While there’s no big upswing in the construction economy this year, there is at least forward progress, according to FMI’s 2021 Engineering and Construction Third Quarter Outlook report. Given a contentious election and pandemic, any progress is probably a good thing.

And for transportation construction, the outlook turns especially bright after 2022.

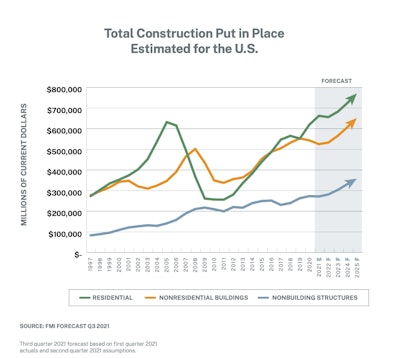

According to the report, total engineering and construction spending for the U.S. is forecast to end 2021 up 2%, compared to up 5% in 2020.

Investment in residential, especially single-family homebuilding and remodeling, is the primary driver in construction spending. Water supply is the only non-residential segment anticipated to grow vigorously this year with a likely gain of 5%.

Multifamily residential, health care, communication, manufacturing, highway and street, and sewage and waste disposal are considered stable and expected to end the year with growth at about the rate of inflation, between 0% and 4%. Mixed public and private segments are expected to end the year with growth roughly in line with inflation and are also considered stable.

Confidence increasing

In the third quarter of last year, the Nonresidential Construction Index (NRCI) dropped to below 40, the only time that’s happened since the Great Recession of 2008-09. No doubt the drop was a result of the coronavirus pandemic, government confusion on how to handle it, and widespread layoffs and lockdowns.

For the third quarter of 2021 the Index is up sharply to 59.7, suggesting continued and increased optimism heading into the rest of the year. According to FMI, the most recent reading indicates increased engineering and construction opportunities ahead. (Scores above 50 mean improving or expanding industry conditions. A score of 50 represents conditions remaining the same. Below 50 signals worse conditions compared to last quarter.)

Homebuilders on a tear

Compared to last year, single-family residential is the clear winner with 8% growth forecast, driven by a rise in the core consumer price index, historically low mortgage rates, and a lack of inventory.

The biggest loser in all segments is the lodging construction industry, down 18% compared at $23.5 billion and projected to drop to $21.7 billion next year

In terms of actual dollar amounts, spending on residential construction is estimated to be $660 billion this year. Non-residential building will top out at $524 billion and non-building structures at $281 billion.

While transportation construction is in negative territory this year, it is expected to rise 2% next year and 9%, 13% and 14% in subsequent years, making it the top performer year-over-year by 2025.

Total construction put in place for the United States in 2021 is projected to be $1.455 trillion. By 2025 that estimate jumps to $1.776 trillion.

You can download the full report here.