Material prices for construction work increased in April, according to the Producer Price Index report from the Bureau of Labor Statistics.

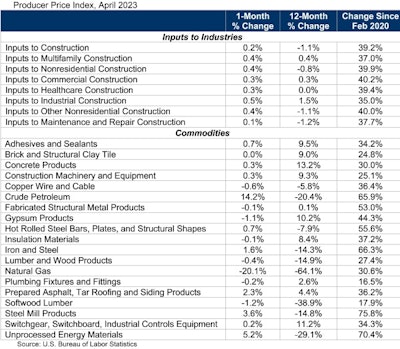

Overall construction input prices were down 1.1% over the past year, while nonresidential construction input prices have fallen 0.8%.

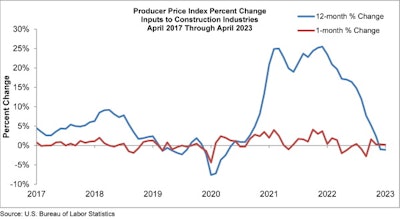

The producer price index for inputs to nonresidential construction, which is a weighted average of the prices charged by goods producers and service providers such as distributors and transportation firms, rose 0.5% from March to April – the largest increase since January.

"Prices remain volatile for many key construction materials, making it difficult for contractors to bid on projects that may take years to complete," said Ken Simonson, Associated General Contractors of America chief economist. “Even some materials that have dropped in price recently have still posted year-over-year increases exceeding 10%.”

According to the Dodge Construction Network, the moderate increase still signals inflationary pressures in the economy, emphasizing the ongoing challenge of managing costs in the current economic climate.

It is possible, that although small, the increase could have an impact on the construction industry.

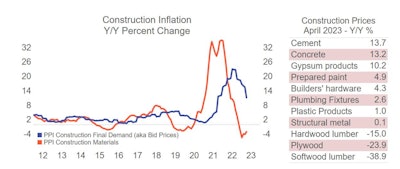

The red line on the graph, which represents the year-over-year% change in a composite index of construction materials, has seen an upturn, which could be concerning as it leads the bid price, represented by the blue line, by 12 months; if sustained, this could potentially lead to a re-acceleration in bid prices in 2024.Dodge Construction Network

The red line on the graph, which represents the year-over-year% change in a composite index of construction materials, has seen an upturn, which could be concerning as it leads the bid price, represented by the blue line, by 12 months; if sustained, this could potentially lead to a re-acceleration in bid prices in 2024.Dodge Construction Network

“Construction input prices were relatively tame in April and were down on an annual basis for the second straight month,” said Anirban Basu, Associated Builders and Contractors chief economist “This PPI release provides some good news for an industry that has dealt with a nearly 40% increase in construction costs since the start of the Covid-19 pandemic.”

As in previous months, price patterns for key construction inputs varied widely in April.

Price changes for the month ranged from increases of 15.3% for liquid asphalt and 3.6% for steel mill products to a decrease of 5.9% for asphalt paving mixtures and blocks.

Associated Builders and Contractors

Associated Builders and Contractors

In addition, a diverse range of input prices continued to rise at double-digit cost increases compared to a year ago. Prices jumped 13.7% year-over-year for cement, 13.3% for electrical switchgear, 13.2% for concrete products, and 12.1% for gypsum building products.

Despite the reasonably positive report, Basu noted that inflation remains a pressing issue for the industry and the broader economy.

He noted that the Consumer Price Index, which he said is more important for monetary policy and broader economic sentiment, was up 4.9% year over year in April, well above the Federal Reserve’s 2% inflation target.

“Despite the annual decline in input costs, contractors’ profit margins are still under pressure,” he said.

ABC’s Construction Confidence Index shows a decline in the percentage of contractors that expect profit margins to increase over the next two quarters.

Basu asserts this is due to higher borrowing and labor costs and the substantial increase in materials prices over much of 2021 and 2022.

Meanwhile, AGC officials suggest the Biden administration’s Buy America rules are contributing to the higher material prices by limiting what materials contractors can use.

“The Biden administration has opted to define the new Buy America rules in a way that leaves no flexibility but causes lots of confusion,” said Stephen E. Sandherr, AGC’s chief executive officer. “As a result, public officials are being both overly restrictive and overly cautious in signing off on the materials contractors can use, which adds to the cost of many materials.”

Associated Builders and Contractors

Associated Builders and Contractors