Government receipts from all excise taxes in the Highway Trust Fund showed no overall growth in the federal fiscal year that ended September 30.

That’s because a big drop in retail taxes on commercial trucks more than offset slight fuel-tax gains, according to the American Association of State Highway and Transportation Officials (AASHTO).

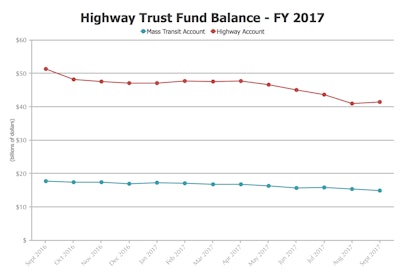

The association has long stressed that the Highway Trust Fund takes in far less in dedicated road user excise taxes on motor fuel and trucking equipment compared to what it spends on federal-aid and transit programs. The upshot is that Congress is forced to repeatedly shift general funds to bail out the Highway Trust Fund.

Total Highway Trust Fund excise tax receipts, net of refunds, were $41.1 billion for the past 12 months, fairly unchanged at .5 percent less than $41.34 billion in the 2016 fiscal year, AASHTO reports.

The association points to Treasury reports on the various Highway Trust Fund contributions for the last two fiscal years, which show gasoline tax receipts of nearly $26.6 billion rose 1.8 percent from the previous fiscal year. Diesel taxes generated about $10.7 billion – a 4.6 percent increase.

A combined 2017 increase in receipts from taxes on both gasoline and diesel plus related fuels was about $941 million. That’s a 2.6 percent gain, AASHTO reports.

But revenue for the trust fund from retail truck taxes was only $3.1 billion in fiscal 2017, down by 27 percent or $1.148 billion. That drop more than offset small gains from motor fuel user fees.

AASHTO says the numbers reflect volatility from such revenue streams as equipment sales, which can fluctuate sharply based on market demand or changes in interest rates for high-cost purchases.

Joung Lee, AASHTO policy director, says the 2017 excise tax receipts help explain why industry groups are urging Congress to find ways to add dedicated revenues to the trust fund.

“Congress and the nation cannot depend on the trust fund’s current mix of fees to even keep growing year to year, depending on market conditions,” Lee tells the AASHTO Journal, “and it continues to generate far less than Congress has authorized the trust fund to spend.

“That means the current $13 billion funding gap will widen to $23 billion by 2027 unless lawmakers address this structural problem.”

As Congress works on tax legislation, state highway department CEOs have joined with officials from two major road-building industry groups to urge a permanent fix to the ailing Highway Trust Fund.

AASHTO has provided Congress with this list of potential revenue-raising options for the trust fund.