In its second year as a “pure-play agriculture and construction company,” CNH reported record revenues and net income for 2023.

With an increased allocation to research and development and capital expenditure investments, a total of 72 new products were launched in 2023, many of which integrated with in-house tech solutions.

The company’s portfolio of construction equipment is sold under three brands: Case Construction Equipment, New Holland Construction, and most recently, Eurocomach, part of the portfolio acquired with Sampierana.

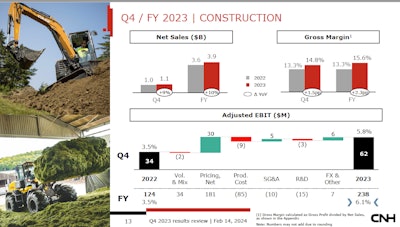

Sales in the company’s construction sector were up 10% in 2023 at $3.9 billion.

The full-year report from the company shows revenues of $24.7 billion, up 5% year-over-year, and a net income of $2.38 billion, a nearly 15% increase compared to a 2022 net income of $2.04 billion.

“Two years ago, we established ambitious margin targets for our agriculture and construction segments, which we achieved earlier than planned,” said Scott Wine, CNH's chief executive officer. "These results, in conjunction with record full-year revenue and net income, reflect the CNH team's tireless efforts to simplify the company, expand through-cycle margins, integrate world-class technology with our great iron, and put our customers at the center of everything we do."

Wine said construction margins were up 230 basis points in Q4 and 260 points for the full year as they improved dealer performance, product innovation, and cost efficiency.

CNH

CNH

In Q4 of 2023, revenues for CNH were $6.79 billion, down 2% from Q4 2022. Conversely, net income was up approximately 4%, with Q4 2023 at $617 million compared with net income of $592 million in Q4 2022.

Reports showed net sales of industrial activities were down 5% to $6.02 billion as South American sales remained soft and low-horsepower tractors were underproduced in North America.

According to Wine, despite the drop in sales, the company expanded its industrial earnings before interest and taxes (EBIT) margin by almost a full percentage point.

Construction net sales increased by 9% in Q4 to $1.07 billion. Wine said that driven primarily by favorable price realization and improved volume in North America, which was partially offset by lower net sales in EMEA and South America. He said the total was short of the company’s projected estimate of $1.1 billion.

The CEO said global industry volume for construction equipment decreased in both heavy and light sub-segments year-over-year in Q4 2023, down 12% and 2%, respectively.

Across the various markets, demand was down 7% in EMEA, 2% in North America, 25% in South America, and 6% for Asia Pacific.

Wine noted that the sector’s adjusted EBIT was $62 million up $28 million for the quarter. The adjusted EBIT margin was up 5.8% compared to the same quarter in 2022.

2024 outlook

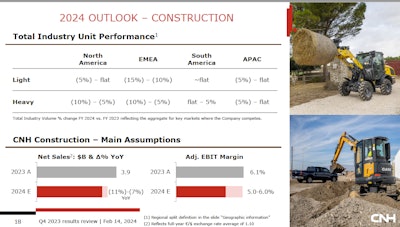

CNH is forecasting industrial retail demand to be down 10% to 15% in 2024. Ag sales are projected to decline between 8% and 12%.

Construction sales are projected to down in the range of 7% to 11% year-over-year. Wine noted that 2023 sales included dealer stocking of an atypically large number of new construction products which will not repeat to the same level in 2024. EBIT margin target for construction is between 5% and 6%.

High-interest rates are expected to soften both residential and commercial construction markets in North America and Europe, partially offset by U.S. infrastructure spending.

Wine said in South America, construction markets are expected to remain flattish, following a market decline in 2023.

Combined, the construction market is expected to decline about 10% in 2024.

Blending ag and construction brings our forecast for industrial net sales down between 8% and 12% in 2024. We do not control industry demand, but we do control how we react to it.

Wine said there are pockets of elevated inventory in North America and Europe to address, which will likely impact first-half sales volumes and pricing. However, those pockets are primarily on the ag side of the business.

“On the construction side we really don't have much and we were pleasantly surprised with the demand in the fourth quarter, which helped manage inventory in that segment a little bit better,” he said. “We’ve probably got room in South America where we've got really lean construction inventory, so overall, I think construction is in reasonably good shape.”

The CEO said the company is targeting an EBIT margin between 14% and 15%.

“It is important to recognize that we are building this margin resiliency while continuing to fully fund our tech journey,” he said noting that in 2024, the company will demonstrate that it can sustain through cycle margin improvements even as the industry declines further.

"My core belief is this game is about product, brand, and distribution," Wine said. "If you look at our portfolio, we are seeing the benefits of improvements in each of those areas.”

In 2023, 72 new products were introduced across the company and that is only expected to continue in both the iron and tech side as increases are made in research and development investments.

“On the brand side, the Case IH and New Holland and Case Construction brands are just really, really strong and we’re trying to leverage those as best we can,” Wine said.

For distribution, the CEO said the company is trying to be good partners in managing dealer inventory while also raising expectations for dealer execution with enhanced control rooms going in to improve management.

“We demonstrated that we could do it in 2023 and we’re just going to get better and better in those three categories over time, which gives us the ability to continue to outperform,” Wine said. “It’s hard work, it’s a very competitive industry, but I like how we’re positioned to compete.”

CNH

CNH