A scene from this year’s Ritchie Bros. Orlando auction.

A scene from this year’s Ritchie Bros. Orlando auction.This is Part 1 of a five-part series on used equipment. Click here to see the other parts of the series. Click here to download the full version of the Used Equipment Report.

Supply and demand determine the price of used equipment, but other less apparent influences also move the needle.

Location is one such influence.

“This year we are seeing certain geographic pockets doing better than others,” says Brian Sandon, eastern U.S. sales manager, J.J. Kane Auctioneers. “One area might do better than the next, even though it’s just a couple hours away. It’s been hard to pinpoint consistently.”

The general trend in the Southeast and the West is a strong, growing economy and rising prices and demand. “Residential building and distribution have spiked up in the Southeast, and out West, the housing market has started to boom again, even in Las Vegas,” says Sandon.

Prices remain steady, trend upward

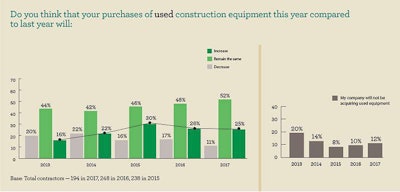

Contractors were generally steady in their used equipment buying expectations, according to the Wells Fargo 2017 Construction Industry Forecast.

Contractors were generally steady in their used equipment buying expectations, according to the Wells Fargo 2017 Construction Industry Forecast.In general, equipment prices in 2017 are similar to, or higher than, what the industry saw in 2016, says Doug Olive, senior vice president, pricing, at Ritchie Bros. There are a few particularly strong categories related to light construction, such as skid steer loaders, loader backhoes and smaller wheel loaders, he says.

“Right now, equipment is in tight supply since it’s out working. Also, OEM production was reduced for certain models between 2014 and 2016, so there is less equipment on the market,” says Olive. “Because of this, there are many sellers looking to take advantage.”

“It’s hard to find good, late-model construction equipment right now that’s not worn out and beat up,” says Sandon. Some reasons: Utilization is up. Rental companies are hanging on to their fleets longer. And at ConExpo this year, orders came in strong, and manufacturer lead times for new equipment are now stretching out. “You just can’t call up and have one delivered in a week like you used to. You might wait up to three or four months, depending on the product,” he says.

All of these factors may prompt a buyer to go to the used equipment market.

“Used prices are trending up,” says Mike Womble, branch manager for Anderson Equipment, based in Buffalo, New York, “which can make it a good time to sell.” Kenneth Tysinger, used equipment sales manager for May Heavy Equipment in Lexington, North Carolina, adds a caveat: “While used equipment prices are up year over year, there has been some softening,” he says. “You would probably be better off to hold off on selling until the end of the year, if possible.”

But buying is a split proposition, Tysinger adds. “New and used equipment prices are up, but there are a lot of good finance options on the market right now. These are enough to persuade buyers to pull the trigger.”

Si Hanna, general manager of remarketing and fleet management for RDO Equipment based in Hewitt, Texas, says equipment prices seem to have stabilized and even rebounded in some segments. “There is a lot of activity happening in the market, and from a dealer perspective, that means opportunity,” he says. “I think over the past 18 to 24 months, the market has favored the buyer because of the amount of machines that have been placed in auction and from some de-fleeting that has happened, but opportunity is always there for a buyer and a seller.”

It depends on the region

The flip side of the coin is that the oil patch – which saw a significant downturn due to the lowered price of gas and oil – has been slow to recover, although it’s now showing signs of life. “That’s hurt used equipment prices in the Dakotas and Texas,” Sandon says. “The bulk of that equipment is not doing as well as it used to, but I’m sure that will turn around with time.”

“Yellow iron prices have tended to stay fairly consistent, but your oilfield stuff and their trucks, they were just giving them away,” says Bob Merritt, director of equipment and construction services operations support at AECOM, a heavy civil and commercial construction firm in Meridian, Idaho. “It was a bloodbath. But that’s starting to turn around and come back.”

Heath Watton, vice president of Southeastern Equipment, a Case dealer in Cambridge, Ohio, says used equipment sales are outpacing new equipment sales in the more rural locales of his sales area, which spans portions of Ohio, Pennsylvania, West Virginia, Kentucky, Indiana and Michigan.

