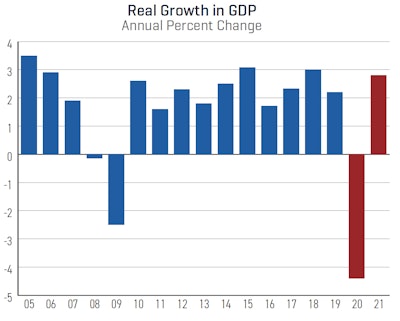

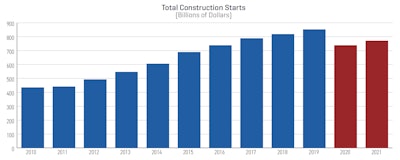

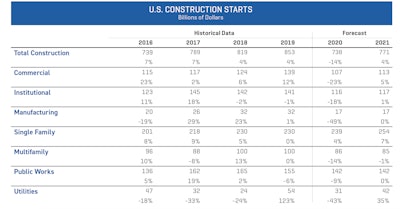

After a 14 percent drop in construction starts for 2020, the industry will regain about 4 percent of that in 2021.

That’s the forecast of Chief Economist Richard Branch of Dodge Data & Analytics. Branch says the pandemic has led to a “deep drop in construction starts in the first half of 2020.” The second-half recovery is underway, but full recovery will be long and gradual for construction markets.

That forecast also counts on more economic stimulus coming out of Washington early next year and the approval and wide distribution of a vaccine.

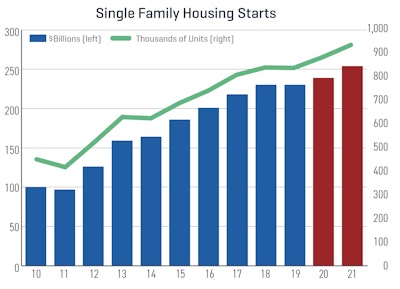

He predicts only the residential sector will exceed its 2019 starts, because of historically low mortgage rates boosting single-family housing and remote workers moving from urban to less dense areas.

Overall, he foresees a 5 percent increase in residential, 3 percent increase in nonresidential and 7 percent increase in nonbuilding construction, which includes public works, such as roads and bridges, and utilities.

“Uncertainty surrounding the next wave of Covid-19 infections in the fall and winter and delayed fiscal stimulus will lead to a slow and jagged recovery in 2021,” he said during the 2021 Dodge Construction Outlook conference November 10.

“Business and consumer confidence will improve over the year as further stimulus comes in early 2021 and a vaccine is approved and becomes more widely distributed, but construction markets have been deeply scarred and will take considerable time to fully recover.”

Quick outlook

Here’s a breakdown of where Branch sees the various construction segments faring next year:

- Single-family housing – 6 percent increase in starts, with a 7 percent increase in dollar value.

- Multi-family – 2 percent drop in starts; 1 percent drop in value.

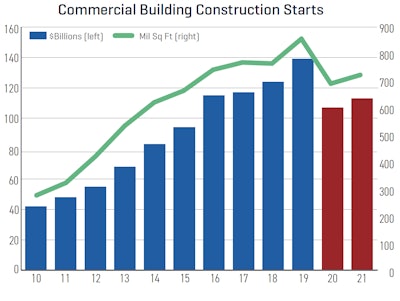

- Commercial – 5 percent increase in value.

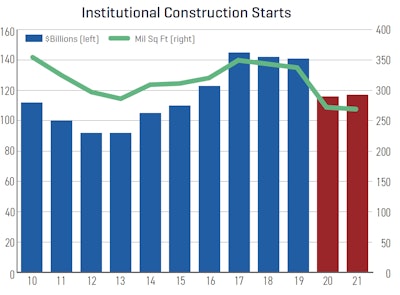

- Institutional – 1 percent increase in starts. This category includes government, education and health care projects.

- Manufacturing plants – Starts will remain flat.

- Public works – Starts will remain flat.

- Electric utilities/gas plants – 35 percent increase in starts.

What’s up

Along with single-family housing construction, these segments are expected to see the biggest gains in 2021:

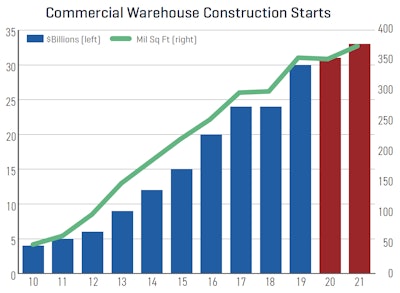

- Warehouse – Large ecommerce companies like Amazon will continue to need more space for distribution as the movement from in-store to online purchases grows.

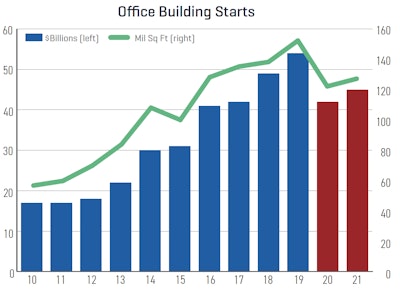

- Office – There will be increased demand for data centers and for renovations to existing offices.

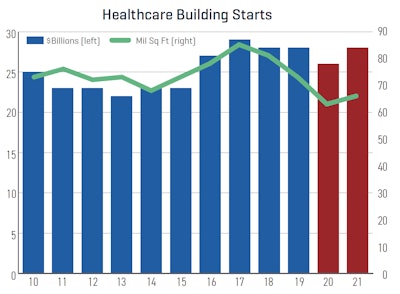

- Health care – Hospitals need more inpatient bed space.

- Electric utilities/gas plants – Several large liquid natural gas export facilities and more wind farms are scheduled.

What’s not

These construction segments are expected to continue to struggle in 2021:

- Multi-family construction – There’s an oversupply of high-end construction in large metro areas and rent values are declining.

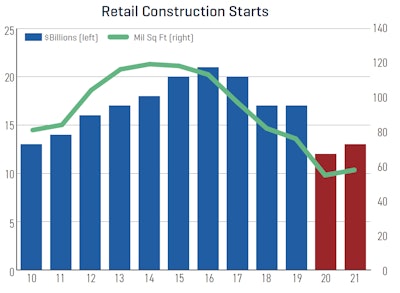

- Retail

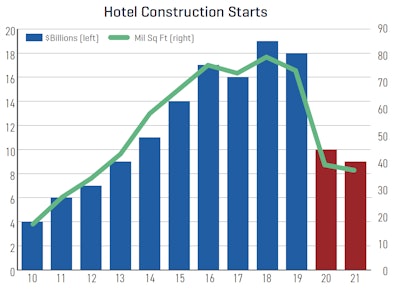

- Hotel

- Public works, buildings and education – State and local governments will see further revenue reductions. There is also uncertainty as to whether additional federal aid will materialize. The federal government is headed toward a December 11 shutdown deadline to approve funding for the rest of the fiscal year.

- Petrochemical – weak domestic and international demand will continue.

A story in charts

The following charts are from the 2021 Dodge Construction Outlook: