total number of machines financed in the first quarter: 1,048 (up 11 percent from 1Q 2018)

Top models: Kubota SVL75-2 CTL (60 machines); Cat 259D CTL (54 machines); Bobcat T595 (52 machines)

Top machine types: CTL (397 machines); compact excavator (298 machines); excavator (149 machines)

Top financed brands: Cat (290 machines, 28 percent of the total); Kubota (194/19 percent); Bobcat (164, 16 percent)

South Carolina

Total number of machines financed in the first quarter: 559 (up 5 percent from 1Q 2018)

Top models: Kubota SVL95-2s CTL (27 machines); Kubota SVL75-2 CTL (27 machines); Bobcat T595 CTL (26 machines)

Top machine types: CTL (227 machines); compact excavator (150 machines); excavator (55 machines)

Top financed brands: Cat (141 machines, 25 percent of the total); Kubota (119/21 percent); Bobcat (111/20 percent)

Virginia

Total number of machines financed in the first quarter: 437 (down 27 percent from 1Q 2018)

Top models: Cat 259D CTL (20 machines); Kubota SVL95-2s CTL (17 machines); Bobcat T770 (16 machines)

Top machine types: CTL (194 machines); compact excavator (100 machines); excavator (37 machines)

Top financed brands: Cat (106 machines, 24 percent of the total); Bobcat (86/20 percent); Deere (75/17 percent)

West Virginia

Total number of machines financed in the first quarter: 176 (down 25 percent from 1Q 2018)

Top models: Cat 745 articulated truck (8 machines); Deere 50G compact excavator (8 machines) Kubota KX040-4 compact excavator (7 machines)

Top machine types: Compact excavator (54 machines); full-size excavator (36 machines); CTL (36 machines)

Top financed brands: Cat (49, machines, 28 percent of the total); Deere (40/23 percent); Kubota (25/14 percent)

About the source

EDA, a division of Equipment World’s parent firm Randall-Reilly, tracks UCC-1 filings used by lenders when a machine is financed.

Depending on the type of machine, financed machines can represent 40 to 75 percent of the total number of machines of that type sold in the United States. While machines can also be bought by cash or letter of credit, which are not tracked by EDA, buyers of higher priced equipment (for example, a large excavator) tend to use financing. EDA continually updates its data.