“Here in Ohio, you have a nice, robust used market,” he says. “There is so much business going on, and there are so many owner-operators,” Watton says. As he tracks where his company’s used equipment is sold, he sees a clear trend of more used equipment being sold in rural areas and more new equipment sales driven by urban buyers.

“Detroit, Michigan; Columbus, Ohio; Cincinnati, Indianapolis, Cleveland – they’re new equipment markets,” Walton continues. “When you get out into the rural markets where there’s not as much industry, a guy is going to buy a used backhoe for $60,000 or $50,000 instead of buying a new one for $110,000.”

One industry segment seeing strong growth – and the resulting increases in used equipment prices – is telecom, fiber and cable construction. “Directional drills, mini-excavators, cable placers and bucket trucks are all starting to increase,” says Sandon. “It’s getting harder to find decent used pieces.”

Is there a Tier 4 effect?

Tier 4 Final engine emissions regulations kicked in 2014-2015. In most cases, these newer machines have not entered the used equipment market, so it’s still not clear what impact these more expensive machines will have.

The looming complication is that most larger Tier 4 machines can’t be exported without expensive retrofitting to meet conditions outside the United States. Many of the smaller Tier 4 units (under 75 horsepower), however, are adaptable with minimal to no modifications.

Another complication: many non-attainment areas (those considered to have air quality worse than national standards) prohibit the import of older, pre-Tier 2 units, and sales in those areas require export after the sale of these units. This can add relocation expenses on top of the price of an older asset, which will drive up the cost for buyers, says Dan Samford, owner of Peak Performance Asset Services, an equipment consulting and value assessment firm.

Samford believes these clean diesel machines should do well when they start showing up in the used equipment stream. “Used Tier 4 iron is desired by the dealers and resellers,” he says. “Dealers want this iron back in their inventory to help build their sales inventory options.” Olive says pricing for the Tier 4 assets Ritchie has seen on the auction block have been “solid.”

One reason the used market may not be seeing much Tier 4 Final equipment yet is because the cost of these machines is substantially higher, and most owners are hanging on to them for an extra year or two to make up for it, says Sandon.

Emissions regulations approximately doubled the cost of a diesel engine, and while that may not proportionally be a big deal for larger equipment, it substantially drives up the price on smaller machines. “It’s most notable with air compressors, especially with older air compressors, such as the 185 Sullairs and Ingersoll Rands,” says Sandon. “You used to be able to buy them used for $2,000 to $3,000. Now it’s hard to get a used air compressor for under $4,000.”

A survey by the Independent Equipment Dealers Association of its members late last year indicated an increase in demand for Tier 3 equipment because of the Environmental Protection Agency’s Tier 4 emissions. Those responding to the survey reported resale prices of Tier 3 and lower equipment had increased by up to 20 percent, with that equipment becoming scarce.

However, Southeastern Equipment’s Watton believes the trend of higher prices for Tier 3-and-lower machines is waning. “Two years ago this was hot and heavy,” he says. “That’s when I saw the biggest jump in a retail value on a Tier 3 or Tier 2 used piece.” At that time, Watton said, a piece of equipment that market trends indicated should be priced at $35,000 could be listed at up to $43,000, and buyers wouldn’t balk.

RDO’s Hanna also believes the Tier 4 transition has worked past any issues, with some machines already entering the used market. “In the United States, there was an initial instinct for customers to be skeptical of the new Tier 4 Interim and Final equipment, and Tier 3 equipment was very popular,” he says. “Tier 4 machines have been working for a while now, and our customers have confidence in them.”

But Tier 4 machines are affecting sales to other countries that are behind in adopting the standard.

“The need to run cleaner fuels with Tier 4 machines has impacted sales to countries that do not have these fuels readily available,” Hanna explains. “Certain countries need to have the capability to operate the lowered tier machines, and de-tiering machines will play a bigger role moving forward to meet these needs.”

Download the entire Used Equipment Report

Part 1: Regional demands drive used prices

Part 2: Buying? Selling? Here are some contractor-honed strategies

Part 3: Lenders — Plenty of credit available for used-equipment buyers

Part 4: Used vocational trucks may not remain a buyer’s market for long

Part 5: How does the No. 1 rental firm dispose of its equipment?