Japanese construction, mining, and industrial equipment manufacturer Komatsu reported strong third-quarter results, with sales up 5.6% from the same period a year ago to 971.9 billion yen.

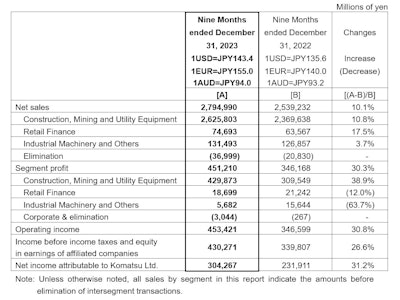

Looking at the first nine months of the fiscal year, Komatsu’s net sales have grown 10.1% to 2,794.9 billion yen, while operating income rose 30.8% to 453.4 billion yen. The company attributed the growth to improved selling prices in most regions and the Japanese yen’s depreciation, which offset increased fixed costs and material prices.

Komatsu maintained its outlook for the fiscal year ending March 31, 2024. It still expects full-year net sales to rise 3.3% and operating income to grow by 11.7%.

Construction, Mining and Industrial Equipment Demand by Region

For the first nine months of the fiscal year, sales of construction, mining and industrial equipment increased by 10.8% compared to the same period last year, to 2,625.8 billion yen.

Construction equipment sales remained steady in North America, while demand softened in Latin America, Europe and Asia.

Komatsu says demand for its mining equipment remained strong and sales increased from the corresponding period a year ago, driven by parts sales and service growth which reflect high machine utilization, improved selling prices in most regions of the world and the Japanese yen’s depreciation.

In the industrial machinery segment, sales also increased thanks to growth in sales of large presses for the automobile manufacturing industry.

Komatsu saw the following performance by region:

- Japan: Demand for new equipment remained flat while sales increased from the corresponding period a year ago, mainly supported by improved selling prices.

- North America: Sales for mining equipment increased. Sales for construction equipment varied by market, with sales bottoming out in the housing sector and remaining steady in the rental, infrastructure development, and energy-related sectors.

- Latin America: Economic uncertainty caused demand for construction equipment to slow. Mining equipment remained strong, with sales increasing from a year ago.

- Europe: Major markets such as the UK, Germany, Italy and other countries saw demand for construction equipment fall due to rising interest rates and high energy prices. Despite that, sales increased from the year prior due to the Japanese yen’s depreciation and improved selling prices.

- CIS: Supply chain restrictions and the ongoing situation in Ukraine caused sales to fall sharply over the same period last year.

- China: Demand remained weak, and sales decreased during the period, as affected by stagnant economic activities and sluggish real estate market conditions.

- Asia: Demand for mining equipment in Indonesia remained steady. However, delays in the public works budgets and economic uncertainty caused demand for construction equipment to fall in Indonesia, Thailand and Vietnam. As a result, sales also decreased from the corresponding period a year ago.

- Oceania: Demand for mining and construction equipment remained steady and sales increased.

- Middle East: Projects in Saudi Arabia, the United Arab Emirates, and other oil-producing countries, as well as post-earthquake reconstruction needs in Turkey, supported demand for construction equipment. As a result, sales rose sharply from the same period last year.

- Africa: Sales increased from the corresponding period a year ago, supported by steady demand for mining and construction equipment and increased parts sales and service revenues.

Komatsu

Komatsu