Despite the majority of the employers surveyed planning to observe the mandate, that doesn’t mean these companies plan to extend benefits to employees’ spouses without adding in a surcharge. In fact, a Business Insurance report on the study indicated that 12 percent of employers already have added a special surcharge or have eliminated coverage to employees’ spouses if the spouse is eligible for coverage from his or her own employer. Between 2015 and 2018, 3 percent of employers surveyed plan to take this type of action. Another 20 percent are expected to do so, but no date has been set.

The Kaiser Family Foundation says that the average premium in 2013 for only covering employees was $5,884. However, adding a spouse can double the cost.

Of the respondents that identified a cost impact of healthcare reform, 54 percent noted a cost increase between 0 percent and 5 percent, while 22 percent estimated their increase in the 5- to 10-percent range – all while group medical costs for employers have continued to rise. Nearly three-quarters (74 percent) indicated their health plan costs increased in 2014, the study indicated.

PPACA Employer Mandate Delayed to 2015: What are the Effects?

Now that implementation of the employer mandate for Patient Protection and Affordable Care Act (PPACA) – which calls for businesses with more than 50 employees to provide “affordable quality insurance” that meets minimum standards or pay a fine of $2,000 per employee – has been delayed until January 1, 2015, it seems that employers can rest a little easier.

However, 96 percent of all U.S. businesses have less than 50 employees, so the employer mandate would not impact them. Out of all the U.S. businesses with 50 or more employees, only about 0.2 percent do not already provide health insurance, according to an Industry Week report. This means the employer mandate delay doesn’t have significant ramifications for those businesses.

However, it does have a considerable effect on taxpayers and is expected to increase the overall cost of healthcare reform. The individual mandate is still slated to begin on January 1, 2014, which requires most Americans (for exceptions see www.healthcare.gov) to attain health insurance through a federal, state or hybrid exchange. The federal and state financial burden will be carried by Americans with higher taxes. The employer mandate provision of the law was expected to generate about $10 billion in penalties. What’s more, employees whose employers decide not to offer coverage in 2014, will now be eligible to receive federal subsidies to buy individual insurance via state or federal exchanges, adding to costs.

At publication time, 17 states and the District of Columbia had opted to set up a state exchange, seven were partnering with the federal government and the rest were “defaulting” to federal facilitated exchanges. This puts financial pressure on the federal government, and 24 states have decided not to expand Medicaid as required by Obamacare, according to the report. (For a video report from Fox Business News Network’s Peter Barnes on the White House’s decision to delay the healthcare law’s employer mandate, go to http://video.foxbusiness.com/v/2529135947

001/obamacares-employer-mandate-delayed-until-2015/.)For continuing coverage on the new healthcare laws, go to BetterRoads.com.

The Willis “Health Care Reform Survey 2014” study’s key findings are as follows:

Employers are choosing to “play” and continue to offer health benefits. “‘Moving away from benefit engagement’ was rated as extremely unlikely by over 60 percent of respondents and somewhat unlikely by another 17 percent,” according to the study. “Employers view their medical benefits as an important and desirable part of their compensation offerings and they will take steps to manage costs so that they can continue to offer benefits to their employees. This conclusion is also evidenced by the findings that the employers represented covered the vast majority of their full-time employees already, before any mandate to do so. That demonstrates the centrality and importance of group medical benefits to their compensation practices.”

Cost shifting is only part of the solution. Nearly 75 percent of respondents experienced an increase in their health plan costs from 2013 to 2014, but of those who had a cost increase, 22 percent of respondents kept employee contributions the same. Strategies other than cost shifting, which are being utilized by employers in attempts to contain costs, include increasing new hire waiting periods, reducing benefits to minimum essential coverage and managing seasonal and variable hour employees to reduce the number of potentially benefit eligible employees.

Private exchanges are emerging as a new distribution channel. While most employers have not finalized strategies, 20 percent of responding employers are considering private exchanges, and 8 percent have strategies in development. The opportunity to control costs through defined contributions while providing greater choice to their workforces (ideally combined with user-friendly technology based tools to assist employees with evaluating those choices) is an attractive prospect for many employers. The majority of respondents also indicated that they are likely to promote employee choice, engagement and consumerism as part of their benefits strategy.

