Chief Editor Jordanne Waldschmidt weighs in on the state of electric construction equipment and where the industry’s attention would be better served in the near term: hybrids. The opinions stated are those of the author and don’t necessarily reflect the views of Equipment World or its parent company, Randall Reilly.

Over the past few years, major construction equipment manufacturers have gone on a spree of snapping up battery technology manufacturers or heavily investing in those businesses.

Cat invested in Lithos Energy. Deere bought Kriesel Electric. Volvo CE nabbed Proterra. Komatsu scooped up American Battery Systems. And Yanmar acquired a majority share of ELEO Technologies, to name a few.

It’s a logical move in the transition to green energy, allowing the OEMs greater control of their own destiny in a lithium battery market that has struggled to keep up with demand.

But despite the noble goal of reducing carbon emissions, it’s a complicated and misguided state of affairs – primarily driven by political overreach and appeasement of corporate investors.

Conflicting Goals

To better predict the near-term future of electric equipment in the construction market, let’s examine some recent happenings in the automotive industry.

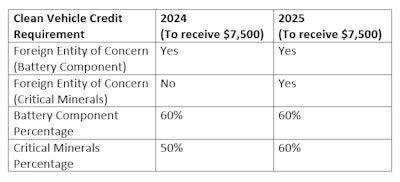

On December 1, the Biden Administration announced a crackdown on automotive manufacturers using battery materials from countries considered “hostile to the U.S.,” including companies owned by, controlled by, or based in China, Russia, North Korea or Iran.

According to the U.S Treasury Department, “Beginning in 2024, an eligible clean vehicle may not contain any battery components that are manufactured by a foreign entity of concern, and beginning in 2025, an eligible clean vehicle may not contain any critical minerals that were extracted, processed, or recycled by a foreign entity of concern.”

This means that many electric vehicles will lose out on the exact clean car tax credits that have made them appealing to consumers.

Equipment World (Chart); US Treasury (Data)

Equipment World (Chart); US Treasury (Data)

(Sidebar: Companies often fail to talk about the fossil fuels required to mine lithium. While I don’t want to go down the rabbit hole of which is “worse” for the environment – mining lithium for multi-use battery packs versus drilling and refining oil for single-use fuel tank fill-ups – it’s worth noting as part of the conversation and food for thought.)

As a result, traditional automakers have been put between a rock and a hard place as they battle more lithium demand than government-friendly suppliers can meet, fewer incentives for consumers to buy the higher-priced vehicles and fierce competition from industry newcomers like Tesla.

Tax credits aside, consumers have been slow to adopt electric vehicles, and it’s causing manufacturers to lose money hand over fist on their investments.

Ford lost an estimated $36,000 on each of the 36,000 electric vehicles it delivered to dealers in the third quarter, according to an article from Reuters. That’s 11% more than its estimated loss per EV during the second quarter.

CEO Jim Farley told investors the company would “slow the ramp-up of money-losing EVs, shifting investment to Ford's commercial vehicle unit and citing plans to quadruple sales of gas-electric hybrids over the next five years.”

And that’s the ticket right there: hybrids.

Continue Investment in ICE and Hybrid Engines

If consumers are unwilling to pay a premium for EVs over comparable internal combustion and hybrid models, how can we expect construction contractors to buck that trend in an industry with increasingly tight margins?

Somewhere along the way, we’ve skipped a few steps, and it’s time to admit we’re going about the transition to green energy all wrong.

Before you hang me for that statement, I'd like to clarify that I'm not against investing in new technologies or electrification. Leaving the planet in a better place for the next generation is something I think we can all rally behind. We’re just not ready for it yet – infrastructure-wise or from a price standpoint.

Few contractors are going to pony up for an electric machine that is multiple times the cost of an ICE equivalent. And I’ll argue that government tax credits to offset the added cost aren’t worth the minimal carbon emissions saved.

By prioritizing hybrid machines, it gives the world time to make the necessary investments in the electrical grid and bring down the cost of expensive battery solutions.

We’re on the right path, we just need to slow down and give adequate time to make the transition. As supplementary technologies like AI and automation advance, it will add to the efficacy of electric machines, creating an ecosystem of efficiency, as seen in the manufacturing environment (and as we heard from Volvo CE's Dr. Ray Gallant, on a recent episode of The Dirt.)

My challenges to OEMs: Don’t stop investing in the internal combustion engines and the bridge technologies necessary to get us to full electrification. Better educate dealer sales personnel on the advantages of current model hybrid machines, despite their higher costs. And don’t be afraid to push back against investors who are out of touch with customer needs and wants.

My challenges to contractors: Consider the efficiency of your current operations. Be open to new technologies. And carefully consider the long-term cost savings of hybrid machines before making a decision on price alone.

There is a place for electrification in the construction industry - and we should keep moving toward that - but it’s going to take the convergence of multiple technologies for it to become a reality. And that reality is likely still 10 years away.