The Bobcat T595 was the top financed new machine in the Midwest Region during the first quarter of 2019.

The Bobcat T595 was the top financed new machine in the Midwest Region during the first quarter of 2019.The Midwest Region saw both double-digit increases and declines in the number of new construction machines financed during the first quarter of 2019, compared with the same period last year, according to an analysis of UCC-1 filings as reported by EDA.

In the plus column were South Dakota (up by 44 percent compared to 1Q 2018), Minnesota (up 42 percent) and North Dakota (up 18 percent). These gains were offset by declines in Illinois (down 15 percent), Nebraska (down 14 percent) and Kansas (down 12 percent) compared with the same time period last year. (For more details go to the state-by-state breakouts toward the end of this article.)

States in the U.S. Census Bureau’s Midwest Region include Iowa, Illinois, Indiana, Kansas, Michigan, Minnesota, Missouri, North Dakota, Nebraska, Ohio, South Dakota and Wisconsin.

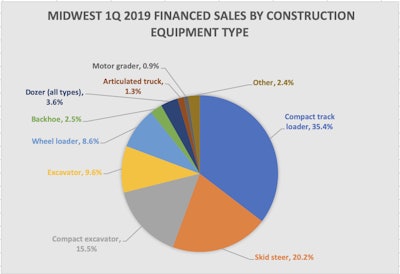

Because of their popularity and lower purchase price, compact machines dominate the data when looking at the number of machines financed. In the Midwest Region, compact track loaders (CTLs) make up 35 percent of the first quarter 5,007-machine total. Skid steers (20.1 percent of the total) came in second, with compact excavators (16 percent) third on the list. (We compiled the data on May 29th; while EDA updates this data on a continual basis, this represents the majority of machines financed during the quarter.)

Source: EDA

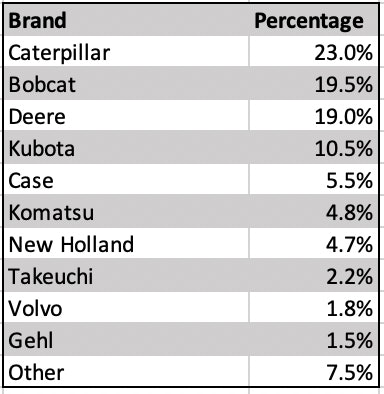

Source: EDALooking at top financed brands, Caterpillar claimed 23 percent of the first quarter machine market, followed by Bobcat (20 percent) and Deere (19 percent). The Bobcat T595 CTL was the top model financed during this time period in the region, with 172 machines sold. Other top models, all CTLs, were the Kubota SVL75-2 and SVL95-2s, Cat 259D and Deere 333G. The only non-CTL in the top 10 model lineup for the quarter was the Deere 35G compact excavator.

Machines in this report include backhoes, dozers, articulated haulers, excavators (mid-and full-size), compact excavators, skid steers, compact track loaders, wheel loaders and toolcarriers, asphalt and concrete pavers, scrapers, graders and single and double-drum compactors.

Similar reports are also available for the Northeast Region, South Atlantic Division and East and South Central Division.

State-by-state

Here’s a state-by-state breakout of equipment financed during 1Q 2019. (Percentages are rounded.)

Iowa

Total number of machines financed in the first quarter: 333 (3 percent decrease from 1Q 2018)

Top models: Deere 325G CTL (21 machines); Deere 317G CTL (15 machines) and Kubota SSV-75 skid steer (14 machines)

Top machine types: CTL (153 machines); skid steer (75 machines); compact excavator (30 machines)

Top financed brands: Deere (86 machines/26 percent of the total); Cat (64/19 percent); Bobcat (60/18 percent)

Illinois

Total number of machines financed in the first quarter: 456 (15 percent decrease from 1Q 2018)

Top models: Cat 262D CTL (14 machines); Case SV340 skid steer (13 machines); Kubota SVL95- 2s CTL (12 machines); Kubota SVL 75-2 (11 machines); Bobcat T770 (11 machines)

Top machine types: CTL (133 machines); skid steer (84 machines); compact excavator (70 machines); wheel loader (68 machines)

Top financed brands: Cat (126 machines); Bobcat (73 machines); Deere (63 machines)

Indiana

Total number of machines financed in the first quarter: 482 (4 percent increase from 1Q 2018)

Top models: Deere 35G compact excavator (48 machines); Kubota SVL75-2 CTL (23 machines); Bobcat T595 CTL (18 machines)

Top machine types: Compact excavator (153 machines); CTL (147 machines); skid steer (57 machines); excavator (55 machines)

Top financed brands: Deere (112 machines, 23 percent of total); Cat (102/21 percent); Bobcat (74/15 percent); Kubota (64/13 percent)

