Contractors in 2025 can get back in the bonus – bonus depreciation, that is – for purchases of new and used construction equipment.

They can also write off as much as double their equipment purchases over 2024, thanks to an increased Section 179 deduction in the federal budget passed in July.

Set to drop to 40% this year for the percentage of bonus depreciation on new and used equipment purchases, Congress raised the level back to 100%, which was set in the 2017 tax law. That law had bonus depreciation phasing out annually until being fully eliminated in 2027.

The 2025 law also raised the Section 179 deduction on new and used equipment purchases to $2.5 million.

Here’s a look at the Section 179 tax deduction and bonus depreciation on equipment purchases for 2025:

Section 179 Still 100% and Much Bigger

The Section 179 tax deduction was made a permanent part of the tax code since it was raised to 100% in 2017. That means the entire cost of new or used construction equipment you purchase or lease this year can be deducted on your business’ 2025 gross income.

The Section 179 deduction is also the highest in its history, after being doubled under the new tax law. Before the change, this year’s deduction was set at $1.25 million. That amount would have begun to phase out at $3.13 million worth of purchases.

Now, the deduction is $2.5 million. Phaseout begins at $4 million of total purchases, gradually dropping until completely phasing out at total purchases of $6.5 million.

Bonus Depreciation Returns to 100%

Another big benefit from the new tax law is the return of 100% bonus depreciation on new and used equipment purchases, starting January 20, 2025.

The phaseout of this accelerated-depreciation benefit began in 2023 after being enacted in 2017. It was set to drop 20% again this year to 40%. That 40% rate is still intact, though, for purchases between January 1 and 19.

For small contractors, bonus depreciation may not be as big of a deal, if their purchases fall under the Section 179 caps.

Bonus depreciation is more often used by larger contractors and can be applied for purchases larger than $4 million and even over the current $6.5 million Section 179 cap.

Unlike Section 179, which is a deduction that cannot exceed the business’ taxable income, bonus depreciation can be taken during years when the business suffers a loss.

How It Works

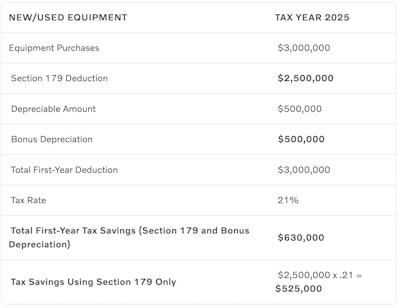

Volvo Construction Equipment released the following chart demonstrating how much a contractor could save in taxes on $3 million worth of equipment when claiming bonus depreciation and Section 179 this year:

Volvo Construction Equipment

Volvo Construction Equipment

Things to Consider

As with any tax break, there are rules about which purchases qualify.

First and foremost, the equipment you buy in 2025 must be put into service for your business before midnight December 31 to qualify for Section 179 or 100% bonus depreciation for this year. There is no set amount of time the equipment must be used in 2025 to qualify, but it must be used more than 50% of the time for the business, rather than personal or other uses.

Contractors should also know that Section 179 and bonus depreciation are not just limited to construction equipment. Under certain conditions, vehicles, business software, computers, and manufacturing tools and equipment are among the other eligible expenses.

Before making any purchase decisions based on taxes, however, make sure you talk first to an accountant or tax adviser.

CPAs usually agree that making a purchase solely for tax purposes is rarely a good idea. The equipment should help your business become more profitable or efficient or both and make good business sense.