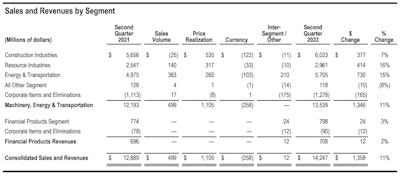

Citing higher sales volume across its three main global segments, Caterpillar says it saw an 11 percent increase in sales and revenue in the second quarter compared to the same period last year, for an increase of $1.3 billion.

The construction industries segment in North America grew by 20 percent in sales and revenue during the second quarter of 2022, as dealers reduced their inventories less than they did during the second quarter of 2021. Total sales for the segment were $6 billion, an increase of $377 million, or 7%, compared with the second quarter of 2021.

Resource industries in North America jumped 29 percent in sales and revenue. Total sales for the segment were $2.9 billion in the second quarter of 2022, an increase of $414 million, or 16%, compared with the second quarter of 2021. Cat says the increase was primarily due to favorable price realization and higher sales of aftermarket parts.

Energy and transportation realized a 14 percent increase in North America. Total sales were $5.705 billion in the second quarter of 2022, an increase of 15%, compared with the second quarter of 2021. Sales increased across all applications – oil and gas, power generation, industrial, transportation – and inter-segment sales.

Caterpillar

Caterpillar

Looking at overall results, Caterpillar says, the increases in North America and Latin America were partially offset by unfavorable currency impacts primarily related to the euro, Australian dollar and Japanese yen. The increase in sales volume was driven by services, partially offset by lower sales of equipment to end users, primarily in China.