Kansas

Total number of machines financed in the first quarter: 253 (12 percent decrease from 1Q 2018)

Top models: Bobcat T650 (13 machines); Deere 333G (10 machines); Bobcat T595 (9 machines), all CTLs

Top machine types:CTL (112 machines); compact excavator (41 machines); skid steer (41 machines); wheel loader (21 machines)

Top financed brands: Cat (56, 22 percent of total); Bobcat (55, 22 percent); Deere (52, 21 percent)

Michigan

Total number of machines financed in the first quarter: 382 (4 percent decrease from 1Q 2018)

Top models: Bobcat T595 (15 machines); Kubota SVL95-2s (10 machines); Deere 325G (10 machines), all CTLs

Top machine types:CTL (126 machines); skid steer (77 machines); compact excavator (64 machines)

Top financed brands: Deere (76 machines, 20 percent of total); Bobcat (75/20 percent); Cat (65/17 percent)

Minnesota

Total number of machines financed in the first quarter: 600 (42 percent increase over 1Q 2018)

Top models:Bobcat T595 (15 machines); Kubota SVL95-2s (10 machines); Deere 325G (10 machines), all CTLs

Top machine types: CTL (126 machines); skid steer (77 machines); compact excavator (64 machines); wheel loader (48 machines)

Top financed brands: Deere (78 machines, 20 percent of total); Bobcat (75/20 percent); Cat (65/17 percent)

Missouri

Total number of machines financed in the first quarter: 609 (1 percent increase over 1Q 2018)

Top models: Kubota SVL95-2s (33 machines); Kubota SVL75-2 (28 machines); Deere 333G (27 machines), all CTLs

Top machine types: CTL (278 machines); compact excavator (108 machines); excavator (56 machines)

Top financed brands: Cat (141 machines, 23 percent of the market); Deere (133/22 percent); Bobcat (99/16 percent); Kubota (94/15 percent)

North Dakota

Total number of machines financed in the first quarter: 117 (18 percent increase over 1Q 2018)

Top models: Cat 330F L excavator (6 machines); Cat 140M3 AWD motor grader (6 machines); Bobcat T770 CTL (5 machines); Bobcat S650 skid steer (5 machines)

Top machine types: Skid steer (29 machines); CTL (19 machines); excavator (18 machines)

Top financed brands: Cat (39 machines, 33 percent of total); Deere (24/21 percent); Bobcat (22/19 percent)

Nebraska

Total number of machines financed in the first quarter:186 (14 percent decrease from 1Q 2018)

Top models: Cat 289D (11 machines); Bobcat T595 (9 machines); Bobcat T650 (8 machines); Deere 333G (8 machines)

Top machine types:CTL (88 machines); skid steer (37 machines); compact excavator (19 machines)

Top financed brands: Bobcat (54 machines, 29 percent of total); Cat (44/24 percent); Deere (32/17 percent)

Ohio

Total number of machines financed in the first quarter: 828 (5 percent increase over 1Q 2018)

Top models: Bobcat T595 (35 machines); Kubota SVL75-2 (31 machines); Kubota SVL95-2s (27 machines)

Top machine types:CTL (265 machines); compact excavator (176 machines); skid steer (139 machines)

Top financed brands: Cat (204 machines, 25 percent of the total); Bobcat (176/21 percent); Kubota (104/13 percent); Deere (98, 12 percent)

South Dakota

Total number of machines financed in the first quarter: 130 (44 percent increase from 1Q 2018)

Top models: Bobcat S570 (9 machines); Kubota SSV65 (6 machines); Bobcat S595 (6 machines), all skid steers

Top machine types:Skid steer (48 machines); CTL (39 machines); excavator (16 machines)

Top financed brands: Bobcat (35 machines, 27 percent of the total); Deere (24/19 percent); Cat (14/11 percent)

Wisconsin

Total number of machines financed in the first quarter: 631 (5 percent increase over 1Q 2018)

Top models: Cat 239D CTL (27 machines); Cat 420F2 backhoe (20 machines); Deere 310L backhoe (20 machines)

Top machine types:Skid steer (184 machines); CTL (181 machines); excavator (69 machines)

Top financed brands: Cat (164 machines, 26 percent of the total); Deere (127/20 percent); Bobcat (94/15 percent)

About the source

EDA, a division of Equipment World’s parent firm Randall-Reilly, tracks UCC-1 filings used by lenders when a machine is financed.

Depending on the type of machine, financed machines can represent 40 to 75 percent of the total number of machines of that type sold in the United States. While machines can also be bought by cash or letter of credit, which are not tracked by EDA, buyers of higher priced equipment (for example, a large excavator) tend to use financing. EDA continually updates its data.