Stable sales in the construction segment helped Deere & Company weather softening agriculture and turf markets, according to the manufacturer’s latest earnings report.

Global net sales and revenue decreased 12 percent, to $15.2 billion, for the second quarter of 2024, and declined 9 percent, to $27.4 billion for the first six months of the company’s fiscal year. The company reported net income of $2.4 billion for the second quarter ended April 28.

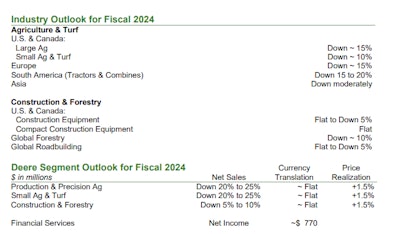

Net sales for Deere’s Construction & Forestry segment declined by 7 percent for the quarter, going from $4.1 billion in Q2 2023 to $3.8 billion in Q2 2024 due to lower shipment volumes. Industry sales for earthmoving equipment in the U.S. and Canada remain flat to down 5 percent, while compact construction equipment in the region is expected to be flat.

“Markets continue to be healthy as U.S. government infrastructure spending further increases, investments in manufacturing persist and single-family housing starts improve,” said Josh Rohleder, Deere manager of investor communications. “Tailwinds are tempered by declines in commercial real estate and softening rental demand throughout the balance of the year.”

Global forestry equipment sales are expected to fall 10 percent, as all global markets continue to be challenged. Global roadbuilding markets are forecasted to be flat to down 5 percent as strong infrastructure spending in the U.S. is offset by continued softness in Western Europe.

Net sales for Deere’s Production & Precision Ag segment dropped 16 percent, to $6.6 billion, compared to $7.8 billion during the same period last year, primarily due to lower shipment volumes. Large ag equipment sales in the U.S. and Canada are expected to be down 15 percent for the year.

The company’s Small Ag & Turf segment took the biggest hit, with net sales down 23 percent, to $3.2 billion for the quarter, from $4.2 billion during Q2 2023. Lower shipment volumes were partially offset by price realization. The segment is forecasted to be down 10 percent for the year in the U.S. and Canada.

“John Deere’s second-quarter results were noteworthy in light of continued changes across the global agricultural sector,” stated John C. May, chairman and chief executive officer. “Thanks to the dedication and hard work of our team, we continue to demonstrate structurally higher performance levels across business cycles and are benefitting from stability in construction end markets amid declining agricultural and turf demand.”

Deere is now forecasting its net income to be approximately $7.0 billion for the full year.

“We are proactively managing our production and inventory levels to adapt to demand changes and position the business for the future,” May explained. “Despite market conditions, we are committed to our strategy and are actively investing in and deploying innovative technologies, products, and solutions to ensure our customers' success.”