The cost of health care reform is a top concern among responding employers, but many have not measured it. Nearly two-thirds of respondents replied that they have not identified the impact of health care reform. Forty-four percent of respondents replied that they have not specifically identified the cost of the Cadillac Tax. While this seems counterintuitive considering the significance and attention applied to the costs of health care reform, it demonstrates that employers’ focus has, in many cases, been drawn to the immediate compliance needs and administrative difficulties. Despite the fact that industry consultants have identified the concern over the impact of the Cadillac tax to their clients, lack of employer engagement on this topic might be because employers view the ongoing cost analysis as a “luxury” as compared to the day-to-day administrative requirements demanded of them more.

Delays have provided breathing room…but have not affected strategies. Though the announcement of the initial employer mandate delay in 2013 came too late for many employers to adjust their strategies, the majority of survey respondents (69 percent) indicated the announcement did not have a major impact on their benefit plan decisions.

Plan design compliance requirements are being met, but administrative compliance has been delayed. The majority of employers (86 percent) have determined that they have a minimum value plan (defined as the plan covering 60 percent of medical costs), but half of respondents have not yet determined the standard measurement (or “look back”) periods and safe harbor methods (for purposes of determining affordability). Requirements that involve administrative changes, as opposed to benefit design and contributions, are more difficult to implement and have been delayed.

Employers continue to rely on their brokers for strategy and health care reform information. Keeping up with health care reform requirements is no small task and employers are overwhelmingly looking to brokers to keep them informed and up to date regarding regulatory changes.

For a downloadable PDF of the full study findings, including charts and graphs of the study’s key findings, go to willis.com/Media_Room/Press_Releases_(Browse_All)/2014/20140609_Willis_Survey_Employers_

Vague_on_Health_Care_Reform_Costs.BR

Survey: One-third of large employers may only offer

consumer-driven health plans next year

The National Business Group on health released a study in mid-August that found that nearly one-third (32 percent) of large employers only plan to offer consumer-driven health plans (CDHP) next year. That’s 10 percent more than in 2014 and almost triple the percent of the employers that offered CHDP-only plans in 2010. The study results were based on a survey of 136 large employers, most of whom have at least 10,000 employees.

A survey released last year by Mercer LLC found that the average cost of coverage through CDHPs was nearly 20 percent less per employee than PPO coverage, a Business Insurance report noted. [For the report, go to businessinsurance.com/article/20131120/NEWS03/131129988/2013#]

This cost factor is important because a provision in the Patient Protection and Affordable Care Act (PPACA) will levy a 40-percent excise tax on health care premiums that exceed $10,200 per person for individual coverage and $27,500 for family coverage starting in 2018.

Full-time employee definition changed to 40 hours for healthcare reform

Employers now have some additional reprieve against the stiff monetary penalties imposed under the Patient Protection and Affordable Care Act (PPACA) for not providing qualified healthcare to full-time employees.

The House of Representatives has voted to ease the healthcare reform law’s definition of a full-time employee by changing it to employees working at least 40 hours per week, Business Insurance reported. The PPACA legislation, which took effect Jan. 1, 2014, requires employers with at least 100 employees – starting in 2015 – to offer qualified coverage to full-time employees, which has been defined as employees working an average of 30 hours per week or 130 hours per month, or face a penalty of $2,000 per employee. The same requirement applies to employers with between 50 and 99 employees, effective in 2015, the Business Insurance report says.

Changing the classification of a fulltime worker for 30 hours per week to 40 hours per week would reduce the number people receiving employer-based coverage by about 1 million, but it would increase the number of uninsured, the Obama Administration said in a statement.

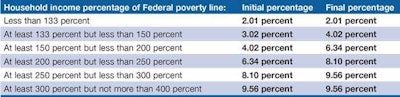

IRS adjusts up affordability percentages for 2015

The Internal Revenue Service (IRS) has released the Revenue Procedure 2014-27 to index the Patient Protection and Affordable Care Act’s (PPACA) affordability percentages for 2015 under the employer’s shared responsibility” (more commonly known as “play or pay”) mandate. This employer mandate change adjusted up the income level, which exempts employees from the PPACA’s individual mandate. For a downloadable PDF of the new IRS adjustments up, go to https://www.irs.gov/pub/irs-drop/rp-14-37.pdf.

The applicable percentage table for 2015 is as follows: