The chief economist for Associated Builders and Contractors forecasts no recession for the U.S. economy for the rest of 2025, but he says the risk of one has risen.

And there are signs the economy and the construction industry are softening, reported Anirban Basu on October 8 during Construction Executive's 2025 Q3 Construction Economic Update and Forecast.

He predicts a return of inflation, interest rates remaining higher for longer, U.S. middle-class and lower middle-class residents facing worsening financial circumstances because of higher tariffs and prices, and the risk of a falling stock market.

In a typical year, the risk of recession is 10% to 15%, but for 2025, the risk has risen to 30% to 40%, among financial analysts at major brokerages, Basu says.

The reason for the higher risk, he says, is an economic expansion with a narrow foundation. Rather than widespread growth, it has been concentrated in booming data center construction, record-high stock and gold prices and wealthy consumers. “Other than that, there aren't really major drivers to the economy,” he says.

Last year, U.S. gross domestic product rose 2.8%. This year, economists predict growth of 1.5% to 2%.

“Ladies and gentlemen, that is not recession,” he said.

Nonresidential Construction Spending by Subsector

This chart shows nonresidential construction spending by subsector between July 2024 and July 2025.

This chart shows nonresidential construction spending by subsector between July 2024 and July 2025.

In a Word: “Uncertainty”

But the ever-changing policies, proposals and political fights out of Washington continue to create more uncertainty for the economy and the construction industry.

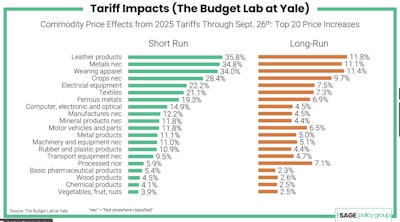

“I got to tell you, each and every week, it feels that something else is happening out of Washington, D.C.,” he said. “Right now, it's federal government shutdown, but … a couple of weeks (ago), it was tariffs on kitchen cabinets and on softwood lumber and on upholstered furniture, for whatever reason.”

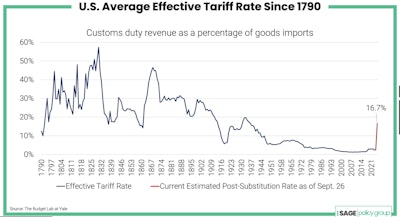

The last time tariff rates approached today's heights was during the Great Depression.

The last time tariff rates approached today's heights was during the Great Depression.

The federal crackdown on undocumented workers has also had an effect.

Basically, the U.S. labor force has not grown since January, yet the unemployment rate, though higher, is still stable.

“When the labor force was growing rapidly, in part because of migration into the country, you needed to add a ton of jobs to keep unemployment stable,” he said. “You don't need to as much anymore.”

On the other hand, lack of job creation creates problems. “Unemployment is up, job growth is soft, and this is where we really see the softening of the U.S. economy.”

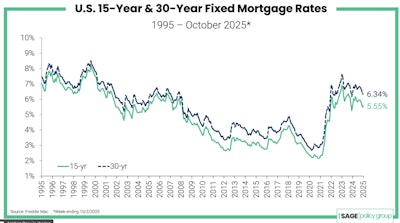

The unemployment situation prompted the Federal Reserve to lower its key interest rate last month and is expected to drop rates twice more this year. Basu notes that those short-term rates don’t always lead to drops in long-term rates, which are the primary drivers of mortgage rates and other loans. They also come at a time of rising inflation, when interest rate hikes are often the main fight against rising prices.

For construction, though, many contractors cite a continued labor shortage, but Basu expects that layoffs could be ahead, especially for a contracting homebuilding market. More people are staying put in their current homes because they have lower interest rates, and young people are priced out of the market.

Basu says he has been shocked at the “massive downturn in construction job openings,” in light of the much-publicized, long-term labor shortage. Job openings have dropped to nearly a 10-year low in construction. He believes that is due to the mass deportation of undocumented workers. The fact that there have not been openings to fill those positions, indicates to him a softening construction market.

“Is the World Getting Riskier or Safer?”

Though he doesn’t foresee a recession for 2025, he does predict higher inflation and interest rates staying higher for longer – all of which can wear on construction.

“Inflation stages a comeback,” he says. “I blame tariffs for that ... but also immigration policy, whether in agriculture, construction, landscaping, home health, restaurants, hotels, etc.”

“Many contractors are telling me, ‘Hey, deal flow is softening.’”

The stock market and other asset markets that have risen rapidly increase the potential risks.

“Our asset prices are overextended,” he says. “You have a slowing economy and growing inflationary pressures, why should the stock market be booming?

“And by the way, when people are investing in the stock market, that's risk-on. When people invest in gold, which is at $4,100 an ounce roughly, that's risk-off.

“So which is it? Is the world getting riskier or safer?”