The technical definition of a recession, two consecutive quarters of decline in the gross domestic product, has been met in 2022 in the first two quarters of the year.

But ABC Chief Economist Anirban Basu counters that general consumer spending, summer travel, job growth, unemployment and wage growth do not indicate recession. In addition, multiple polls and surveys conducted by the Associated Builders and Contractors and other industry sources suggest that construction contractors remain optimistic about their profit margins over the next six months.

The confidence starts to decline, though, when projections go out for 12 months and beyond.

"When you have 43,000 jobs in September, when unemployment is down to 3.5%, when average hourly earnings are growing at 5% or better, when contractors are telling me that they expect growth in sales and employment, to me that is not indicia of recession,” Basu said during the recent Q3 Construction Executive Economic Update and Forecast. "Those are indicia of an economy that is still growing. It's not in recession right now.”

Throughout 2022, Basu has maintained a forecast of recession in 2023, and after the third quarter, his forecast has not changed.

"I think we're headed for a recession in 2023, and I do not believe it will be a mild one," he said.

As borrowing costs continue to rise rapidly ,they will continue to drive the economy into recession. He forecasts that consumer spending will decline and as has already occurred. And due to rising interest rates, the housing and financial markets will be in turmoil.

Key to the entire scenario are the actions of the U.S. Federal Reserve.

“The United States owes an apology to the entire world for putting us in this position,” Basu said. “This inflationary episode and this need to ramp up interest rates around the world.” The strength of the dollar has reduced the inflationary impact that it would otherwise be in the U.S., however, even with the strong dollar, the Federal Reserve has continued to increase interest rates, which forces the hand of the global economy."

“They're never going to stop increasing interest rates until they see inflation slowing," he said. "I'm worried about an output gap that I think the U.S. economy will enter recession before the Federal Reserve finishes tightening the monetary policy. I'm not expecting it to be especially mild, and again, this is one of the reasons that I do not share the optimism of many contractors.”

The anticipation is that inflation will remain "stubbornly high." To counteract inflation, the Federal Reserve must destroy the momentum in the U.S. labor market to get inflation back down to 2%.

Growth or stagnation?

Despite all the talk of recession, many construction contractors remain upbeat, in part because some of the leading economic indicators are still positive.

Unemployment has fallen to 3.5%, and job numbers are increasing. In addition, according to the Architecture Billings Index, there's a lot of design work taking place. Normally that offers a positive outlook for the economy, but that is not necessarily the case in this instance.

“Project owners are having projects designed, and then they're looking at the marketplace, and the marketplace is not recovering the way we thought it would. For instance, the office workers are not coming back,” Basu said. Designs are occurring based on the notion that funds are available in some cases via the $1.2 trillion infrastructure law.

Simultaneously, the notion from contractors is that they expect the industry to continue to see rising sales, experience a steady rising backlog, rising employment and expanding profit margins. Basu noted these are the projections, despite the fact that wages have grown at some of the fastest rates in nearly 40 years. Construction wages have risen 5.5%, and overall material prices have continued to fluctuate dramatically over the past two years.

“My very strong sense is that many of you have been able to pass along your cost increase to the project owner, and I hypothesize that during the months ahead, you will find more difficulty passing along those cost increases,” he said.

These challenges make him less optimistic about the fate of nonresidential construction in 2023. He said that in many cases, project owners are having projects designed, out for bid, and when the bids come in, they are shocked at the amounts.

“Workers are more expensive. Supply chain, materials are more expensive, and yet contractors are confident profit margins will continue to rise over the next six months,” he said. “What investors and other stakeholders are looking for is evidence of slowing economic growth, less inflation and, therefore, a Federal Reserve that can pause, that can hit the brakes on this rate tightening.”

Nonresidential contractors, particularly those in infrastructure-related construction, say they will be busy for the next five years, based on the available federal, state and local funding. But the economy is changing and will likely never be the same as it was in 2019-2020, Basu says.

Associated Builders and Contractors

Associated Builders and Contractors

Can you get what you need?

On top of the rising interest rates, Basu believes the economy will remain unbalanced, with supply struggling with global demand. “It will continue to be the case that demand will continue to chase supply, and that's inflationary,” he said.

The issue has lingered for so many months because the world had been operating in a “just in time” inventory world. Meaning, if you wanted it, it would be there “just in time.” “Now all of a sudden, that global supply chain has been broken for various reasons,” Basu said.

In the long term, more supply chains returning to North America will help. However, he said, in the short term, it’s inflation and more constrained supply.

Ultimately, the looming question is when will the supply issues return to "normal." When the Russia-Ukraine conflict ends? When China changes its Covid policies? Basu’s best guess is that the supply chain challenges will continue into 2024 and possibly 2025.

Associated Builders and Contractors

Associated Builders and Contractors

What about labor?

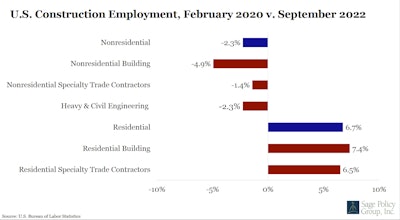

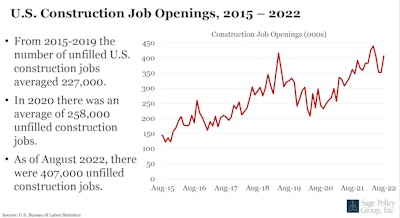

Data suggest that contractors are reporting difficulty finding workers. Basu says the number of jobs supported by nonresidential construction is down on a year-over-year basis.

"Costs are rising, compensation is rising, and yet employers collectively continue to hire briskly. We're creating too many jobs,” Basu said.

"Many contractors tell me that they have far greater difficulty finding human capital than they did pre-pandemic.”

Among the challenges is an aging workforce. “Many baby boomers or finely skilled tradespeople have retired in large numbers and an ungodly percentage of those skilled tradespeople will retire within the next five to 10 years,” Basu said. “Even if we enter recession, even if construction activity slows down, contractors will be paying more in wages.”

The constant labor challenge in construction has only been hampered by the pandemic as millions of people are not in the workforce. “They don't want to go to a job site, they don't want to commute, and they don't want to be with their colleagues,” he said. “For construction, manufacturing, brick and mortar retail, restaurants, hotels, where you have to supply the service at the job site, this just makes life that much more frustrating and recruitment and retention that much more challenging.”

For now, one of the fastest-growing occupational segments of construction is unskilled labor. “In many cases, we're losing a lot of talent in the workforce, to retirement or other industries, and we're not recovering that in the form of entry into the marketplace,” he said.

For the contractors, Basu suggested looking at their cash flow. “Let go of underperforming employees,” he said. “I know you're busy and sometimes they come in handy, but the fact of the matter is, it might be a great time to build up some cash reserves because we don't know what the economy is going to look like between 2023 and 2024, and backlog can run up very quickly.”

Projects focused on publicly financed infrastructure projects such as roads, bridges, schools and utilities should be OK. Healthcare, multi-family, data centers and warehouse construction should also fare well.