More tech packed into lower-cost machines

Technology has always been a tricky issue for compact equipment. Tech features can be expensive and represent a higher percentage of total initial cost than on larger models. And the same technology that provides clear value for production-class equipment doesn’t have the same return on investment for compact machines, which handle varied applications and typically have lower utilization rates.

OEMs have responded to this increased demand in various ways.

Adding tech

Bobcat expanded their R-Series lineup with the launch of the E85 in 2018. It is among seven models offering the optional Bobcat Depth-Check System. With Depth-Check, sensors monitor the position of the bucket teeth for accurate and consistent digging. “We have seen a steady take

In-cab advances on the R-Series include optional automatic heating and air conditioning and a secondary auxiliary selector toggle switch on the left joystick for boom swing control with better metering than by foot pedals.

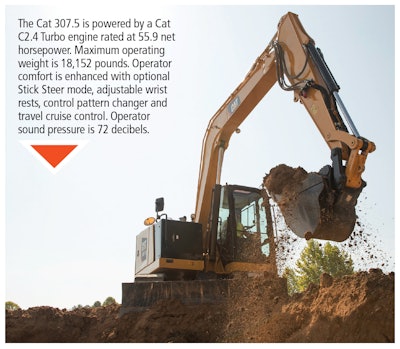

Caterpillar sought to bring the technology with greatest value to its next generation machines. They currently have four models each in the 1- to 2-ton and 7- to 10-ton sizes. The monitor that had been only in the larger models is now standard all the way down to the 1- and 2-ton machines. All but the smallest models include a camera. Cruise control is found on the left joystick. Also on the left joystick is Stick Steer, which makes Cat’s compact excavators handle like skid steer loaders while traveling.

Features on Hitachi’s six-model lineup include a heavy-duty X-frame that provides a stable platform and resists dirt buildup, wedge-style couplers for quick changes of a variety of buckets and attachments, rubber tracks, and Tier 4 Final Yanmar engines. A canopy is available on all models as a cost-effective alternative to a cab. Isochronous high idle reduces noise by maintaining a constant engine speed under varying loads.

As part of Kobelco’s iNDr noise and dust reduction package, engine compartments are fully enclosed, resulting in much lower noise levels. A thumb mounting lug is standard on most machines, and suspension seats are on many models.

Kobelco also addresses the North American market with higher capacity engine and hydraulic cooling systems, says George Lumpkins, general manager of marketing, Kobelco USA. In addition, the ability to change between steel and rubber tracks without modifying the excavator base is optimized for North America. Counterweights are heavier, or additional weights are available. North American models’ pattern changers include a tractor loader backhoe pattern.

Doran Herritt, construction equipment brand marketing manager, New Holland, points to four tech features on the company’s compact excavators. The auto-shift travel system downshifts and upshifts automatically to maintain momentum as loads change due to condition changes. Auto idle drops engine speed to reduce wear and conserve fuel when the operator is not using the travel or excavator levers. Fleetforce telematics includes usage monitoring, which helps with preventive maintenance scheduling, and geofencing. The smallest New Holland model, the E17c, has retractable tracks.

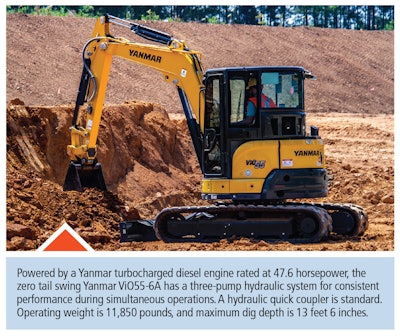

Yanmar now offers eight compact excavators in two series. The ViO Series line, launched in 1993, has six models of zero tail swing machines. Standard features include Eco and Auto-Deceleration modes for up to 20 percent fuel savings. The SV Series models are built around an ultra-tight turning radius for added versatility in confined worksites. The two SV machines bookend the Yanmar lineup as the smallest and largest models, the SV08-1B with 10.3 horsepower and the SV100-2A at 74 horsepower. Both are diesel. The ViO 80 and SV100 come standard with second auxiliary hydraulics to the end of the arm. In addition, “SmartAssist Remote Service, Yanmar’s comprehensive telematics package, is also free for the first five years on all the ViO25 and larger

Electric surge

Electric equipment is coming on strong, and compact excavators are ideal candidates. Their duty cycles, utilization rates and physical design make them well suited for electrification.

In addition to going all-in on electric, Beainy says, Volvo is also looking at hybrid and battery-enhanced designs. “Our research has shown that electrification is possible for many machine types and sizes, but diesel engines will remain appropriate for certain sizes, applications and markets for some time yet, so we’ll continue meeting that demand as well.”

