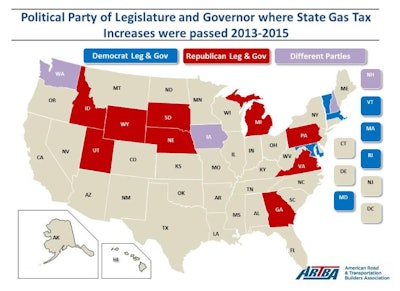

TIAC reviewed more than 2,500 state legislators in 16 states in the report, and found that 91 percent of those supporting legislation to raise state gas taxes from 2013 to 2015 who then ran for re-election, won during the next general election. ARTBA points out that 21 states have increased fuel taxes since 2013, including the four so far this year, including California, Indiana, Montana and Tennessee.

Ninety-five percent of Republican state legislators supporting gas tax hikes were reelected, although the same percentage of those not supporting the increases were reelected. On the Democrat side, 89 percent supporting gas tax increases were reelected, while 86 percent voting against the legislation were reelected.

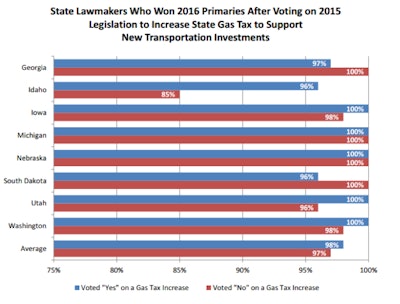

TIAC also reports in reviewing the 2016 primary elections in the eight states that passed gas tax increases, 98 percent of lawmakers from both parties who approved the hikes and ran for their seat in a primary moved on to the general election. Ninety-seven person who voted against the increases moved on—a statistical tie.

The full report is available here.