JCB’s 19C-1E, introduced at the ARA Show in February, is the first of several planned electric excavator models. “The 19C-1E meets growing customer demands for a machine with zero emissions and reduced noise pollution,” says Chris Lucas, JCB North America product manager for compact excavators. “This eliminates the need for costl

y exhaust monitoring and extraction when working indoors, underground or in sensitive urban locations.” He notes the electric machine is five times quieter than a comparably sized diesel machine, an important consideration when working outside of normal hours or in noise-sensitive environments such as schools and hospitals. The 19C-1E is tether-free and powered by a three- or four-cell lithium ion battery pack. The battery can power the machine through a typical day without recharging.

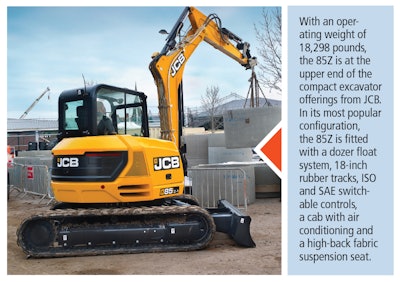

JCB has not neglected traditional diesel-powered compact excavators and recently launched their next generation of 8- to 10-ton models. Technology features include a Lift Overload System, which provides the operator with terrain information and indicates lifting limits based on the position of the machine. Other features include a twin-lock hydraulic coupler with an LED indicator, and a “below-idle” option that drops engine idle speed to 950 rpm for improved fuel consumption.

Wacker Neuson debuted their first electric compact excavator at Bauma, the 1.7-ton EZ17e. This is the frontrunner of a range of electric models the company has planned. Wacker Neuson also offers the 803 dual-power machine, which runs on its diesel engine for typical applications but can also be powered by the company’s electrically driven hydraulic power unit (HPU). This allows one machine to work in traditional environments as well as those where emissions and noise are special considerations.

Other features on some Wacker Neuson models include an ad

vanced color display and jog dial, allowing operators to easily set and store flow rates to match attachments. “Maintaining the optimal system settings appropriate to the application makes work more productive and saves time when switching attachments,” says Wacker Neuson market product manager John Dotto. The EZ36 allows the operator to program the sensitivity and speed of the dozer blade. Combined with the model’s float feature, this makes cleanup work and backfilling faster and easier. VDS, or Vertical Digging System, allows the h

ouse of the excavator to be leveled on slopes up to 15 degrees. This enhances operator comfort and allows the operator to dig flat-bottom trenches on uneven surfaces without overdigging.

Hyundai and Cummins have announced a collaboration on electrified compact excavator designs. While that effort is being developed, new diesel models are coming above and below the current models, as well as second models within key size classes. Chad Parker, senior product specialist, notes that the compact excavator line is Hyundai’s largest and fastest-growing in terms of units sold and new models being prepped for introduction. “This reflects the strong economy, especially new home and utility construction and landscaping.” The 9A series models feature four-way angle blades, thumb brackets, proportional hydraulics and pin-grabber-style dual-locking quick couplers. Buckets have lifting eyes and two-piece teeth for easier replacement. Dozer blades have replaceable cutting edges and an improved curve profile for better grade and cutting ability.

Business as usual

There’s been a flurry of joint ventures, mergers and acquisitions recently, as OEMs expand their offerings. And while some companies cozy up to others, others prefer to go it alone on the path to growth.

By the end of 2019, Caterpillar will have 31 models of compact excavators worldwide and 21 models in North America. “We know some of these are niche products,” says Worley, “but we want to provide solutions.” One example is the 306 XTC, which swaps out the blade for a skid steer bucket. Variable-angle booms are available, as are niche products targeted at demolition,

Worley says compact excavators are one of the few products that show up in every market in the world, which is part of what drives this diverse range of models. They are also the smallest machines in the Cat catalog that require operators. When developing this extensive lineup, Cat spent two years conducting field surveys of owners of both Cat and competitors’ machines.

Some 80 percent of the tools Cat offers are their own. The rest are the result of branding or collaboration and are mostly low-volume specialty products requiring specific design and construction expertise.

As a result of a relationship dating back to the 1960s, Hitachi Construction Machinery and Deere & Company signed a supply agreement in 1983 to manufacture construction excavators, including compact excavators. says Spendlove.

The relationship between Kubota and Land Pride has evolved over time. Land Pride launched in 1986 as a division of Great Plains Manufacturing Inc., making tools and implements for tractors. It formed an alliance with Kubota in 2007 to build attachments specifically for Kubota tractors. Kubota-branded construction attachments built by Land Pride appeared in 2015, and in July 2016, Kubota acquired Land Pride. Customers can now purchase Land Pride attachments separately or as part of the purchase of Kubota equipment.